We are happy to note that SP Jain has provided placement data to us in the InsideIIM format. SP Jain has been publishing its final placement report, audited by CRISIL, in the IPRS format since 2011 (read the 2011 report here and the 2012 report here ). We were unable to find the 2013 report in the IPRS format. At InsideIIM, our view on the IPRS format is that although it provides an amazing level of detail about salaries, it suffers from a drawback because it does not incorporate profile information (i.e. the job profile for which the candidate was hired). We appreciate the forthrightness of SP Jain for reporting its placements in the IPRS format, but we also believe that the quality of job profiles is the most critical input while evaluating the placements at a B school. The InsideIIM placement report provides data on job profiles, and we are delighted to have this data from SP Jain from this year onwards. We hope this is the beginning of a long and fruitful relationship.

Highlights of final placements for the batch of 2014 - SP Jain (as reported to us by the institute)

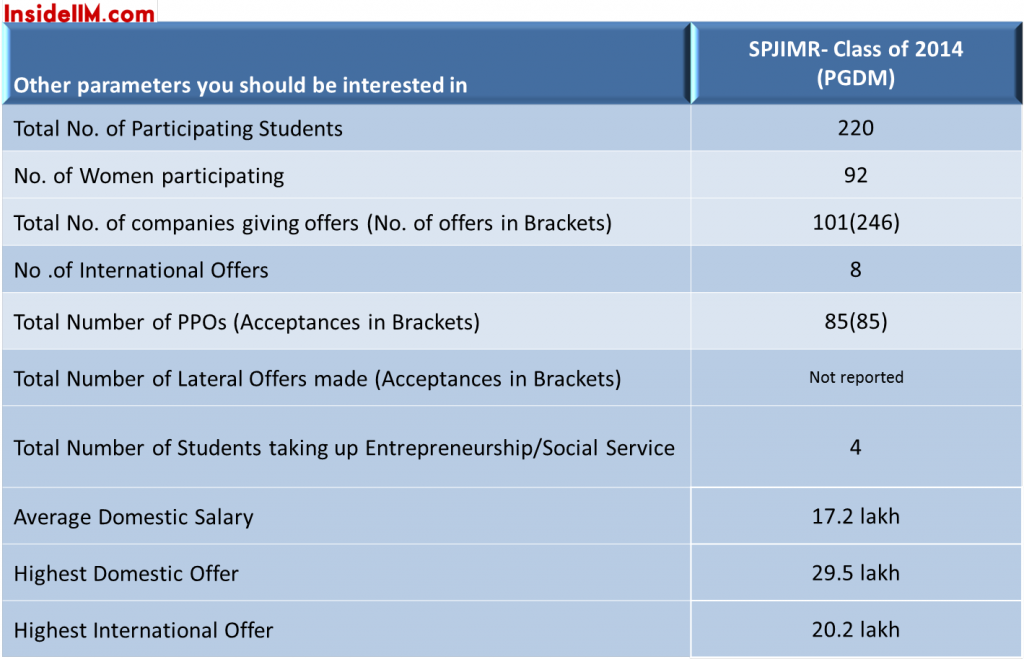

- SP Jain Institute of Management and Research completed placements for the PGDM Class of 2014 with a 22.9% increase in the highest salary from Rs 24 lakh last year to Rs 29.5 lakh this time.

- The average salary has gone up around 6.8% to Rs 17.2 lakh even as 101 companies including 51 first-timers made 246 offers to the 228-strong batch.

- The median salary for the batch was Rs 16.8 lakh. 70% of the batch has offers of Rs. 15 lakh and more, while 85% had salaries of Rs 13 lakh and more.

Banking and finance

According to SP Jain's placement report on its website, around 21% of the batch was offered roles in banking and financial services. The list of recruiters - though not large as the number of finance recruiters at some other schools in the same tier, still has good options for SP Jain students in terms of diversity of roles. You have to remember that the batch size is relatively modest (220 students) and moreover the class is already divided into four sections (finance management, marketing management, information management and operations management) before the commencement of the course, therefore placements would be a more orderly affair. Big global names include Citibank, HSBC (in corporate banking/transaction banking roles) and Goldman Sachs, Nomura and JP Morgan (in middle office roles). Front-end investment banking roles have been offered by a couple of Indian players - JM Financial and Avista Advisory. Franklin Templeton offered a role in asset management, while some other firms (GE, Pepsi, Amazon and Dell) offered roles in corporate finance.

Consulting and General Management

Consulting: Financial consulting firms seem to exert a strong pull over SP Jain. The list includes Deloitte, KPMG, and Ernst & Young. Even Capgemini offered a role in financial consulting (risk management). Another recruiter in consulting was Bain Capability Centre (which is an offshore group providing support and shared services to Bain Consulting). Companies in IT consulting include Cognizant and IBM. BristleCone offered a role in operations consulting. The statistics on SP Jain's website say that around 23% of the batch took up offers in consulting. That's roughly 50 students, which is a pretty high rate of more than five offers per company in consulting. We believe there must be some other names as well who recruited for consulting profiles.

General Management

The big names are all there - TAS, Mahindra and Mahindra, and RIL. Only Aditya Birla Group is missing. Tata Strategic Management Group also hired from SP Jain. TAS has been a long-term recruiter at SP Jain.

FMCG

At SP Jain, FMCG companies have recruited for a diverse variety of profiles. The main recruiters offering pure sales and marketing roles (according to the information given to us) are GSK, P&G, Kraft, Asian Paints and Colgate Palmolive. Supply chain roles were offered by a number of FMCG companies including HUL, Britannia, Marico, Kraft, GSK and P&G. Pepsico offered a corporate finance role, as stated earlier.

Technology, E-commerce, Media and others

Things would have looked pretty interesting if you did your MBA in information management - with two technology giants - Microsoft and Google recruiting from SP Jain. Other major recruiters include Philips and Samsung in the consumer products space, Airtel and Vodafone in the telecom space, and Cisco and Siemens in the B2B space. The e-commerce space saw recruitment from Amazon and Flipkart.

Pharma and others

Pharma saw recruitment from Ranbaxy, Cipla, Glenmark and Dr. Reddy's All were for Sales and Marketing roles.

Summary

To summarize, the batch of 220 students received 246 offers from 101 companies. Total number of PPOs was 85 - around 38%, which is higher than the figure at XLRI (32%) and FMS (17%). The high rate of PPOs is indicative of the focussed nature of SP Jain's MBA program - where domain is decided prior to course commencement - leading to a very low probability of domain changes as the course goes along. This also increases the probability of a PPO being accepted. All in all, we once again congratulate SP Jain for completing another successful placement season.

Although we have taken all efforts to verify the information presented in the report, we cannot guarantee that it is 100% correct.

Read the final placement report of SPJIMR - class of 2013 here.

Read the previous reports of the 2014 final placement season - (XLRI , TISS Mumbai, IIM Ahmedabad, IIFT Delhi & Kolkata)