Types of e-wallet :

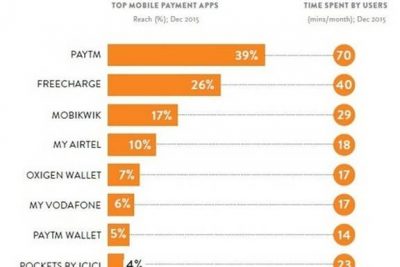

1) Open loop wallet (PayTm, Freecharge)

2) Closed loop wallet (OlaMoney, m-Pesa)

3) Private label wallet (BookMyShow)

Repercussions of Demonetisation

• With demonetisation, both Paytm and Mobikwik have seen a record hit in payment transactions. Paytm says it hit 5 million payment transactions a day, 700 percent increase in traffic 3x growth in downloads. This adds up to around Rs 24,000 crore.

• MobiKwik claims to have seen an 18X increase in overall transactions, and over 2000 percent increase in transaction value.

• OlaMoney witnessed over 1500 percent increase in recharges

• RazorPay had over 150% increase

References

http://indiatoday.intoday.in/story/local-vendors-e-wallets-mobile-payments/1/810823.html

————-

About the Author:

Niteen Bali is a graduate of NIT Karnataka, Surathkal. Post which he got into IIM Calcutta. He believes in the philosophy of Batman and Chandler is his god. He also believes in short bios.

Comments