Contribution to Provident Fund is one of the components of any employee’s salary structure. This is on account of the regulatory requirement that an employer has to comply with having more than 20 employees. Currently, 12% of an employee’s basic salary is deducted from the employee’s cost to company (‘CTC’) and is contributed to the Provident Fund. A matching contribution is also required to be made by the employer, which also forms a part of the CTC. Therefore, a total of 24% of the basic salary is contributed to Employee’s Provident Fund every year.

The new Employee’s Provident Fund Organization (‘EPFO’) circular brings a welcome change for every salaried employee who is concerned with his income during his retirement phase. The latest demographic data shows that though Indians are living longer (approx 70 years), for majority of them, the sunset years are spent in poor health condition with limited or no income flow. For a comfortable retirement, you need to save more form now and the new EPF rule enforces these higher savings. As a result, EPF now becomes the most important retirement planning tool for salaried class.

Below is the gist of the basic components of an employee’s salary structure:

- Basic Salary – Varies from employer to employer, usually is 45% to 55% of CTC

- House Rent Allowance (‘HRA’) – Is always 40% or 50% of the basic salary

- Transportation Allowance – Fixed @ Rs 800 p.m.

- Medical Allowance – Fixed @ Rs 15,000 p.a.

- Employee’s contributions to Provident Fund – Is always 12% of the basic salary

- Employer’s contributions to Provident Fund – Is always 12% of the basic salary

- Special Allowance – Balancing figure of the CTC

It can be seen from the above that the contributions to Provident Fund amounts to 24% of the “Basic Salary”. The new EPFO circular suggests that the contributions to Provident Fund will be 12% of the “Basic Salary plus many of the allowances given to the employee” and a matching contribution from the employer. This will result in increase in the base level for making a PF contribution resulting in good retirement savings for an employee. The allowances that are to be considered for calculating the PF contribution base includes all emoluments paid to the employee excluding HRA, dearness allowance, cash value of any food concession, overtime allowance, bonus and commission. This implies that allowances such as Transportation Allowance, Medical Allowance, Special Allowance, Children Education Allowance, etc will be included in the PF contribution calculation, besides the basic salary.

However, it is pertinent to note that contribution to PF is inversely proportional to your take-home salary. Increase in the former results in a decrease in the latter. This will significantly pinch the employees, more so in the present day situation where majority of the salaried employees are surviving on EMI payments. However, the reduction in net take home salary is minimal considering the benefits that will be reaped in future as well as the tax benefits that will be availed on account of increase in the PF contribution.

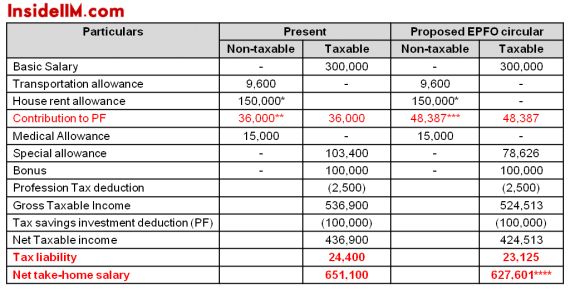

Let’s take an illustrative example where your CTC is Rs 650,000 p.a. with the compensation plan offered by the employer as: Basic Salary – 300,000, Travelling Allowance – 9,600, HRA – 150,000, contributions to PF – 72,000 (24% of basic salary), Medical Allowance – 15,000, Special Allowance – 103,400, bonus over and above your CTC - 100,000 and tax savings investments (including PF) – Rs 100,000. The tax liability and net take home salary under the above compensation plan as of now and per the new EPFO circular will be as under:

* Assuming HRA is availed

** 12% of 300,000

*** 12% of 403,226 (300,000 + 9,600 + 15,000 + 78,626)

**** (300,000 + 9,600 + 150,000 + 15,000 + 78,626 + 100,000 – 2,500 – 23,125)

As can be seen from above, the retirement savings increases by approximately 34%, whereas the net take-home salary reduces by approximately 3.6%. The reduction is low on account of the reduction in tax liability by approximately 11%. This circular is beneficial from tax perspective given the reduction in tax liability and also provides an opportunity to the employee to invest funds in options other than that for retirement planning which will be taken care of by the increase in PF contribution by the proposed circular.

The implication of the above circular rests on the decision of the Supreme Court, a move that will reduce the take home salary of over 5 crore workers. Till then, this circular is a wake up call for employers to review their position in relation to the compensation structure of their employees.

What is your duty?

As suggested earlier, the circular is a wake up call for all the employers. So while your employers revise your salary structure, you are also enforced to formulate your action plan. Calculate the total amount you are putting in retirement options and recalculate the same on the basis of the increased contribution to the PF. Opt for some other mode of investment and increase your returns since PF will give you a return of only 8.5% p.a. Invest wisely.

- Prince Doshi

Prince Doshi is a qualified Chartered Accountant and a B.Com graduate from Narsee Monjee College of Commerce and Economics. He has a post qualification experience working as an Associate for BMR & Associates, a leading tax consultancy firm. Presently, he is into his own Chartered Accountancy practice specialising in the field of income-tax consultancy, sales tax, service tax and audit compliance

All articles by CA Prince Doshi

Tax Planning services by Prince Doshi

You may also like to read:

All you need to know about Tax Benefits on Education Loan Interest Payments

Final Placements – Class of 2012 – The Big Test

Comments

Anusheel Shrivastava

Correction required - "Employee’s contributions to Provident Fund – Is always 12% of the basic salary"- Actually it is minimum 12%, an employee can always contribute more if he wants, but employer will not match the increased contribution. Although most people don't use the options of increasing, but many people use it, specially those who are going for some foreign jobs, so as to earn a secured 8.5% interest on a big amount. Though a tangential issue, but I pointed it out so that Junta reading this have right idea!

29 Dec 2012, 03.05 AM

+Read Replies (1)

Prince Doshi

Yes its correct. The contribution is always 12% since from tax perspective, only 12% contribution is exempt from tax. Any contribution higher than that is taxable under the head 'Salary' and therefore it is not advisable to increase the contribution from more than 12%. Thanks for pointing out.

29 Dec 2012, 11.04 AM |

Pankaj

What about voluntary PF? Is it chargeable too? VPF is considered as contribution for tax exemption. Another query: Since base level for PF contribution is increased now, will it increase our CTC and reduce our take home salary

29 Dec 2012, 08.53 PM

+Read Replies (1)

Prince Doshi

No your CTC will remain same but as explained above, your net take home salary will reduce. Your employer is not going to pay you more out of his own pocket and therefore, your total CTC will continue to remain same with reduced take home salary. Employee's contribution to PF is included in your taxable income. But, the same will be allowed as deduction under section 80C (maximum of Rs 1 lac). On account of this deduction, employee's contribution to PF is considered as exempt from tax and therefore you are right in considering VPF as contribution for tax exemption. But there is a thin line of difference between exemption and deduction. Separately, employer's contribution to PF in excess of 12% of salary will always be taxable. Hope this may clarify your doubt.

29 Dec 2012, 10.19 PM |

Shashank

In the table you mentioned Take Home salary as 651000, but the CTC was supposed to be 650000. Don't you think the take home would be much lesser considering tds and other deductions?

30 Dec 2012, 12.18 AM

+Read Replies (1)

Prince Doshi

Ur take home salary is 651000 (ie greater than CTC of 650,000) on account of the bonus component of Rs 100,000 which I have considered in the above example that is over and above ur CTC. Ur take home is lesser. Ur take home is 651,000 on your income of Rs 750,000 (CTC of 650,000 + Bonus of 100,000). Hope this clarifies ur query.

30 Dec 2012, 06.34 PM |