The huge argument on the comparative benefits of investing in the gold market or the real estate continues to remain a topic of heated debate for economists throughout the world.

Technically speaking both real estate and gold are treated as physical assets. People invested in gold, particularly after the financial crisis in 2008, to keep their money safe primarily to avoid the risk of holding currency that could lose its value. But with the recent rise in the value of dollar, the shift to gold has decreased. Modern day economists consider Gold as a ‘dead investment’ ,with no productivity. The rise in the gold prices before the financial year 2013 was considered normal but the recent fall in the gold prices (as illustrated in Exhibit 1) shows that gold investors have decreased as compared to investors in stocks and bonds, widely known an unstable investments.

Exhibit 1: Gold Price Trends (http://www.kitco.com/charts/popup/au3650nyb_.html)

Even after such negative vibes about gold, people especially in India still invest a lot in gold. According to gold analysts, gold as an investment is safer, useful and is always considered as a good long term investment. Obviously, compared to real estate business, it needs no maintenance. The fact that India is the world’s largest consumer of gold speaks for itself. But that particularly stems from the fact that for them gold is a multi-purpose asset!

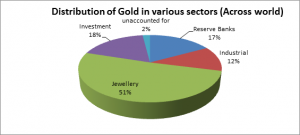

The gold market consists of three segments - industrial, jewellery and other investments. Among that, 51% of the the gold market comprises jewellery, while 12 % is consumed in industries and 18 % in investment. In India, due to the anxiety of the people to safeguard their money, most of the gold jewellery is kept in lockers and hence not utilized. Even during times of the volatility, gold is highly in demand because in India it is a custom and tradition to give gold jewellery as a symbol of wealth especially during weddings.

Source : http://moneyexcel.com

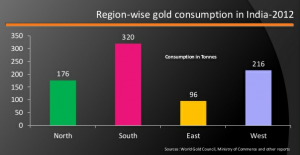

On further inspection of the gold consumption in India based on the report by the World Gold Council in 2012, the people in the southern region consumed 320 tonnes of gold as compared to 176 tonnes in the North,96 tonnes in the East and 216 tonnes in the West. It is obvious that states in south India consume more gold than any other region citing cultural reasons. Delhi , Punjab , Haryana contribute to about 65 % of North Indian consumers.

In the context of currency volatility, gold is considered a safe haven but when it comes to cash inflow, it is the least productive. In fact, unlike real estate, the investments made in gold are not utilized as such for the economic growth and development of the nation.

Compared to gold, the scope of a real estate investment varies regionally. This can be explained by comparing the scenario in India and in UAE. The real estate boom in Dubai can be considered as a bubble to a small extent due to speculation in the secondary market. However, the Government is trying to control the secondary market so that the bubble created in 2008 does not happen again. The real estate business in Dubai is a saturated market compared to India. In particular, the recent boom in this business is due to investments coming from other Gulf countries looking for stability. The risks involved in making the correct decision involves demographic, marketing and financial considerations. The sustainability of the investment may or may not be short-lived.

Now, the real estate sector in India is in its growing stages. The rising middle class has provided a boost to the real estate market in India. The number of people in a household in the US is around 2.6 while in India it is 4.8. Considering the US to be a saturated market, it is obvious that there is tremendous scope for real estate investments in India due to unsold inventory. The developments are in the growing stage. Unlike gold, real estate business has higher scope in terms of flexibility over its performance. If we consider India, there are innumerable factors responsible for the ‘boom’ namely the liberalization in 1991, the rising population of the country and its purchasing power, the increasing importance given to tourism. The presence of foreign investors and NRI’s has enhanced this field to the extent that real estate is now considered as an investment of highest cash inflow.

Investment in Gold and Real Estate have their pros and cons. Making the right decision at the right time counts, especially in the long run. However, if disposable income is available for investment, then it is highly recommended that one invests in Real Estate rather than gold, and promote the economic growth of the country.

References

- Gulf News

- http://moneyexcel.com

- Anne Mary Sebastian

Anne is a first year PGP student at the IIM Indore UAE Campus. She graduated as a BE from College of Engineering , Trivandrum, and now plans to focus on Marketing. Reading books, Writing poems and short stories are her passions and hobbies.

Follow more Stories on InsideIIM from IIM Indore UAE Campus at iimindore-uae.insideiim.com