If you have taken an education loan for your post-graduate course then you will find this useful. The timing of this article is also crucial especially for all the aspiring MBA grads who have given their CAT exams and are awaiting results and call from IIMs. Considering the present and foreseeable cost of education, undertaking a two-year MBA course will involve significant amount of capital investment – ranging from Rs 5 lacs to Rs 30 lacs (including cost of incidental expenses like travelling, hostel accommodation, etc). Nothing to say about the Masters course pursued abroad. As a result, majority of the students opt for availing education loans to fulfill their dreams. Availing an education loan is hassle-free given that the banks are aware of the fact that the rewards post completion of the course would be significant enough to repay their loan amount easily. However, there is an icing on the cake provided by the Indian Income-tax laws which the students aren’t completely aware of. I am deliberately stressing upon the term ‘completely’ based on the conversations I have had in the past with many students. I am talking about the tax benefits that the students can achieve on availing an education loan. These tax benefits effectively help you to reduce the overall cost of your education loan.

(Promoted : All articles by CA Prince Doshi, Tax Planning services by Prince Doshi )

So don’t lose sleep over the interest rates - here we provide you with the tax benefit tips that you should consider and take benefit of. The tax benefits are in respect of the deduction available to an individual from his total taxable income, an amount equivalent to the interest paid on the education loan. Deduction in respect of interest paid on education loan is available subject to following conditions:

- The deduction is available only to an individual in respect of interest paid by him on the education loan – Please note that it is not available to HUF, firm or company. Further, no deduction is available for repayment of principal component (which was available six years back).

- The individual should have taken loan from any financial institution (i.e. a banking company or any other institution approved by the Central Government) or an approved charitable institution (ie an institution established for charitable purposes and approved by the prescribed authority as per the IT Laws) – Please note that interest paid on education loan taken from relatives or friends will not be eligible for deduction.

- The loan must have been taken for the purpose of pursuing higher education. Higher education means any course of study (including vocational studies) pursued after passing the Senior Secondary Education or its equivalent from any school, board or university recognized by the Central or State Government or local authority or by any other authorized authority – This implies that interest on loan taken for pursuing any course after Class XII or its equivalent, will qualify for deduction.

- The loan should have been taken for higher education of self, spouse, children or the children of whom you are a guardian – Please note that in case your parents have taken loan in their name for your higher education, the parents will be entitled to deduction. This plays a vital role from a family tax planning perspective for which you may consult a Chartered Accountant for reaping maximum tax benefits.

- The interest component should have been paid only out of the income which is chargeable to tax – Please note that interest component paid from income which is exempt from tax shall not qualify for deduction.

- The biggest gain is the deduction amount – entire amount of interest paid during a financial year (provided your total taxable income is higher than the total interest component). There is no cap on the qualifying amount of deduction.

- Period of deduction - Deduction shall be allowed in computing the total income in respect of the initial financial year and subsequent seven years following the first financial year or until the interest is paid in full, whichever is earlier. This implies that the interest amount will be allowed as deduction for a maximum period of 8 financial years.

- The loan amount also includes incidental expenses for pursuing higher studies like hostel charges, transport charges, etc.

- There is no condition that the course should be pursued only in India - This implies that the loan taken for pursuing higher studies abroad will also be allowed as deduction.

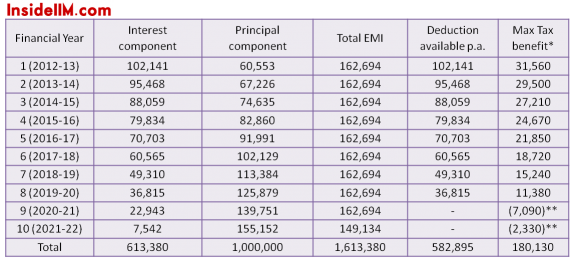

Let’s take an illustrative example where you have taken an education loan from bank in April 2012 for pursuing higher studies in India amounting to Rs 10 lacs @ 10.5% interest per annum for a period of 10 years. Your EMI in this case would be Rs 13,558 comprising of principal and interest component. The total EMI payment, principal and interest repayment and deduction available every year will be as under:

* Assuming a maximum tax rate of 30.9% (The actual tax rate can either be 10.3%, 20.6% or 30.9%).

**Represents tax benefit lost.

Given the above, the interest component amounting to Rs 582,895 paid for the Financial Years 2012-13 to 2019-20 will be allowed as a deduction to you in your return of income for respective financial year, resulting in a maximum total tax benefit of Rs 180,130. However, interest component for year 9 (2020-21) and year 10 (2021-22) will not be allowed as a deduction since the time limit of 8 financial years elapse during the year 2019-20, resulting in loss of maximum tax benefit amounting to Rs 9,420.

What is your duty?

If possible, try to maintain the tenure of your education loan to maximum eight years to reap maximum tax benefits. Further, do an optimum family tax planning by ensuring that the loan is taken in the name of the individual (you or your parents) who is or is to pay maximum taxes on his income since, deduction is available only to the individual in whose name the loan is availed. Consult an expert, if required. You will save much more than what you will pay to him.

Final Tip – This one is worth couple of grands which is being given to you all for free - Timing of availing the education loan. If you have read and understood the article correctly, you will realize that the period of deduction is 8 financial years ie period of April 1 to March 31. Accordingly, avail the education loan in the month of April or during the earlier months of a financial year to ensure that maximum interest component is availed as a deduction in the 1st and 8th financial year and minimum benefit is lost in case the duration of loan exceeds 8 years. In case the loan is taken in the later half of the year say in December then, in the 1st year deduction will be available for interest component of only 4 months which will comprise to be 1st financial year.

Given the above, with minimum effort you can effectively reduce your education cost and at the same time be an honest taxpayer paying the necessary taxes on your income

Questions and suggestions are always appreciated.

- Prince Doshi

Prince Doshi is a qualified Chartered Accountant and a B.Com graduate from Narsee Monjee College of Commerce and Economics. He has a post qualification experience working as an Associate for BMR & Associates, a leading tax consultancy firm. Presently, he is into his own Chartered Accountancy practice specialising in the field of income-tax consultancy, sales tax, service tax and audit compliance

All articles by CA Prince Doshi

Tax Planning services by Prince Doshi

You may also like to read:

Final Placements - Class of 2012 - The Big Test