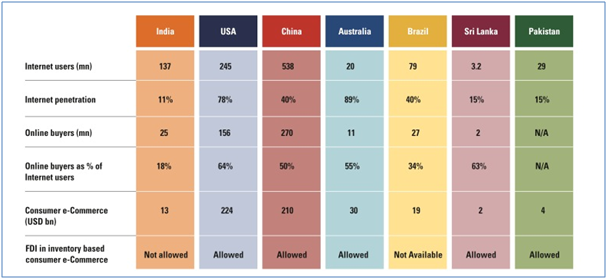

According to an IAMAI-KPMG report released in September 2013, there is a direct co-relati0n between the number of internet users, online buyers, openness to FDI and the value of e-commerce. The number of online buyers and size of e-Commerce industry are very high in countries in which FDI is permitted. (Exhibit 1)

EXHIBIT 1

With the new Government’s plan to allow foreign retailers to sell via e-Commerce platforms, it is a clear indication that FDI will be permitted as well in the near future. This is bound to propel the e-Commerce industry in Indian to even loftier heights.

Various demand and supply driven factors also support the growth of the industry. Favourable demographics, increasing number of urban households, growing internet penetration in smaller towns and rural areas, proliferation of mobile devices and emerging need for convenience, choice and access are acting as prime movers from the demand side.

Growth of Mobile Internet:

Mobile phones are proving to be an important factor in the e-Commerce ecosystem because of its easy compatibility with the Internet. India has more than 900 million mobile users, of which around 300 million use data services. This number is expected to touch 1200 million by 2015. Also, more than 100 million mobile users are expected to use 3G and 4G connectivity in the coming years. Of the total 900 million mobile users, a meagre 27 million are active on the Internet. Moreover, only 4% of the active mobile internet users buy products through mobiles. However, analysts expect the situation to improve with growing access to the Internet penetration and the availability of broadband, and the rapid adoption of smartphones and tablets which could prompt more young people to shop online. According to a recent report, an internet penetration of 25% could be the tipping point for e-commerce growth.

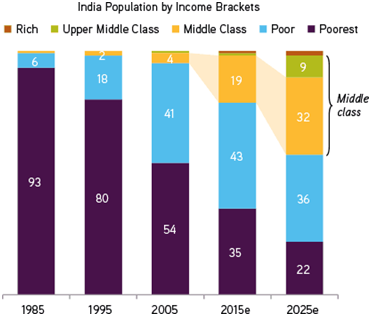

Rising Middle Class:

According to consulting giant McKinsey and Co, the size of the Indian middle class is estimated to cross 250 Million by 2015 that is roughly one-fifth of the Indian population. (Exhibit 2) A rise in middle class means more disposable income which in turn directly translates to more tech savvy (online) methods of purchasing goods/services. Herein lies the potential of e-Commerce in the coming years.

EXHIBIT 2

Growth of smartphone sales among youth:

Young people in India spend 16% of their disposable income online and an estimated 828 million Indians will be less than the age of 35 in 2015, the IAMAI-KPMG report said. These people use mobile devices to shop, and the increasing penetration of smartphones in the country can only help the cause of e-commerce. According to research firm Convergence Catalyst, smartphones sales in India more than doubled in 2013 to reach 41-43 million units. For the first time, monthly sales crossed four million units in the December quarter. According to a September report by Avendus Capital, smartphone penetration in India is forecast to touch 382 million by 2016 while research firm International Data Corp. (IDC) predicts that 155.6 million smartphones will be shipped to India in 2016 alone. Total tablet sales in India grew from 1 million in 2011 to around 3 million units in 2012 and this number was expected to double in 2013 to reach 6 million units.

E-Commerce is much more than Flipkart and Amazon:

People tend to be skeptical about the valuation of Indian e-Commerce industry largely because their idea about the industry is restricted to e-tailers like Flipkart and Amazon. However, there is more than meets the eye. Travel operators (rail and air tickets and the like), account for more than 70% of the market, with sales of other goods accounting for the rest.

EXHIBIT 3

As the Exhibit 3 indicates, the e-Commerce travel industry, which contributes to nearly three-fourths of the overall sales, is also growing in a steep curve. This cements the view expressed by us regarding the rationality of the industry valuations.

So, though e-tail might account for only a small percentage of the industry, it is bound to keep growing, until one day almost all retail transactions are conducted online – that is the premise. Based on this premise, and armed with investible funds, private equity players are placing risky bets that their investee companies will be the last people standing in the e-Commerce marketplace after the shakeout occurs.

So, is the decision to pump in millions into e-Commerce rational and justified?

The answer is ‘YES’, provided the investors are rational enough to bet on the right horse. The Indian market is cluttered with numerous e-Commerce players and it is true that not many will stand the test of time. So, the ultimate, final answer boils down to the foresightedness and prudence of the investors in choosing the right player to back.

References Cited:

https://www.kpmg.com/IN/en/IssuesAndInsights/ArticlesPublications/Documents/KPMG-IAMAI-ES.pdf

http://www.iamai.in/PRelease_detail.aspx?nid=3161&NMonth=9&NYear=2013

Team Name: The Intellect Box (IIM Ranchi)

Team Members: Sayan Kar, Adarsh K A M.

The Article arguing FOR the motion can be read here: Battle #1: Valuations in the Indian E-Commerce Industry have Become Irrational - IIM Trichy - FOR

------------------------

Counterpunch by IIM Trichy 24 hours later

The first paragraph of the article (IIM Ranchi) is precisely the definition of a speculative bubble, in a way exemplifying what we stated. According to Investopedia, “For most bubbles, in the beginning, attractive fundamentals may drive prices higher, but over time behavioural finance theories suggest that people invest so as to not "miss the boat" on high returns gained by others. When the artificially high prices inevitably fall, most short-term investors are shaken out of the market after which the market can return to being driven by fundamental metrics”.

We agree that the demand drivers point to a huge growth potential but the valuations have exceeded the growth fundamentals as we have shown in the previous article. The term “irrational exuberance” coined by Alan Greenspan, the ex-fed chairman describes this phenomena of inflated asset prices that aren’t supported by fundamentals. Robert Shiller, an expert on market volatility, supports this theory in his book, Irrational Exuberance. He cautioned that a market that is overvalued by historical standards is inherently precarious. No one wants to sit on the bubble if or when it bursts.

The FDI argument

FDI will actually lead to an influx of a large number of players and the size of the industry will go up. This also means the price-battle will continue, affecting the profitability of the e-commerce firms. High valuations won’t sustain without return on investments.

Just yesterday, an article in the Economic Times pointed to the similarities between the e-commerce and the airlines industry. The e-commerce giant Amazon hasn’t yet made any profits and they keep pumping in a lot of money for expansion. Similar is the case with Indian e-commerce firms; they require a continuous stream of money, year after year. Though Amazon and Flipkart have a higher market share relative to the competitors, there are too many firms vying to capture the customer’s interest.

Brand loyalty and profitability

But do these customers offer loyalty? When they want to buy a product, they will look up sites that offer the best discount, (free) delivery options and buy there. Does service differentiation really matter? If Flipkart suddenly stops the discounts, will these customers still buy from it? Will the massive amounts of money being written off as ‘customer acquisition’ costs provide any returns in the future?

There is no denying the fact that demand drivers offer a huge revenue potential for this industry. The world-wide revenues of e-commerce firms in 2014 are $ 1.5 trillion! Who wouldn’t want to get a slice of that! But that doesn’t guarantee profitability. Airlines industry has revenues of $750 billion. What about the return on investments? It ranged between 2.9-5% over the past few years (The Economic Times).

The e-commerce industry will continue to grow but will it completely replace the retail transactions anytime soon? A 2014 report by Technopak says that 97% of the estimated retail sales of INR 62, 40,000 crore will still take place online.

It’s not all about Flipkart? Or is it?

Are people sceptical about the valuation of E-commerce industry because they think that industry is just Flipkart and Amazon? Or do the investors think that way?

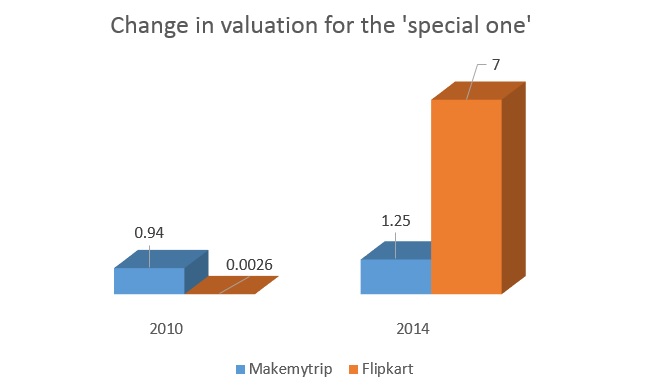

We agree that E-commerce is not all about Flipkart and Amazon. The travel segment occupies 70% of the market share where as Flipkart has a 5% share of the e-commerce market. The valuation of an online retail company is almost seven times the value of a listed company in the travel segment. Why is then there is so much difference in their valuations?

“E-commerce is much more than Flipkart and Amazon”, say our friends from IIM Ranchi. We would like them to reiterate this fact to the PE firms who are busy bloating up valuations of just the e-tailers and conveniently ignoring everyone else. Look at how the valuations of Makemytrip and Flipkart have shaped up over the past four years. When we say that the entire e-commerce industry is growing as a whole, why this special treatment to Flipkart only? This is where we talk about the ‘expectations’ theory where we attribute this magnanimous rise to a bubble of expectations and speculations.

Also, MMT listed on NASDAQ sometime in 2009. How did it fare there?

[caption id="attachment_45375" align="aligncenter" width="757"] Source: Ycharts[/caption]

Source: Ycharts[/caption]

We see a -40% return. Why did the intelligentsia of the US Stock markets not deem it fit to think that MMT is also a vision of India’s future, a beacon of hope for the emerging economy ravishing with oodles of market potential? Is the e-commerce growth story really not about just Flipkart?

The GMV conundrum

We talked about the GMV multiplier method for valuing e-commerce firms. Let’s now look into the impact of GMV on profitability. Even if we the Gross Merchandise Value (GMV) increases substantially, it doesn’t necessarily translate into profits. Let us assume that 2 years down the line, the GMV of Flipkart goes up to $ 2 billion. Assuming a gross margin of 15%, they will earn $150 million a year. Currently, the data indicates that they lose $ 10 million cash every month. Let the total expenses be $ 15 million per month. If the costs increase by 20% in two years, then they will lose $ 18 million a month, or $ 216 million a year. They would still be making $ 76 million losses.

They might eventually make profits but what about the rate of return for the investors? Will they accept an IRR that is less than the return from fixed deposits? No and we all know it.

The hype around mobile penetration

According to IAMAI reports (December 2013), US has 245 million Internet users, of whom 156 million are online buyers, China has 538 million Internet with 270 million online buyers. “Even Sri Lanka, with 3.2 million internet users, has two million online buyers. In each of these countries, online buyers constitute 50% of the total internet users. India, on the other hand, with over 231 million internet users, has just 25 million online buyers. While our friends have attributed this to a huge potential for the future, reports from PTI suggest that this number is primarily attributed to poor back-end operations which lead to a lack of trust in online purchase. This is a major reason why the growth rate of customers transacting online will be slower than what is expected.

The ‘right horse’

If all the investors go after the ‘right horse’, it is only natural that it will become overpriced. The investors who didn’t want to miss out the bus second time, will buy at these high valuations. Will the returns be in line with the expectations? When the prices come down to the lower, sustainable levels, will the small investors stick around? The ‘buy low and sell high’ strategy will not be within the reach of the late entrants.

Before betting on the right horse, it is important to analyse the horse’s track record, sometimes even the jockey’s record. The question to ponder about is “Do they normally place really high bets or is it the horse placing that fluctuates?” (Do read about betting on horse races to comprehend this statement)

Team IIM Trichy

Bhanu Putumbaka

Venkat Iyer

Comments

Ashish Verma

What about the fact that the percentage of internet users in India is not even the 16%? Ashish Verma Delhi school of Economics

25 Aug 2014, 08.19 PM

Ashish Verma

and only half of them would be doing transactions by e-commerce, which would be 8% (to be generous). Its just that i don't feel pumping in millions into e-Commerce is justified, as you are clearly ignoring 92% of the Indian population here.

25 Aug 2014, 08.38 PM

+Read Replies (1)

Sayan Kar

Ashish Verma: That is true, but only if we look at the present. With the current rate of rising middle class, which invariably leads to better internet access. in India and the active collaboration of the government and private players in laying out a plan to connect the entire country through an internet highway (Digital India) tbis scenario is about to undergo a drastic change. We must not forget that these valuations are not based on a one year plan but a long-term plan in which the internet penetration in India is set to see a massive increase.

28 Aug 2014, 10.37 PM |

venkat iyer

"Flipkart removed the delivery charges for the most obvious reason – to counter the growing competition" This was exactly what we hinted at. We never mentioned that it was to cover something ‘shady’. Well, we’re not talking about Satyam here, for starters. To make it clearer, we meant that delivery charges were removed because the competition (Amazon) offered free delivery, thus putting pressures on Flipkart’s bottomline (It was a major reason why small cart customers were moving towards Amazon). Thus, in an industry such as this, price wars would lead to lower profit margins, thus making the huge valuations (HUGE expectations of growth in profits) untenable. This was our point.

26 Aug 2014, 06.53 PM

+Read Replies (1)

Sayan Kar

Well, the point was probably not that clearly mentioned then. Anyway, we are talking about a market which follows the most common structure- monopolistic competition. Taking in the typialities of that structure it might not be very hard to observe that the firms (Flipkart and Amazon in this case) invariably move towards product/service differentiation and operate on a short-run to short-run cost curve. This primarily means that they keep earning profits (once the profit-making initiates of course) even in the long run. This is made possible by product diversification, moving into untapped markets and often having the first-movers advantage. Either Flipkart or Amazon might perish in the long run, so to say. However, that doesn't matter in this case as we are looking at the whole industry per se and not any individual player. The one who innovates, differentiates, diversifies will sustain in the long run and will do so while earning healthy profits(with or without major rivals staying in the market).

28 Aug 2014, 10.45 PM |