Participants at IIM Indore Mumbai Campus got a detailed overview about Private Equity Funds Management on 1

st November by Mr. Kartik Ramachandran, Principal, IDFC Project Equity Pvt. Ltd. He gave an interactive session on ‘

Ramblings on Private Equity Industry & Thoughts on career planning’.

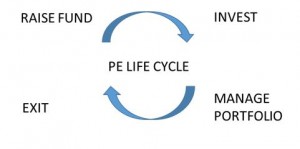

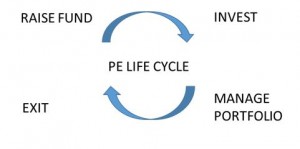

Mr. Kartik is an alumnus of IIM Indore 2001 batch. He has been working in IDFC for the last 7 years and has vast experience in private equity. He spoke about the scope and functioning of Private Equity firms. Since the last two decades PE funds have been offering around 15-16% returns and therefore it’s an attraction for many investors. The boom in PE came in the year 2005. Even then raising the funds is a difficult task for a PE firm, because of the lack of liquidity in PE investments. Also, since the gestation period of return on investments in PE is more so people hesitate in investing, which makes raising funds a difficult task. Once the funds are raised, a Fund Manager (General Partner) does research for various investment options. Mr. Kartik explained the common investment cycle followed in PE firms as:

He emphasized the importance of understanding the legal frameworks of PE investments, as the funds are huge and the firms no public record. He also explained the various factors covered in an investment term sheet. He suggested that a retail investor should stay away from private equity as there is high risk appetite.

He discussed the career options in private equity. As these are thin(less people) organizations, the selection of a candidate is done through great scrutiny. The upside for a GP (General Partner) is that he gets a share of returns on successful investment and no downside if the investment doesn’t yield significant returns. He also explained the traits of a good private equity fund manager. The investment committee is the one who takes the final decision after all the factors are weighed in. The discussion ended with few more questions from the students, such as the choice of investments a company makes, how a company decides to go for private equity or for IPO.