Bank notes made their appearance in India towards the end of the 18th Century. Before that coins and barter system were most prominent.

Presidency banks (now known as State Bank of India) initially undertook the management of Paper Currency, who were appointed as agents by the Government of India for the issue, payment and exchange of promissory notes.

This task was later assigned to currency mints, thereafter to the CGA and later the Office of Controller of the Currency was created in 1913 from whom the Reserve Bank of India took over the function of note issue from 1935.Since then RBI is the sole authority for currency management.

Currency management essentially relates to planning, designing, issue and withdrawal of currency, ensuring its integrity, availability and the maintenance of quality. The Department of Currency Management (DCM) of the Reserve Bank undertakes all these functions.

Under Sections 24 and 25 of the Reserve Bank of India Act, bank notes of any denomination not exceeding 10,000 rupees can be issued by the Reserve Bank, the design, form and material of the notes being such as may be approved by the Central Government on the recommendations of the Central Board of the Bank.

Currency notes are legal tender at any place in India in payment or on account without limit as per the Act. However the Central Government may deprive currency notes of any denomination of their legal tender character on recommendation of the Central Board.

Demonetization Phase -

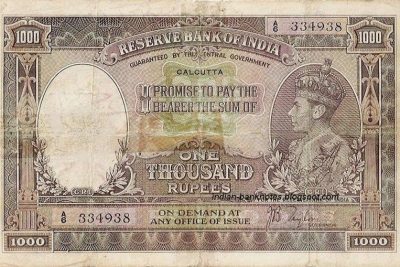

In the year 1946, with the object of checking unaccounted money and tax evasion, Government demonetized notes of Rs.500, Rs.1000 and Rs.10,000. But since such high denomination currency was not accessible to the common people it did not have much impact. The Bank reintroduced from 1954, notes of the denominational value of Rs.1000 and Rs.10000. Interestingly Rs.5000 notes were also introduced from that year.

The second phase of demonetization took place in the year 1978 when the then prime minister of India Morarji Desai announced demonetization of Rs.1000, Rs.5000 and Rs.10000 on the ground that the availability of these notes facilitated illicit transfer of money for financing transactions which were harmful to the national economy or for illegal purposes. Notes in the denomination of Rs.1000 have been reintroduced in October 2000.

The latest phase of demonetization of Rs.500 and Rs.1000 currency notes of Mahatma Gandhi series in the year 2016 was witnessed by all of us. It was also announced that the new Rs.500 and Rs.2000 banknotes of the Mahatma Gandhi new series would be introduced in exchange for the old banknotes.

The regulation of currency is not as simple as it seems.There are several rules and laws which governs the function of currency management, which makes the task more complex yet it remains the most important function of Reserve Bank of India.