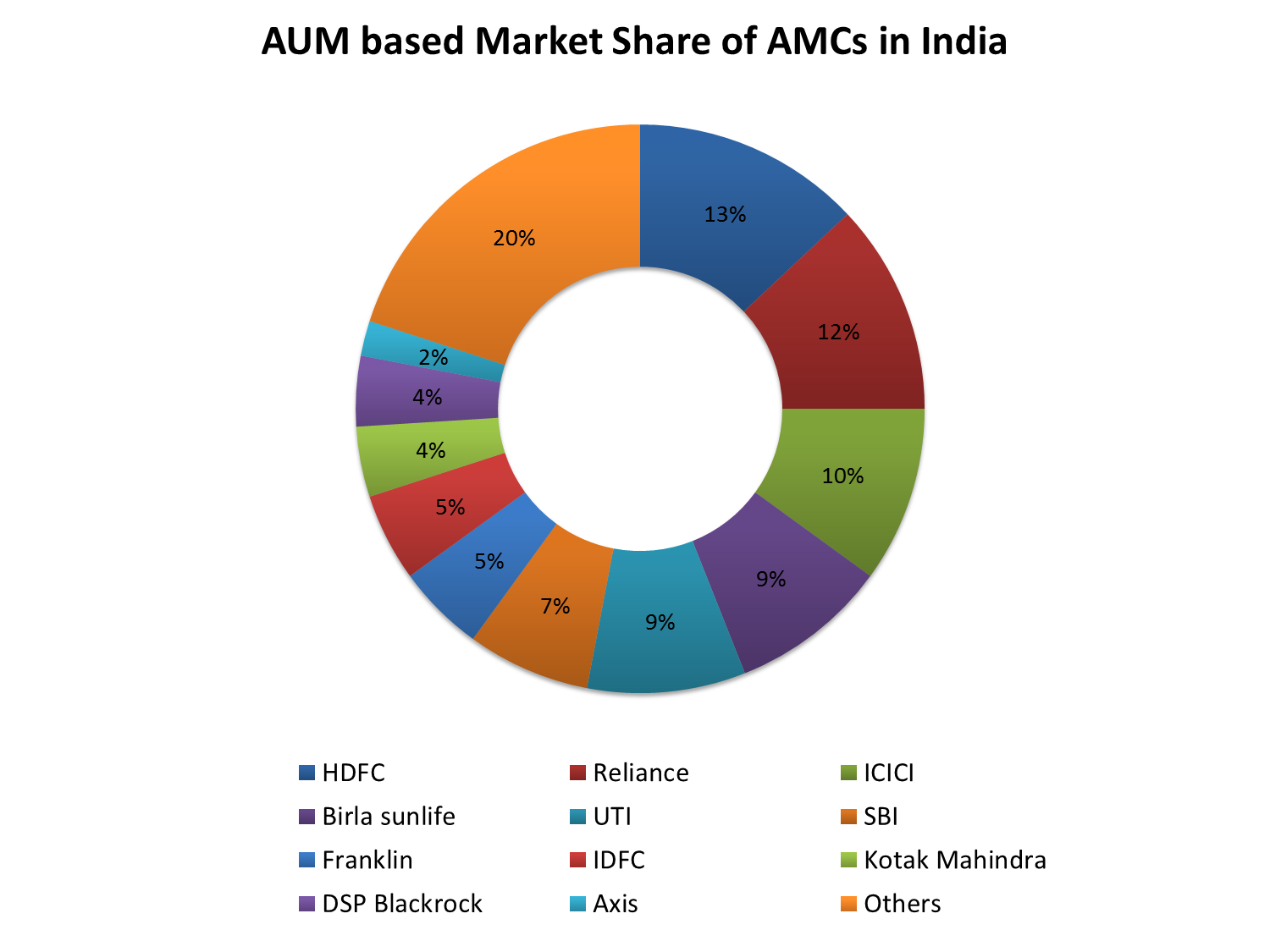

As the honorable Finance Minister of India, Mr. Arun Jaitley presented the union budget of 2014-15 on July 10; there was uproar about the setbacks for the mutual fund industry. The Mutual Fund industry in India comprises of both domestic and international players with HDFC mutual fund leading in terms of AUM (Asset under Management).

This Budget proposed increase in the long term period for tax calculation from one to three years, taking away the benefits of tax arbitrage. This Decision came as a shock to the FMPs (Fixed Maturity Plans) which were designed specifically to take advantage from it. Debt oriented schemes which constitute 57% of AUM of the Industry, will be affected most.

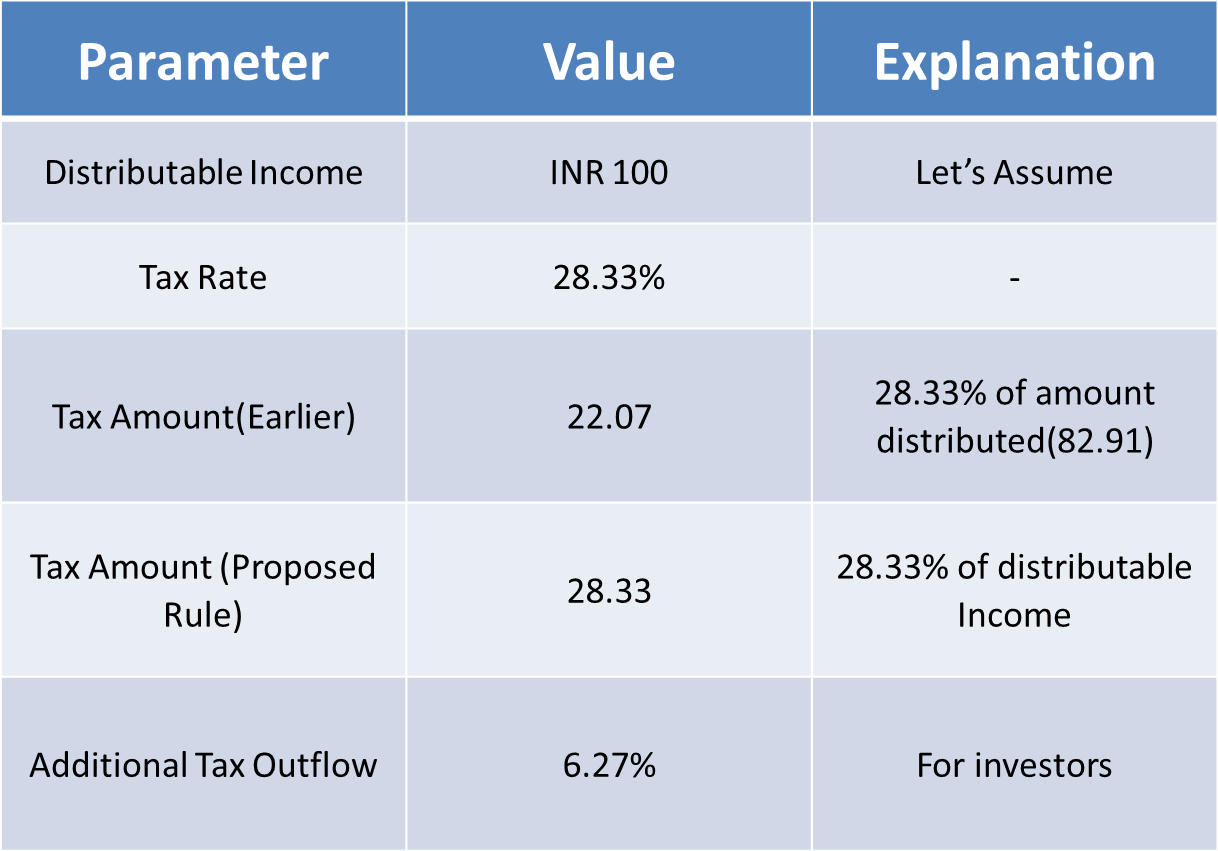

Another setback to debt funds came in the form of change in the DDT (Dividend Distribution Tax) Calculation Method, which will now be more applicable on the Distributable Surplus rather than the Amount Distributed. This will impose an additional tax liability of 6.27% on the investors.

Exhibit 1: Calculation of Dividend Distribution Tax

Long Term Capital Gain Tax which was earlier calculated as lower of 10.3% without indexation and 20.6% with indexation, will now be calculated uniformly as 20.6% with indexation.

These proposals are the reason why all articles in leading newspapers and magazines are taking this budget as heartbreak for the mutual fund industry.

But is this budget completely demolishing the expectations of the mutual fund industry? The answer is ‘NO’. Despite all these setbacks, this budget also creates new opportunities for this sector. The government has indicated that it wants to promote investments in the country and raised the investment limit under Section 80C to 1.5 Lakh from 1 Lakh, which will directly benefit the ELSS (Equity Linked Saving Schemes) of the mutual fund companies. Long term tax benefits will still be available for investments with a horizon of more than 3 years.

This Budget also allows the Mutual fund companies to introduce Pension Funds. Pension Funds, which accounts for a large pool of investments in developed countries, open doors for investments of long horizon. FMPs which are affected adversely, can also be reinvented according to the recent standards.

New Government in the country is very keen to promote the growth and investments in the country. Measures taken by RBI and Government has been successful to a significant extent in controlling the Inflation, which is a good signal for the stock market.

So, despite a few setbacks, this budget brings a lot of new opportunities for the mutual fund Industry. It is now clear that to sustain in this dynamic economic environment, changing regulatory standards and rising competition, Mutual fund companies need to update their products and schemes to gain the confidence of investors.

-Kaushal Kishor

References:

1. http://indiabudget.nic.in/ub2014-15/bh/bh1.pdf

2. http://pib.nic.in/archieve/others/2014/jul/gbEngSpeech.pdf