The final part on Analysis of Budget brings to you what you get as a consumer and what will happen to the trade of India. The Government has proposed an alternative tax scheme for consumers and feels that 80% of taxpayers will opt for it.

One can form an opinion about the same after understanding the implications of the scheme!

Part 1 of the Budget 2020 Analysis: Aspirational India

Part 2 of the Budget 2020 Analysis: The Business World

New Income Tax Scheme

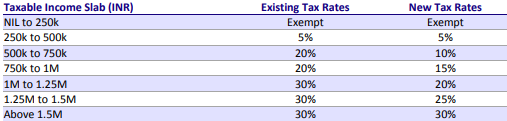

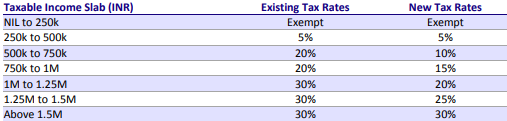

In the 2020 budget the government has announced an optional new income tax scheme (lower income tax rates) for individuals / HUF.

The flip side is that under the new tax system people who opt for lower tax rates will not be able to claim most of the exemptions and deductions. If a person has business income, he/she can not revert to the old tax regime once the new tax scheme is selected. However, an individual without business income will have the option to go back to the old regime.

Source: Union Budget Document

The new option may not be really beneficial for a large section of taxpayers. Anybody earning Rs 15 lakhs or more would save Rs 75,000 in income tax under the new IT rates. At 30% marginal tax rate, this is equivalent to tax saving on deduction of Rs 250,000. Thus in simple terms, if the deduction amount you have to forego is higher than Rs 250,000, then the new tax regime will not make sense.

Now let us see what all exemptions gets disallowed if you opt for lower tax rates:

LTA: 60,000

Standard Deduction: 40,000

Interest on HL: 200,000

80C Investments: 150,000

80D Medical Insurance: 50,000

80TTA Savings Account interest: 10,000

Income of Minor child: 1,500

The above itself Totals to Rs 511,500

Impact Analysis of new tax structure-: (Source: MOFSL)

Further HRA and Donation under Section 80G is also not allowed. HRA exemption itself can be substantial amount.The maximum incremental gain on migrating to the new tax structure would be only INR15,000 p.a. (assuming the taxpayer continues to avail benefits from investments under 80C (INR150K) and 80D (Mediclaim) under existing regime). However, to avail these incremental benefits, the taxpayer would need to forego host of deductions (e.g. HRA, interest on housing loan, LTA, exemptions for SEZ units, standard deduction, deduction for entertainment allowance, professional tax, donations and various other deductions under chapter VIA). Net in net, it seems to be a no brainer.

Extension Of Time Limit For Interest On Affordable Housing Scheme

The loan interest deduction (INR150k) taken for the purchase of an affordable residential property has been extended to FY20-21 for another year. Consequently, interest on loans received up to 31st Mar'21 is eligible for deduction under section 80EEA of the Income Tax Act. The said deduction is intended to encourage first-time buyers to invest in property in residential homes.

No Dispute but Trust Scheme – ‘Vivad Se Vishwas’ Scheme

A taxpayer would be required to pay only the amount of the taxes in question and receive a full waiver of interest and penalty if he/she pays by Mar'20 31st. Those that take advantage of this scheme after Mar'20 31st will have to pay some extra amount. The scheme remains open until Jun'20 30th. Taxpayers in whose cases appeal at any stage are pending can benefit from this scheme.

Hence, good schemes have been proposed for the consumer but nothing to increase monetary benefit and help out the consumer in slowing down economy with rising inflation!

Now, let’s see the government’s stance on Import and Export

NIRVIK-Niryat Rin Vikas Yojana

Under the scheme, also called the Export Credit Insurance Scheme (ECIS),

the insurance guaranteed could cover up to 90 per cent of the principal and interest and include both pre- and post-shipment credit. The Export Credit Guarantee Corporation currently provides credit guarantee of up to 60 % loss.

The ministry has also proposed to subsidize the premium under the scheme that has to be paid by exporters of certain key sectors. The government has also announced

an electronic-refund model for quick and automatic disbursal of input tax credit refunds for exporters, set to go live by the end of the month.

The government has gone protective when it comes to Imports. Custom duties on around 50 products including electrical appliance, footwear, furniture etc. have been increased which will further hike inflation!

Hence, the exporter will find it easy to get credit but the imports are going to be costly.

This is the last part of the analysis and all 3 parts cover almost all important provisions related to the budget. Prepare well and ace your WAT-GDPI. All the best!

***

Recommended Current Affairs topics for your MBA Interview Preparation!

Coronavirus And Its Impact On Global Economy

Citizenship Amendment Act (CAA) - All You Need To Know

The US-China Trade War Explained

Iran USA Conflict

Article 370 And Article 35A

Venezuela's Oily Hyperinflation Story

The Zomato-Uber Eats Deal Explained

Why Should India Be Friends With Its Neighbours?

All You Need To Know About Air India

Opting Out Of RCEP - Does India Need To Rethink Its Decision?