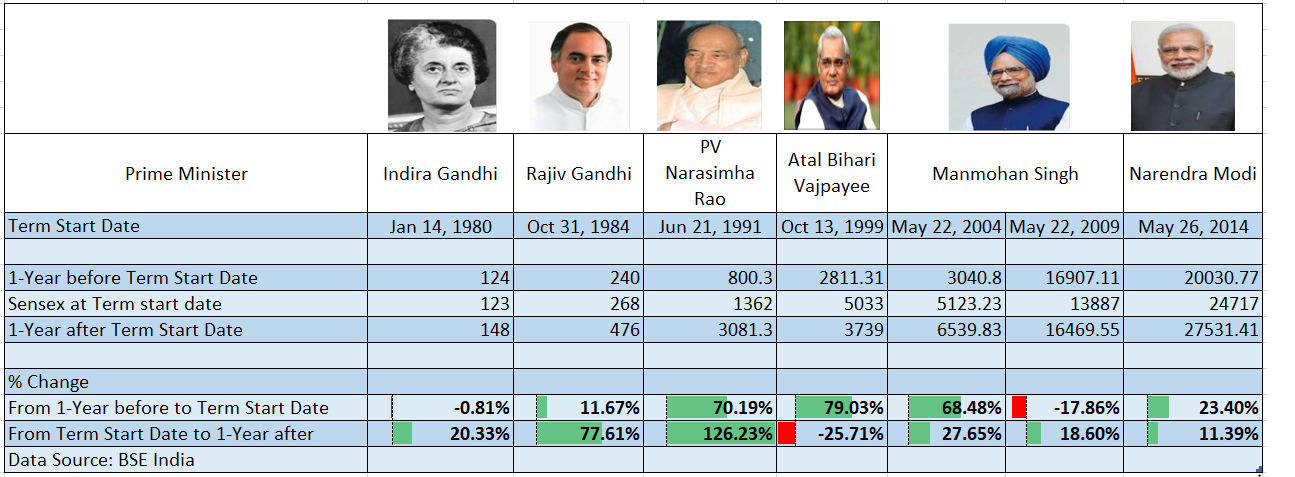

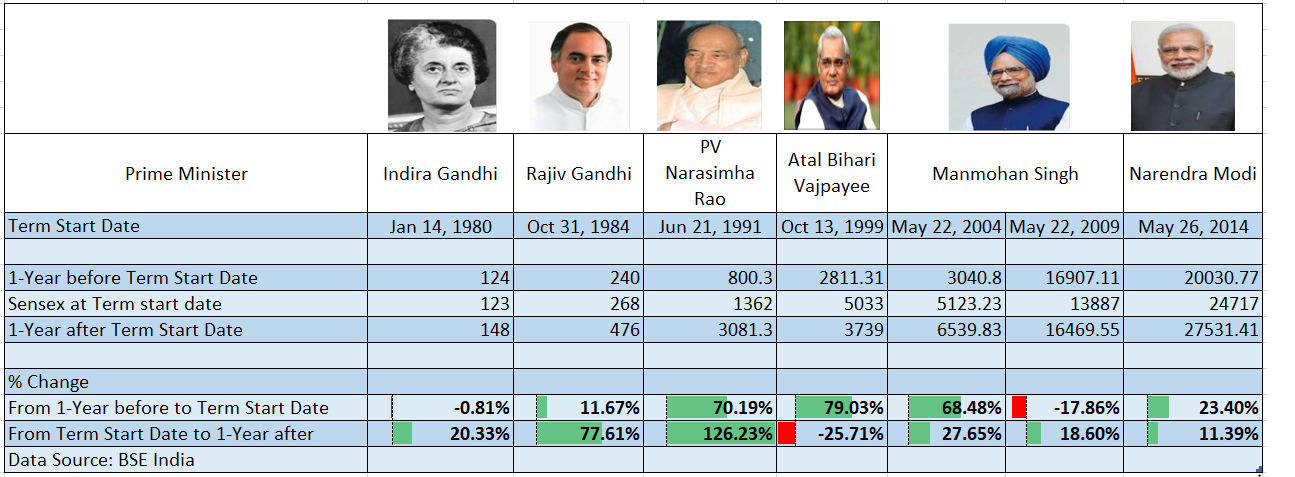

Note: This research was done by Krishna Kunal and me during our Summer Internship. Governments that have completed at least 3 years have been considered.

As we are about to enter 2019, a year set to be a significant one in the Indian political landscape, there is a lot of apprehension about how the financial markets will react to it. Usually, in the election time period, the investor focus is less on the corporate earnings and more on the outcome of the political battle.

There are plenty of factors that are in play, with globally there being a possibility of a US-China trade war denting economies around the world despite there being a recent temporary truce in the war. The direction of Brexit can also have its ripple effects in India with a hard Brexit meaning loss of the European market access for the Indian businesses setup in UK (For Eg- Tata JLR). Though the US Fed has forecasted a slower rate hike next year in their monetary tightening, they still increased the US Policy Rate in the most recent meeting. The European Central Bank is set to stop its quantitative easing programme after a long time. The Indian fiscal balances are largely controlled through the Oil prices which have been favourable lately (Brent Crude hovering around $50/barrel) due to the US continuously producing Shale Oil and OPEC having discord among their own camps. The coming months in the run-up to the elections are likely to see some populist measures with a lot of talk going about the farm loan waivers that can hurt the banks’ balance sheets and affect their ability to lend. On the other hand Govt. is planning another recapitalization of banks with the intent to enable lending by PSU banks and also stimulate growth in the coming quarters.

There has been a lot of volatility in the markets lately and investors might be looking at some option trading strategies that count on high volatility.

If history is anything to go by it is likely that this year will be a positive one for the Indian Financial Markets. According to the General elections from the past 38 years, there have been all but one occasions where the markets failed to give positive returns in the year following the elections. Both the Indira Gandhi led govt. in 1980 (1-year return of 20%) and the Rajiv Gandhi led govt. in 1984 (1-year return of 77%) gave decent 1-year returns. The PV Narasimha Rao govt. in 1991 led the liberalization process and opened up the Indian markets for global investors helping market gain staggering returns (1-year return of 126%). The Vajpayee govt. in 1999 was built amongst a lot of turmoil on the domestic (Kargil conflict) as well as a global front (9/11 Attack in the US) and hence the market reacted in a negative way. The two Manmohan Singh terms also yielded handsome positive 1-year returns of 27% and 18% respectively. The Narendra Modi govt. came to power with a huge majority in 2014 delivering a 1-year return of 11.4%. The Market doesn’t like uncertainty so historically after the results it reacts in a positive way instilling confidence in the investors.

So all in all, the past data suggests that there’s always been an uptick in the market sentiment post the General Elections results, no matter the party that comes to power.