If you are pursuing an MBA, there is a high chance that you have taken an educational loan. Here, I will be discussing how one should plan their finances during and majorly post MBA.

Most MBA course fees hover from 15 Lacs to 25 Lacs; thus, the preference to take an education loan. Banks are competing against each other to provide the best rates to students.

So, in case you are planning to take a loan, search thoroughly on the internet. There are many sites which can provide information about them. Another source is to speak to your seniors/alumni to understand which bank they chose & why.

What to do if you are self-financing your loan?

In case one plans to get their education self-financed, referring S.80C of The IT Act is recommended. It states that when a parent finances the education of their child (up to 2 children), the principal paid towards tuition fees can be utilized for deduction from taxable income.

This principal payment will help your parents get a tax deduction up to 1.5 Lacs every year. It is important to note that many tax-saving investments are covered under S.80C, and the maximum overall deductible amount is Rs.1.5 Lacs every year.

What to do if you have taken an education loan?

Most of us feel the pinch of interest once we start repaying the loan. Loans are considered as a burden on the chest and many try to get done with them in the earliest possible time. But herein, I would like to re-introduce you to one of the topics studied but often forgotten in finance - leveraging!

Leveraging in simple terms is the use of debt along with owned funds.

An important aspect to be seen is the cost of capital. If one has multiple loans like car loan, housing loan, etc. most often, education loan would have the lowest interest burden.

Investing smartly in Tax Saver MFs can yield returns ranging from 10%-20%. So, wouldn’t it be prudent enough to not rush for repaying the loan and instead utilize the funds to invest and gain higher returns or save your money and keep them aside for liquidity or as a contingency fund?

In short, utilize the low cost of debt to either invest and earn higher or save your money for emergency requirements.

Delay, not prepay your loan!

Another reason why loans should not be repaid at the earliest is that, while there is no incentive in early repayment, there is an incentive in delaying it.

Example- If you take a loan @9% interest and repay it in 10 years, the interest amount would be roughly 0.5x your principal amount, while, if you plan to repay it in 3 years, the interest amount will only be 0.15x of the principal.

S.80E of the IT Act provides you with the incentive to benefit from the interest paid on education loan. S.80E allows for the deduction of interest paid in an assessment year from the taxable income.

Thus, if you pay tax in 30% or 20% bracket, you would end up paying lower taxes. Alternatively, it can also be seen as a reduction in the loan rate standing effectively at 6.3% or 7.2% respectively.

The best part about S.80E is that unlike S.80C, there is no threshold limit here. S.80E allows interest deduction for up to 8 years, assisting you in tax planning and setting your repayment duration.

It is no secret that the world, along with our country, is heading towards a recession. It would only be prudent to plan your finances as carefully as possible.

Alternatively, one can prepone their payments anytime by paying low/no additional charges.

Tips on Personal Finance

Having mentioned above the benefits of delaying your repayment, I would now share some known but crucial facts to help you maintain your finances -

- Plan your expense well in advance

- Credit cards are your friends, do not exploit them

- Do not purchase anything and everything on EMIs; the debt will be mountainous in no time

- Schedule your payments using auto-debit instructions to prevent defaults

- Invest & diversify them

- Ensure to have emergency funds at all times

- Reconcile your expenditure periodically

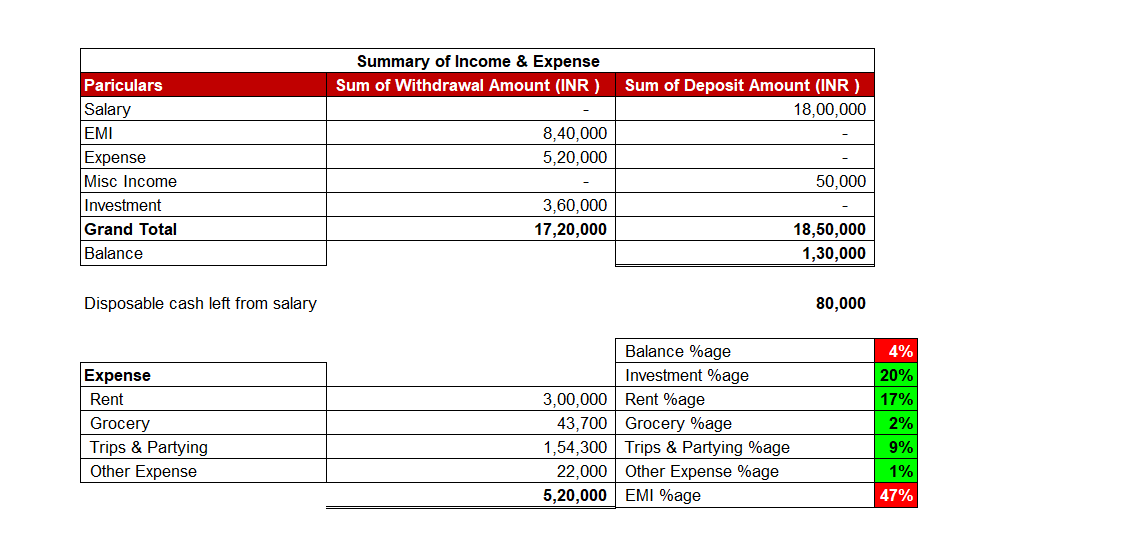

To keep check on my utilization of funds, I have prepared a pivot table from my bank statement, which helps me know my fund position and make decisions. Below is a specimen copy for reference. Anything similar that helps one stay in control of their funds is recommended.

Note: All views are expressed by the author in his personal capacity and should in no way be termed as an investment advice. Consult a wealth manager to plan your finances.

About the Author

Shailesh is a Chartered Accountant with experience from EY. He has had the experience of working with many listed entities. He is a karateka and takes a keen interest in problem-solving.