(Promoted : All articles by CA Prince Doshi , Tax Planning services by Prince Doshi )

All you need to do to avail exemption of House Rent Allowance from your salary income and reduce your tax liability

A salaried employee is expected to offer his entire salary income to tax without any deductions except for profession tax. This gives a very limited opportunity for a salaried employee to devise any tax planning mechanism with respect to his salary income. Further, taxes are already deducted by the employer on the salary income by way of TDS (referred to as tax deducted at source) and only the net salary income is received by the employee at the end of each month.

However, all’s not lost for the salaried employees considering the exemption available for House Rent Allowance (‘HRA’). This is the only component of the salary structure (‘CTC’) that can be used by an employee to reduce his tax liability significantly. HRA, as a component of CTC is usually 40% or 50% of the basic salary. The Income Tax Laws provide for exemption of HRA subject to fulfillment of certain conditions. Every employee needs to cash upon these conditions to significantly reduce their tax liability on their salary income. Enumerated below is the mode of computation of HRA exemption:

Exemption in respect of HRA is least of the following:

1) Amount equal to 50% of salary where the accommodation is located in Mumbai, Kolkata, Chennai or Delhi (Metros) or amount equal to 40% of salary in case the accommodation is located elsewhere (Non Metros);

2) HRA actually received from the employer;

3) Excess of rent paid over 10% of salary

It can be seen from the above that the amount of HRA exemption depends upon the following:

- “Salary” of the employee - Salary in this case means basic salary and dearness allowance, if any. It is pertinent to note that ‘salary’ for HRA purposes do not include any other allowance or perquisites;

- HRA received from the employer as a component of CTC;

- House rent paid by the employee; and

- Place where the house is taken on rent.

How to avail HRA exemption?

Pay rent for the accommodation that you live in. But, what if you are staying with your parents / relative and are therefore not paying any rent? Will you still be eligible for HRA exemption? No. It is pertinent to note that no HRA exemption is available if you live in a house for which you do not pay any rent or rent paid is less than 10% of the salary. This implies that paying house rent is a must for availing HRA exemption.

So the immediate question that needs to be answered is what should be done in case you are staying with your parents / relatives and aren’t paying any rent? Solution is simple. Pay rent to your parents / relative. This is the most common practice that is followed by every salaried employee which is even legally permissible. However, it is important that this amount is shown as rent income in the hands of the recipient (ie your parents / relative in this case). Ignoring the rent amount in the hands of the recipient is illegal and tantamounts to tax evasion which should be avoided. So please ignore doing so. However, the rent income would be taxed in the hands of the recipient subject to flat 30% deduction.

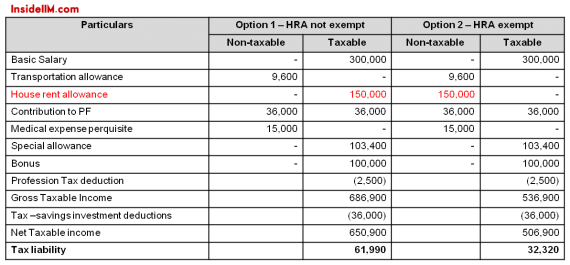

Lets consider an illustrative example where your CTC is Rs 650,000 p.a. with the compensation plan selected as: Basic Salary – 300,000, TA – 9,600, HRA – 150,000 (50% of basic salary), contributions to PF – 72,000 (24% of basic salary), medical perquisite – 15,000, special allowance – 103,400 and bonus over and above your CTC to be Rs 100,000. The tax liability under the above compensation plan can be as under:

As can be seen from the above, your tax liability would be reduced by approximately 48% by availing HRA exemption. All you need to do is pay rent for the accommodation that you live in either to the landlord of your accommodation or to your parent / relative in whose name the accommodation is registered.

What should be the rent component paid?

To avail Rs 150,000 as HRA exemption based on the above CTC, you will have to pay rent of Rs 180,000 p.a. The HRA exemption would be least of the below:

|

Rs 150,000 |

|

Rs 150,000 |

|

Rs 150,000 (Rs 180,000 – Rs 30,000) |

*Add 10% of your basic salary component to the HRA received component to arrive at the rent component (all p.a. calculations)

If you are living in a rented premise, the rent would be fixed by your landlord and you wouldn’t have any say on that. You have to calculate the HRA exemption based on the aforesaid calculations and fixed rent. The above calculation becomes essential when you have to decide upon the rent that you will have to pay to your parent / relative in whose name the premise is registered.

What is your duty?

It is not that you have planned and your tax liability will reduce. It is your duty to submit appropriate declaration details with your employer on timely basis. In order to avail HRA exemption, it is mandatory to submit rent receipt demonstrating rent paid. Additionally, declaring Permanent Account Number (‘PAN’) of the recipient becomes mandatory if the rent amount is more than Rs 180,000 p.a. Therefore, if this is the case in your scenario, ensure that you declare appropriate landlord details to your employer to avail HRA exemption.

Given the above, with minimum efforts you can save your hard earned salary and at the same time be an honest taxpayer paying the necessary taxes on your income. Save more, invest more and earn more

- Prince Doshi

Chartered Accountant

Prince Doshi is a qualified Chartered Accountant and a B.Com graduate from Narsee Monjee College of Commerce and Economics. He has a post qualification experience working as an Associate for BMR & Associates, a leading tax consultancy firm. Presently, he is into his own Chartered Accountancy practice specialising in the field of income-tax consultancy, sales tax, service tax and audit compliance.

All articles by CA Prince Doshi

Tax Planning services by Prince Doshi

You must read :

Reduction in Take Home Salary – Important for all graduating in 2013 and beyond

Have you planned your tax savings for the financial year (‘FY’) ending March 31, 2013?

All you need to know about Tax Benefits on Education Loan Interest Payments