While India revels in its 7%+ GDP growth rate, decreasing inflation levels, over a 1 billion mobile phones in the country, 220 million smart phones, and as the only country amongst the BRICs that is standing up straight and steadfast, a number of Indians may be feeling otherwise.

And the question that most Indians are asking is ' Why am I feeling poorer as I get richer?'

Hamburger Economics

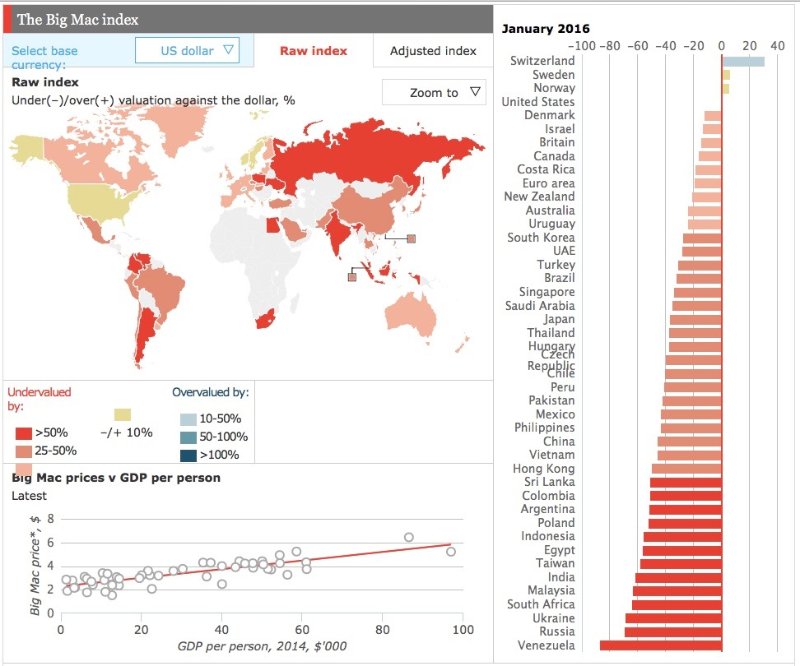

The Big Mac Index invented by the Economist was a light hearted guide that they published every year and simplified to a great deal Purchasing Power Parity as a concept. The index gave us the real prices or affordability of the Big Mac in every country globally. In 2016, the average price of a Big Mac in America in January 2016 was $4.93; in China it was only $2.68 at market exchange rates. So in a sense the Big Mac index told us that that the yuan was undervalued by 46% at that time.

India and its Dosa Economics

Our Reserve Bank of India Governor, Dr Raghuram Rajan is now famous for his Dosa Economics or Dosanomics as it has been coined now ( Dosa is a pancake for the international LinkedIn reader ). Just like the Burger the Indian Dosa has been brought up several times since he took over as Governor as a method of simplifying Indian economics.

At a recent event an engineering student asked him a difficult question on Dosa Economics. ' You taught us that lower interest rates with lower inflation rates is better than higher interest rates with higher inflation rates.' Her question was that when the inflation rates go up, dosa prices go up but when inflation rates come down, the dosa prices don't come down.

Governor Rajan explained the phenomenon with the Samuelson-Balassa effect. He explained that sectors that had no technological improvement typically prices would be high even if inflation was low. So what Governor Rajan was saying was that while the technology for making dosas hadn't changed at all, the wages of the dosa maker were constantly going up.

But the question to ask is if we have many other sectors like the dosa sector in the Indian economy. Where there is no improvement in technology and productivity but the wages are constantly moving upwards. Because if it is then we have an explanation for why we are feeling poorer all the time.

Samuelson-Balassa Effect

The Samuelson-Balassa effect tells us that countries with high productivity growth also experience high wage growth, which leads to higher real exchange rates. The Balassa-Samuelson effect suggests that an increase in wages in the tradable goods sector of an emerging economy will also lead to higher wages in the non-tradable (service) sector of the economy.

India's Economic Paradox

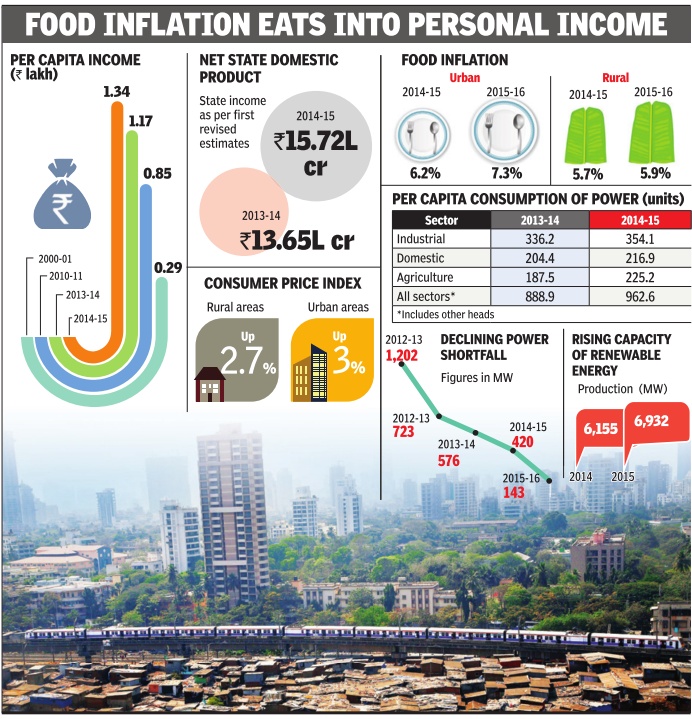

So is it true that most Indians are feeling poorer when in fact they are getting richer with their earnings going up? Not too long ago after the engineering student asked Governor Rajan the dosa question we see an article in the Times of India of 18 March giving details of how food inflation is eating into personal income in the State of Maharashtra in the article 'Economic paradox: We are richer, but our quality of life is poorer'

The Rich Poor Indian?

So behind the facade of India's high GDP rate, lower inflation rates and lower interest rates and a large middle class with purchasing power that we boast about, are Indians actually in a real sense getting poorer? Well it would certainly seem so, if one were to listen to the average Indian housewife who is constantly complaining about the prices of tomatoes and onions and other vegetables. Or the young couple in Mumbai who gets richer every year and yet find that buying a flat in Mumbai is way beyond their reach.

And the interesting question might be if the dosa maker had to eat his own dosas for breakfast, does he find them too expensive to eat than say a few years ago? But maybe we can save that question for the next time we meet Governor Rajan!

In the meantime we must comfort ourselves that Issac Newton's famous quote 'what goes up, must come down' does not apply to Indian economics.

--------

About the Author

Prabhakar Mundkur is an ad veteran with over 35 years of experience in Advertising and Marketing. He works as an independent consultant and is also Chief Mentor with Percept H. All previous posts of Prabhakar can be found here.