In this part of the 6th Edition of the InsideIIM Alumni Report, we look at the Banking & Finance sector. Here, we look at the number of alumni of top b-schools of India working at some of the top Indian and multi-national banks.

We will look at absolute numbers of alumni in each company and compare percentages of alumni in 2 ways –

- Which school has the highest representation of a company among its ‘peers’ and

- Which company has the highest percentage of alumni for a given business school?

(Peers are defined based on the year of establishment of the business school. More details below.)

Why do we create this report every year?

1) To help potential aspirants know about a business school’s reputation in the corporate world – alumni stats are a good indicator – both number, as well as diversity, is important.

2) It helps current students and alumni get an overall picture of their own alumni and facilitates more targeted networking.

Creation of 2 Business School Clusters – Pre 1966 and Post 1966

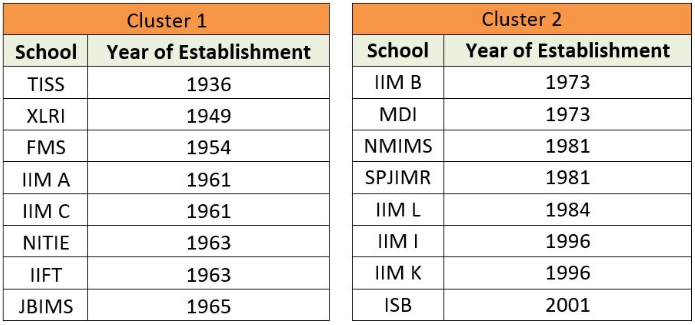

Top b-schools in India are divided into two categories based on the years in which they were established. The rationale behind such a selection criterion is to ensure that the alum base is strong and comparable for the b-schools under consideration. As there was no top b-school established between 1965 and 1973, the cut-off year chosen for dividing the schools is taken to be 1965. This criterion divides the schools into two clusters – Cluster 1 – Pre-1966 and Cluster 2 – Post-1966 – having 8 schools in each cluster.

The table summarises these clusters with the year of establishment

We understand that a lot of good business schools may have been left out but it is not possible for us to do this for every school yet. We encourage you to add alumni stats of your school in a separate story if you think there is enough interesting and insightful data.

Analysis of Alumni in Banking & Finance Companies

A total of 25 companies were considered to represent the financial sector. These companies are among the top rated names in InsideIIM’s Annual Recruitment Survey. The list of companies covers all businesses under Banking & Finance – For e.g. corporate banking, investment banking, financial services etc.

The analysis done below gives a detailed look into:

– Company wise slicing of Alumni across Category 1 b-schools.

– Cumulative percentage of alumni working in different companies.

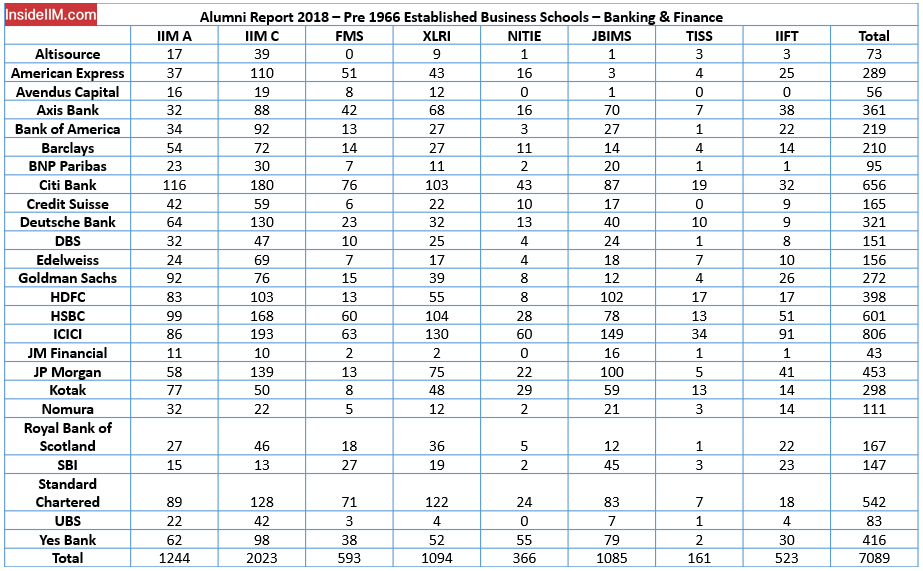

The Pre 1966 Top Business Schools

Given below is the raw data from LinkedIn for the 8 Schools in this cluster of schools established prior to 1966.

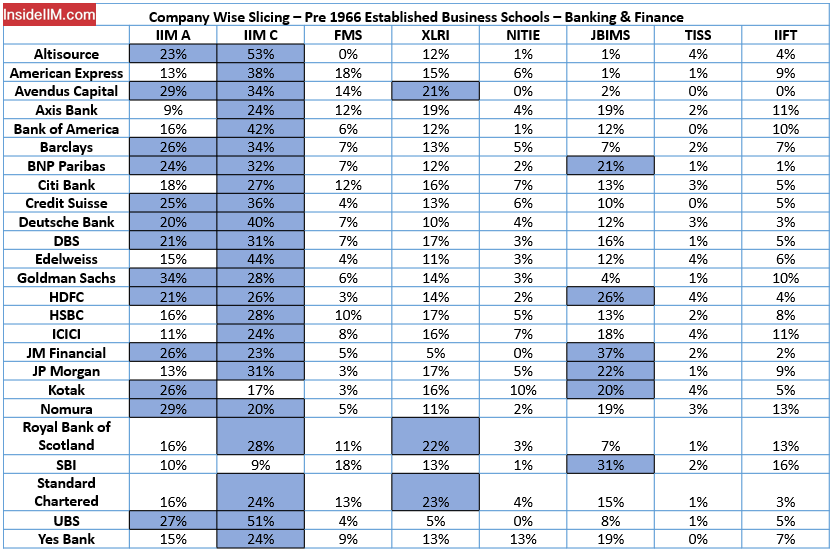

% of Alumni in each Company from each of the 8 Top Schools established prior to 1966

In the above table, wherever the percentage of total alumni from a b-school in a particular company crosses 20%, it has been marked in Blue.

Key Takeaways -

From the data at hand, we can conclude that:

- The predominance of IIM Calcutta's alumni in this cluster is highly impressive but not very surprising, as this trend has been followed ever since the inception of the Alumni Report series. The 'Gems of Joka' by themselves form almost 30% of the total number of alumni across all 8 b-schools. The "Finance Campus of India" recorded 109 and 137 final offers for Finance roles for the Class of 2018 and 2017 respectively; the highest numbers across all domains for both the years.

- After Calcutta, the cluster is dominated by the alumni of IIM Ahmedabad, where WIMWIans are present in 13 out of 25 recruiters. Here, the biggest recruiters are Goldman Sachs, Avendus Capital and Nomura.

- JBIMS has the second smallest batch size in this cluster but is quite well-represented across various recruiters in this report. This can be attributed to the location of the b-school as well as the inclusion of alumni from its MSc. Finance course. Here, SBI, JM Financial and HDFC are three of the biggest recruiters for JBIMS (all of whose head offices are in Mumbai).

- TISS, IIFT, NITIE, and FMS are under-represented in this cluster. For TISS, its small batch size and the dominance of XLRI for HRM roles may be the reason for a relatively smaller alumni presence across Banking & Finance recruiters.

- ICICI, Citi Bank, and HSBC are the biggest recruiters in this cluster.

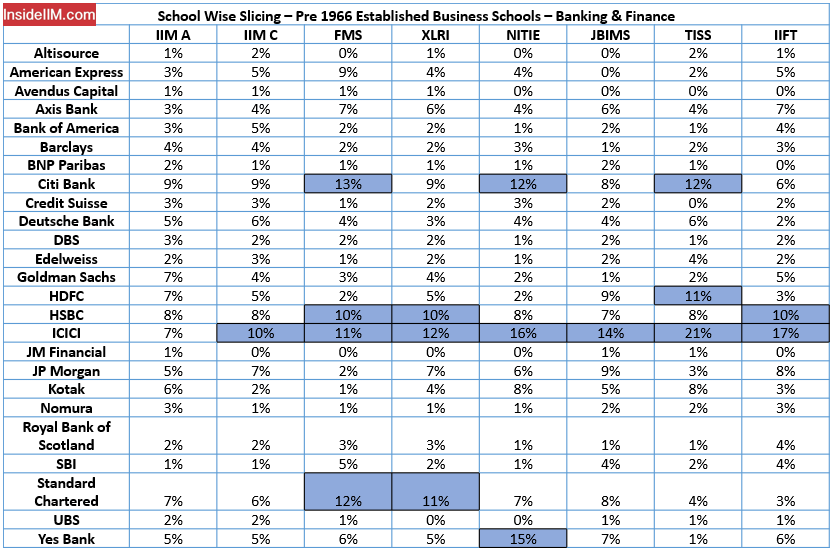

% of Alumni for each School in Top Companies of all Alumni working in the Top Companies Considered

In the above table, wherever the percentage of total alumni from a b-school in a particular company crosses 10%, it has been marked in Blue.

Key Takeaways -

From the data at hand, we can conclude that:

- The alumni of FMS are present in high numbers at Citi Bank, HSBC, ICICI, and Standard Chartered, and they make up almost 50% of the total FMS alumnus working across all 25 banks.

- XLRI alumni are present in maximum numbers at HSBC, ICICI and Standard Chartered, while TISS graduates are present in maximum numbers at Citi, HDFC and ICICI. A point to be noted is that XL alumni are present in large numbers in the core business at these 3 banks, as opposed to the expected HRM roles.

- A significant number of alumni from all 8 b-schools are present at ICICI and HSBC, a trend that we will also see in the next cluster of management institutes.

The Post 1966 Top Business Schools

Limitations:

1) No filtration has been done for job profile and hence it represents every function from Investment Banking to Technology to HR.

2) All the possible businesses of a company have been considered. E.g. Barclays includes Barclays Investment Bank, Barclays Wealth and Investment and Barclays Corporate Banking.

3) Prima facie, it may seem that a larger number of alumni determines the strength of the b-school. However, the quality of roles offered play an extremely important part in understanding placements and the quality of the alum base of the respective b-school. E.g. There is a substantial difference between working in a front-end investment banking role and working in a KPO. These points are not illustrated in these reports owing to the subjectivity involved.

4) NMIMS also has many undergrad degrees. The figures for NMIMS could be influenced heavily because of this as B.Com, BBA, B.Sc. Eco grads are also counted along with the post-grad MBA. Also, we have seen many examples of Narsee Monjee College of Commerce and Economics grad label themselves under NMIMS by mistake on LinkedIn.

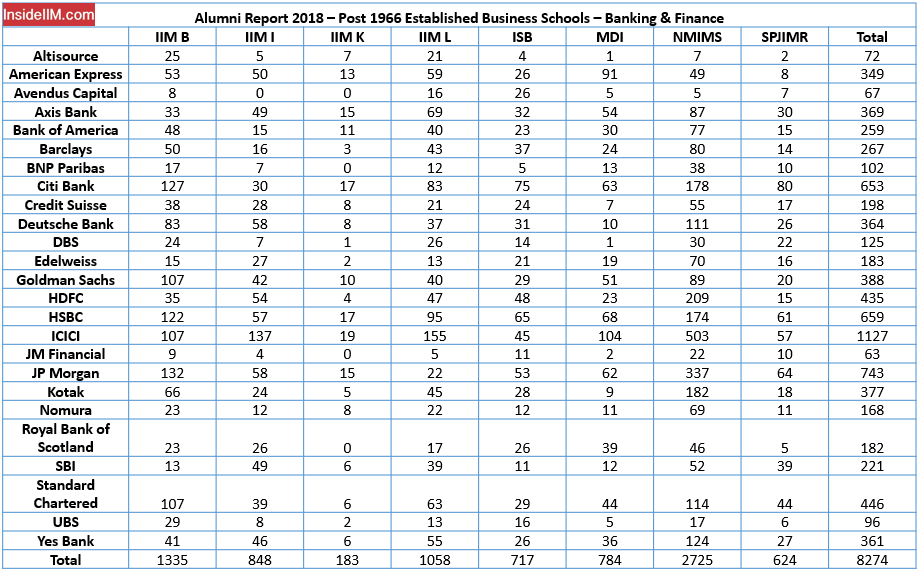

Given below is the raw data from LinkedIn for the 8 Schools in this cluster of schools established post-1966

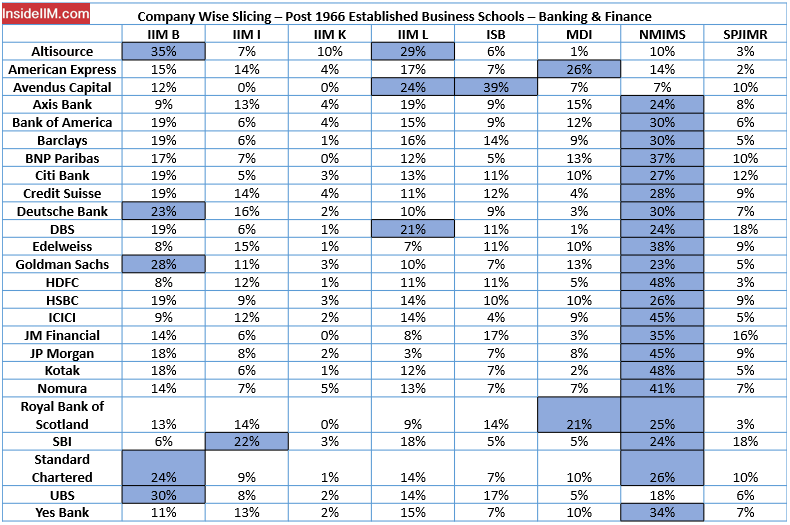

% of Alumni in each Company from each of the 8 Top Schools established post-1966

In the above table, wherever the percentage of total alumni from a b-school in a particular company crosses 20%, it has been marked in Blue.

Key Takeaways -

From the data at hand, we can conclude that:

- NMIMS has a distinct advantage in this cluster, although this can be attributed to the large batch size and the inclusion of undergraduate degree courses.

- ICICI, J.P. Morgan, and HSBC are the biggest recruiters in this cluster, and the alumni there make up over 30% of the total alumni base. ICICI has historically been the biggest recruiter for both clusters, which can be because of the large numbers they hire in during campus placements.

At the other end, JM Financial, Altisource and Avendus Capital have the smallest alumni base across these 8 b-schools. - The alumni of IIM Bangalore enjoy good representation across a lot of companies, with a major presence at Altisource, UBS, Deutsche Bank and Goldman Sachs. Consulting and BFSI have been the most preferred domains at IIM Bangalore, and Goldman Sachs has been one of the top recruiters for the latter, offering the highest number of offers (9) during the Final Placements of 2018, the second highest (14) in 2017 and again the highest (14) in 2016.

- Alumni of IIM Lucknow have a good presence at Altisource, DBS and Avendus Capital.

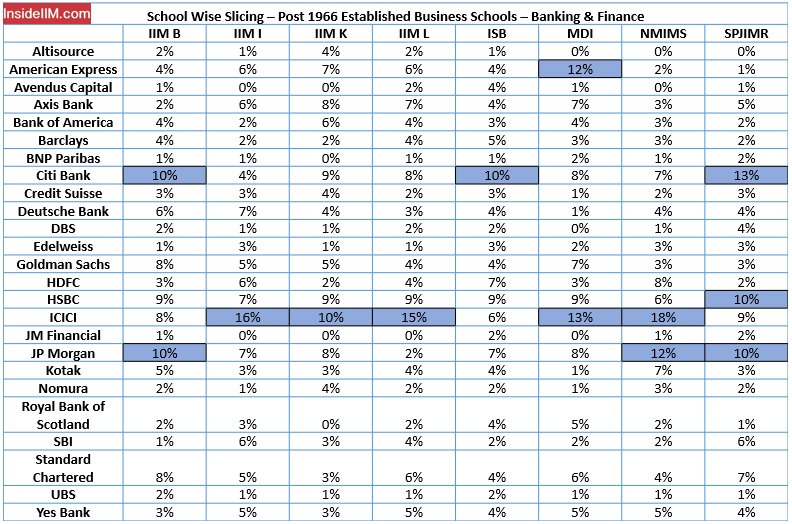

% of Total Alumni from each of the 8 Top Schools established post -1966 in each company

In the above table, wherever the percentage of total alumni from a b-school in a particular company crosses 10%, it has been marked in Blue.

Key Takeaways -

From the data at hand, we can conclude that:

- If you belong to IIM B, chances of you being at Citi Bank and J.P. Morgan are quite high. A point to be noted is that at J.P. Morgan, more than 3/5th of the total alumni are A-Level executives as either Vice Presidents or Executive Directors.

- SPJIMR alumni appear to have an affinity towards Citi Bank, HSBC and J.P. Morgan, and are distributed in maximum numbers across these top banks. Almost half the alumni of SPJIMR are A-level executives at JP Morgan, as Vice Presidents or Executive Directors.

- Although their numbers have not crossed the 10% mark but in terms of alumni presence, HSBC, much like ICICI, has emerged as a bank where the majority of the b-school alumni are presently working.

Limitations of the report:

- The first evident limitation is the fact that not everyone is on LinkedIn. And even if they are on LinkedIn, they may not necessarily update their employment/b-school data. For instance, IIM Kozhikode alumni are present in relatively fewer numbers due to a technical issue with the Kozhikode official LinkedIn account, as a result of which alumni have not been mapped to the official account.

- No filtration has been done for job profile and hence it represents every function from Investment Banking to Technology to HR to Operations. The salaries of those in different functions in the same bank are different – E.g., someone in Banking Operations at Citibank is paid differently from someone who is a relationship manager. Unfortunately, that cannot be accurately gauged from LinkedIn data.

- All the possible businesses of a company have been considered. E.g., Barclays includes Barclays Investment Bank, Barclays Wealth and Investment, and Barclays Corporate Banking.

- Prima facie, it may seem that a larger number of alumni determines the strength of the b-school. However, the quality of roles offered plays an extremely important part in understanding placements and the quality of the alum base of the respective b-school. For e.g. There is a substantial difference between working in a front-end investment banking role and working in a KPO. These points are not illustrated in these reports owing to the subjectivity involved.

----------------------------------------------------------------------------------------------------------------------------

Also, read: