Lately we have a new celebrity in news – The Non-Performing Assets. We see it everywhere, in earnings releases, analyst reports, govt talks, RBI talks, etc. But what are they? And why are they so important? Let’s take a look –

In plain vanilla terms, Non- Performing Assets (NPA) are those loans or credit facilities extended by a lender which ceases to generate returns (either in terms of interest or principle payment). But don’t be fooled, every unpaid due is not categorized as an NPA. Loans unpaid for 30-days are categorized as Special Mention 1 (SM1), those unpaid for 60 days are categorized as Special Mention 2 (SM2) and only those which are unpaid for a period of 90 days or more become our dreaded NPAs.

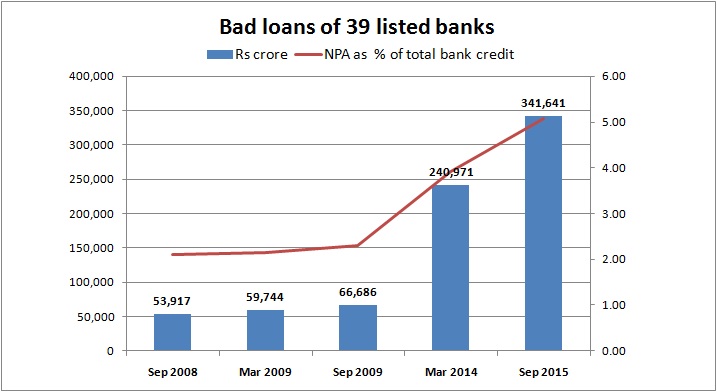

They are of high importance to the Indian banking sector because, by the end of 2015, Gross NPAs (exclusive of any recovered interest of principle payment) of 24 listed Public sector banks was ~INR 4 lakh crore (1.5 times their market value then) while the number for 16 listed Private sector lenders was ~INR 50,000 crores.

Banks are expected to maintain a provisioning for bad loans in addition to the general provisioning as follows:

| CLASSIFICATION | % OF PROVISIONING |

| 1. General Provisioning for Loans | 0.40% of total outstanding advances |

| 2. Sub-Standard Assets (loans classified as special mention for upto 12 months) | Secured - 15% of outstanding advances

Unsecured - 25% of outstanding advances |

| 3. Doubtful Assets (Loans classified as NPAs for 1 to 3 yrs) | Secured:

0-1 : 25% of outstanding advances 1-2 yrs - 40% of outstanding advances 2-3 yrs - 100% of outstanding advances Unsecured: 100% of outstanding advances throughout |

| 4. Loss Asset (Loans classified as NPAs for more than 3 yrs) | 100% of outstanding advances |

SARFAESI the Savior:

In order to help solve the situation of Non-Performing assets, banks are entrusted with Securitization and Reconstruction of Financial Assets and Enforcement of Security Interest (SARFAESI) powers. The Act has provisions which allow the banks to take legal recourse to recover their dues from defaulters. Upon classification as an NPA, the lender issues a 60 day warning to the borrower to repay his dues, failing which the bank can take possession of the assets and can also give it on lease or sell it; as per provisions of the SAFAESI Act.

When the SARFAESI was not enough for the Banks alone to handle, the act gave rise to Asset Reconstruction Companies (ARCs) to help reduce the growing burden on Banks. Banks are now allowed to sell NPAs to ARCs at a discount. This not only helps transfer the bad-assets from the books of the Bank into the hands of a professional to handle the recoveries, but also by way of mandating banks to invest into the ARCs, ensures that the banks do not wash off their dirty linen on ARCs and go scot-free without maintaining any provision.

In current news, the RBI has mandated banks to clear off their NPAs by 2017 and this has led to banks writing–off a whopping 1.14 lakh crores in the past 3 years.

So the next time around you hear the new celeb being talked about, hope you don’t find yourself turning away your face, but instead saying “Hey, I know this one!”.

Please leave a comment below if you have any queries. Happy to help :)