It wasn’t until 2018 when I got a call letter for the MBA program at the Vinod Gupta School of Management, IIT Kharagpur, that I developed a curiosity about Stock Markets. Partially because never had I thought in my wildest of dreams that I would one day turn into an active trader. Even my friend Sai Ram Teja or SRT as we call him, would resonate with this. Here is an anecdote of the transformation journey of our duo from being rookies to emerging as an equity analyst and a trader.

VGSoM launched its pre-induction series that provided the incoming students with a glimpse of the business world and also gauged their potential to be worthy junior coordinators of the clubs so as to uphold their legacy. During our final days at our previous workplace, we received a mail from Drishtee Capital, the student-run trading and investment club of VGSoM. It detailed a task to analyse a stock of our choice and explain our rationale to buy it or not for a term of six-month holding. At the time, we were barely familiar with terms such as P&L, Balance sheet, equity, and such other jargon.

With Google at our fingertips, we managed to learn the ABCs of stock analysis and made our submissions. Fast forward to club selections day; extensive preparation on basics helped us crack the interview. The interview with the senior coordinators mainly revolved around the three financial statements, applications of financial ratios, and industry hot-topics. I was the only finance newbie selected in the club, amongst others who already had prior work-ex in the finance domain or a CFA certification. On the contrary, SRT had a fair understanding of stock markets.

The on-boarding began with the seniors conducting KT sessions that we zealously attended. While SRT and other junior club members effortlessly coped up with the fin-lingo, it took me a while in comprehending these discussions after the meeting. While we were juggling between assignments, summer internship interview preparations and club activities, it was SRT who turned to be the junior SPOC of the club as he flaunted his leadership skills and academic competence. First-year was buzzed with virtual trading, interactive discussions on trending topics, and preparing insightful stock analysis reports on stocks.

No sooner did first-year whoosh away than we bid farewell to our seniors and inherited the portfolio. Initially, we felt shaky in suggesting stocks for the long term as now real cash was involved, unlike in virtual trading, which left room for experimenting with our strategies. Fundamental analysis (FA) only explains the company performance and sheds no light on market entry points to buy low and sell high.

To complement FA, I began exploring technical analysis (TA). I ransacked pricey YouTube channels, telegram, and WhatsApp groups of trading gurus that merely mentioned the stocks to buy without the rationale behind it. Meanwhile, SRT developed and monitored a watchlist of stocks from various sectors ranging from small to large caps. He mastered the understanding of stock behaviour and their corresponding price movements based on external market news and invested with proper stop-loss (SL) in place. In my pursuit of knowledge as I hopped from one channel to the other, I eventually landed upon TradingSutra and JSK financials. They supplemented their calls with logic where I experienced a steep learning curve.

Following daily news and market trends have become a part of our routine. We use the My Stocks Portfolio app from Peeksoft to actively monitor the prices during class breaks. As we share our observations regularly in our club WhatsApp group with our juniors.

Equally important as the resources are, is to surround yourself with experts who share your interests and motivate you to pursue your aspirations, chase them and help you to become proficient in your domain eventually. In this regard, I always had my buddy, SRT by my side.

Our recommended strategy is to analyse stock fundamentals, observe prices for a week before buying, prepare TA charts, set price alerts on Sentinel, and eventually place buy-sell orders with an SL upon receiving trigger notifications when prices enter the desired zone.

In our journey, we imbibed valuable qualities such as self-discipline, patience, apathy to profit-loss alike, risk management, and avoiding panic trades after losses. Besides managing the club portfolio, we extrapolated these qualities to our daily lives as well.

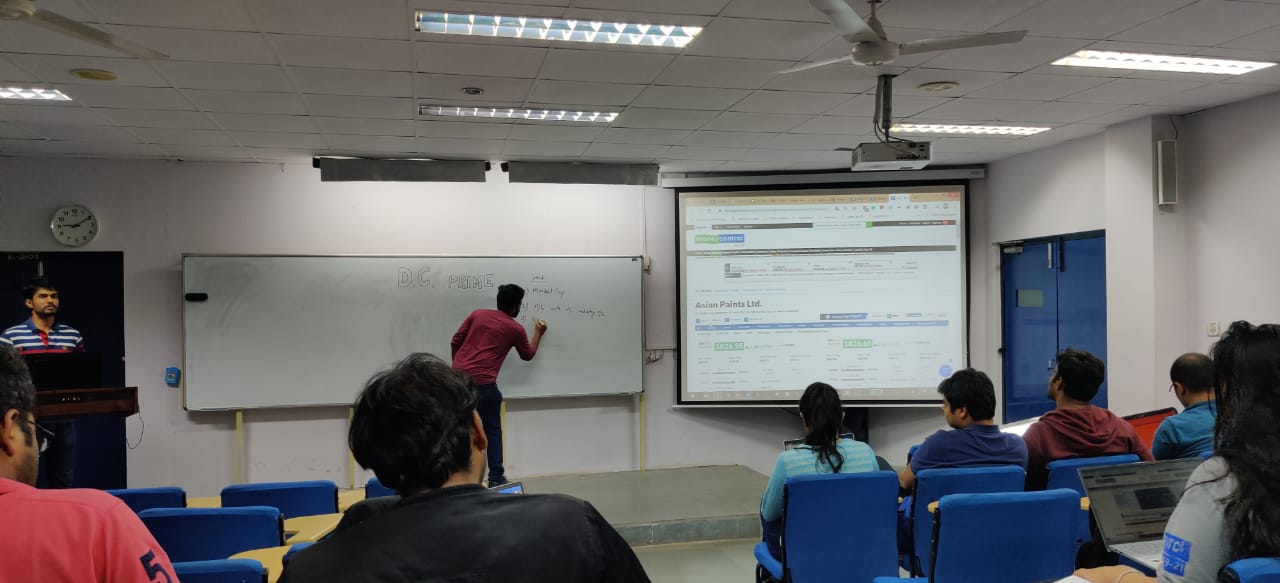

The inquisitiveness of the students motivated our duo to launch DC Prime, a forum for trading enthusiasts of VGSoM to host discussions and knowledge sharing sessions on finance, trading, TA, and stock markets to bring in synergy from mutual learning. Also, we conduct workshops under the event, Trade Shastra, thus making Drishtee Capital a harbinger of knowledge in investing. We are sure that our quest for learning will continue beyond our MBA stint as well.