Economics concepts are one of the most commonly asked questions in MBA PI irrespective of the candidate's academic background. In this article, We have explained important economics concepts and questions for the MBA interview that will be helpful to get a gist and last-minute revision. These reflect the questions asked in actual interviews!

Convert your best B-School call with the fifth season of InsideIIM's highly-rated MBA Admissions Bootcamp - WATPI Edge! Over the last four years, we have a 94%+ success rate in our last four seasons. Enroll now! Sessions are ongoing!

Important Economics Concepts and Questions for MBA Interview

What is Economics and Why is it important?

Economic resources are limited, and the same resources can be used in multiple ways. Thus, trade-offs must always be made. Economics is the science of the optimum utilization of economic resources. For economics to exist, we must first understand an economic good.

Economic good

An economic good is a physical object or service that has value to people and can be sold for a non-negative price in the market.

Examples of economic goods: bread, oil, education

Examples of non-economic goods: air, pollution, peace, friendship

The Two Branches!

Macroeconomics is the branch of economics that studies how an overall economy functions on a large scale.

Microeconomics is the study of how individuals and businesses allocate resources. It examines how these decisions affect the supply and demand for goods and services, determining prices.

Demand and Supply

Demand is the want or desire to possess an economic good, backed by the necessary financial capability to buy that good at a given price. Supply is the total quantity of an economic good available for purchase at a given price in the market.

The demand and supply of economic goods lead to variability in their price. Consider the case where a shortage in the supply of an economic good leads to a hike in the cost of that commodity.

Get mentored by students and alumni of top B-Schools! Join InsideIIM's highly-rated MBA Admissions Bootcamp - WATPI Edge S05!

Types of Goods

An economic good can again be classified into two types based on its usage. These are: Complementary good and Supplementary good.

Complementary- An economic good is usually used along with another good.

Ex: Tea – milk, sugar, Pen – ink, paper

Supplementary- An economic good is used in place of another good.

Ex: Tea – coffee, cold drinks, Pen – pencil, crayon, brush

Another important distinguishing is based on the usage of the product:

Consumer and Customer

Consumer- An individual who acquires an economic good for direct use or consumption and not for resale or use in the production of some other economic good.

Ex: A person buying a motorcycle for his personal use

Customer- An individual who purchases an economic good on behalf of the consumer.

A customer may be different from the consumer.

Ex: Government purchasing oil for OPEC for consumption by the people

Law of Demand

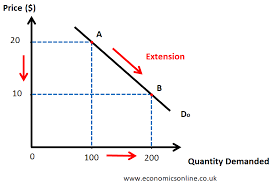

The higher the price of an economic good, the lower the quantity demanded, and vice versa. The demand curve of a normal economic good is downward sloping.

Diminishing Marginal Utility

The utility, and therefore the demand of every incremental unit of an economic good diminishes as we increase its consumption.

Consider that you are hungry and you have a pack of biscuits. The utility that you will derive from having the first piece would be maximum as it would lead to the highest satisfaction. The utility from the second biscuit would be slightly lower as your hunger has partly been satiated after having the first one. Since, the utility has decreased, you may not be willing to pay the same amount for the subsequent ones. This phenomenon is known as diminishing marginal utility.

Implications:

The price will have to be reduced to sell every incremental unit

If the price reduces, the demand increases

Other factors affecting demand

- Income

- Tastes and Preferences

- Price of complementary good

- The price of the substitute good

- Price expectations of the customer

- Number of customers (at a macro level)

Exceptions to the Law of Demand

Giffen Good / Inferior Good: If the good is inferior quality without any close substitute where increasing the price would lead to a rise in the demand for the good.

Consider the example of pizza and bread (giffen good). Here, pizza is costlier and bread is cheaper and inferior. If the price of bread increases, the consumer would not be left with adequate money to buy lamb.

Hence, he would cut down on his consumption of lamb and spend it on inferior goods i.e. bread to consume the same quantity based on his needs

Veblen Good (snob effect, bandwagon effect): These goods are luxury goods and have a snob appeal. They are not commonplace and cannot be afforded by all. Hence, it their price increases, they are demanded more – as they indicate a status symbol.

Examples of Veblen goods: Diamond Antiques, Super Luxury Cars

Also Read:

- How to Prepare for WAT 2024 in MBA Interviews: Tips to Create Compelling Essays

- How to Crack MBA Group Discussion Round 2025: Tips, Strategies, and Current Topics

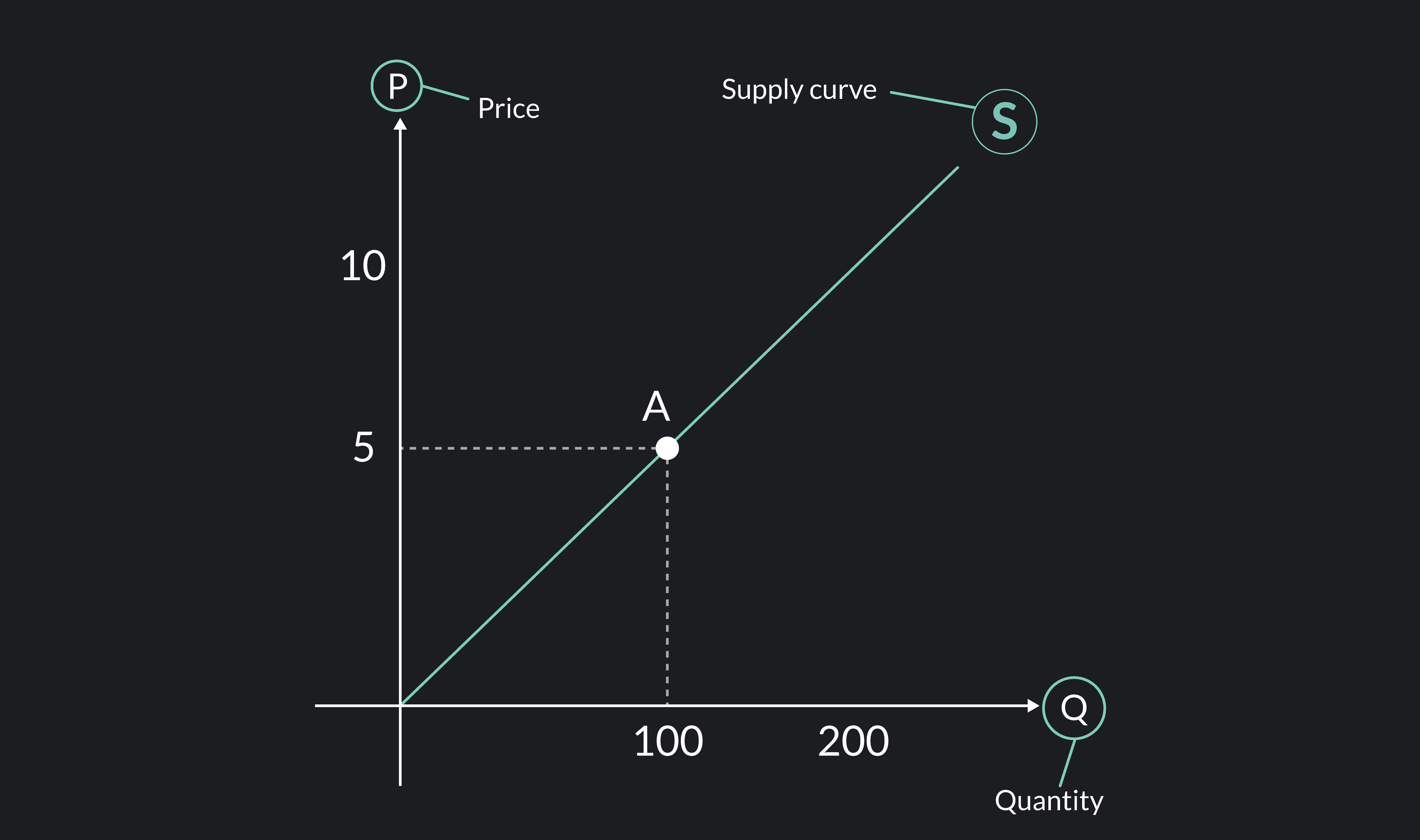

Law of Supply

The higher the price of an economic good, the higher its quantity supplied. The supply curve of a normal economic good is upward-sloping.

Other factors affecting supply

- Price and availability of resources

- Price of complementary goods

- Price of substitute goods

- Technological changes

- Price expectations of the seller

- Taxes and subsidies

- Number of sellers (at a macro level)

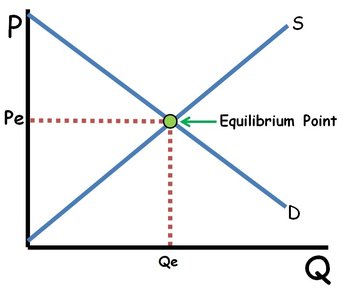

Equilibrium

Price determination in a marketplace occurs at a point where the demand and the supply curve intersect with each other. This gives rise to equilibrium.

The point where the demand and the supply curve intersect is known as the equilibrium. This works like the invisible hand of the market. It is a state where the supply and the demand curve balance each other, against which the price can be determined.

Factors affecting equilibrium

- Change in quantity demanded

- Shift in demand

- Change in quantity supplied

- Shift in supply

Gross Domestic Product

GDP- The total market value of the basket of all final goods and services manufactured within a country in a given financial year.

2 Approaches to Calculating GDP

- Consumption Approach: GDP = H.H. Consumption + Investment + Govt. Expenditure + Net Exports

- Income Approach: GDP = Wages + Interest + Rent + Profit + Tax + Depreciation

Out of the two, the consumption approach is preferred as the expenditure can be traced easily. This approach is used in India.

GDP of Various Economies

(By Nominal GDP in Trillion Dollars)

- US- 28.78

- China- 18.53

- Germany- 4.59

- Japan- 4.11

- India- 3.94

( as of Q 1 2024)

Per Capita Income

To measure the sector's income, we used a concept known as per capita income, which can be used to measure the health of economies with different populations. It is the average annual income of an individual expressed in dollars. It indicates the average income of an individual in a country or state.

Formula = GDP/Population

In Macroeconomics, we also try and classify the types of market based on the competition level and nature. Let us look at the various categories -

Types of Market

1. Perfect Competition

A hypothetical market where no single producer or consumer has the market power to influence the prices.

Characteristics

- A large number of buyers and sellers

- Goods are perfect substitutes for each other

- All buyers and sellers have perfect, complete, and homogenous market information

- There are no entry and exit barriers

2. Oligopoly

A market with a small number of sellers selling a similar commodity.

Characteristics

- High interaction among sellers

- Sellers are price makers

3. Monopoly

A market with a single seller with no close substitute for the product either due to technical reasons or licensing.

Characteristics

- Seller is the price maker

- The firm can enjoy abnormal profit

- Fierce competitiveness of an existing firm

Policies and RBI

To influence the economy of a nation, we have two tools known as monetary and fiscal policy.

| Monetary Policy | Fiscal Policy |

| The government’s policy of achieving economic objectives (employment, per capita income, the balance of trade, economic parity) through money supply. | The government’s policy of achieving economic objectives (employment, per capita income, the balance of trade, economic parity) through government revenue collection and spending. |

| Contraction policy: deflation or decrease in prices | Fund sources: Taxes, duties, fines, borrowings |

| Incremental policy: inflation or increase in prices | Fund uses: Infrastructure, mining, public welfare, defense, power generation, R&D |

Tools that RBI has:

- Cash Reserve Ratio

Cash Reserve requirements imposed on banks. It is the minimum level of funds to be kept with RBI every fortnight to tackle sudden consumer withdrawals or liquidity problems. CRR rate is 4.%

- Statutory Liquidity Ratio

It is the minimum amount of money that a commercial bank needs to preserve in the form of cash, gold, or government securities before providing credit to its customers. SLR rate is 18%

- Repo Rate- 6.50%

The rate at which RBI Loans money to commercial banks by selling qualifying securities. It is also called Repurchase agreement or repurchase option. It is short term.

- Bank Rate- 6.75%- It is long-term money lent by RBI without any security needs.

- Reverse Repo Rate- 3.35%- Rate at which RBI borrows money from banks.

- Marginal Standing Facility Rate- 6.75% The rate at which banks borrow money from RBI in case of emergency.

In addition to these, here is a list of other important terms related to Macroeconomics.

Other Important Terms:

- Goods and Services Tax: Consumption-based tax levied on the manufacture, consumption, and sale of goods and services at a national level. It is an example of an indirect tax.

- Inflation: It is the quantitative measure of the rate at which the average price level of a basket of selected goods and services in an economy rises over some time.

- Deflation: Gradual decrease in the prices of goods and services typically a result of the contraction in the economy.

- Recession: A period of temporary economic decline in trade identified by a fall in the GDP for a consecutive quarter. It is a result of business cycle contraction in an economy.

- Stagflation: Condition of slow economic growth and relatively high unemployment accompanied by rising prices.

- Depreciation: Gradual decrease in the economic value of capital, stock, or firm.

- Devaluation: Deliberate downward adjustment of the value of a country’s currency relative to the baseline.

- Unemployment: It is the condition that arises when one is willing to work but cannot find any work at an economically productive age for a consecutive period of at least 6 months.

- Fiscal Policy: It is how a government adjusts its spending level and tax rates to monitor and influence a nation’s economy.

- Balance of trade: This occurs when the total imports and the total exports of a country is equal. A positive balance of trade occurs when the exports are more than the imports, whereas a negative balance of trade occurs when the imports are greater than the exports.

More questions:

- Cross Price Elasticity of Demand

- How do firms determine the optimal level of production?

- Causes and effects of inflation

- Budget Line

- Lemon Market

- Universal Basic Income

- Consumer Price Index

- Producer and Consumer Surplus

- Gresham's Law

- Difference between Nominal and Real GDP

- Kanehman's contribution

- PPP theory

- Balance of Payments

- Budget and Fiscal Deficit

- Effect of Taxation

- IS, LM Curve

- Econometrics

- GDP vs IIP

- Concept of Bounded Rationality

- Regression Analysis

- Net Factor Income from Abroad