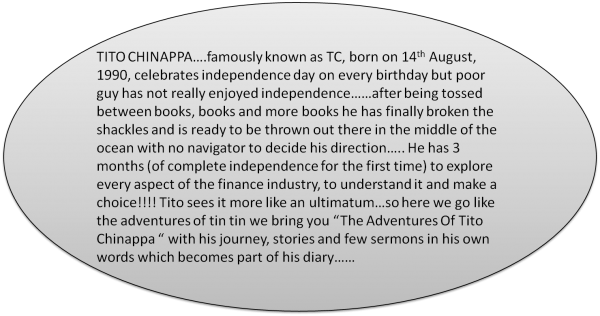

“Tito Nano Chinappa” the most promising newcomer in town or should I say the most eligible bachelor……before you jump to conclusions let me help - Bachelor of Finance is what I meant (not that you can’t consider him for the alternative meaning, like I said he needs a bit of polishing but has all the potential). That was about his name.. Let us now get a closer look- a peek into his personality….

First day at Citrus Bank Private Ltd and Tito Chinappa walks down the red carpet in his well ironed suit, matching tie of course and not to ignore the shiny shoes!!! Inside the elevator and out, there he is on the floor dedicated to “Corporate Banking”. He enters and (eyes almost popping out) - Ms Senorita D’cruz (the tall, blonde and beautiful girl) the HR executive is there waiting for him. She has been given the responsibility to introduce Tito to various aspects of finance and help him make a choice (Tito can’t believe his luck) and the introduction begins……………….

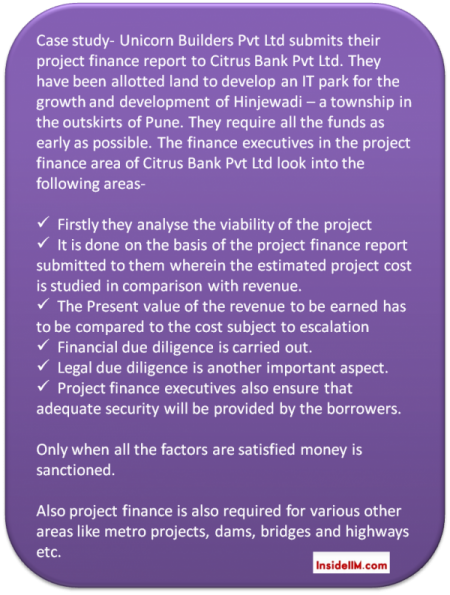

Project Finance

“This is the perfect launch pad for any entrant but it comes with the tagline – limited seats and so meant for a lucky few. It explores the dynamic aspects of your personality.” Tito wonders what dynamics will eventually be discovered or does he even have anything called a personality. It goes on

“A career in Project Financing requires you to structure and arrange finance for large, complex and long-term infrastructure and industrial projects which include power plants, chemical processing plants, mines, transportation, environment, and telecommunications infrastructure. It allows you to meet the CFOs and entrepreneurs. Tito decides this is the best, after all meeting the CFO....what a start!!!

Finally Tito writes his own analysis of what he understood-

There are two distinct roles which requires the lender to don the hat of a businessman while studying the business model and of a banker while analysing the revenue generated by a project

-As a source of security. (For the exposure)

- As a source of repayment.

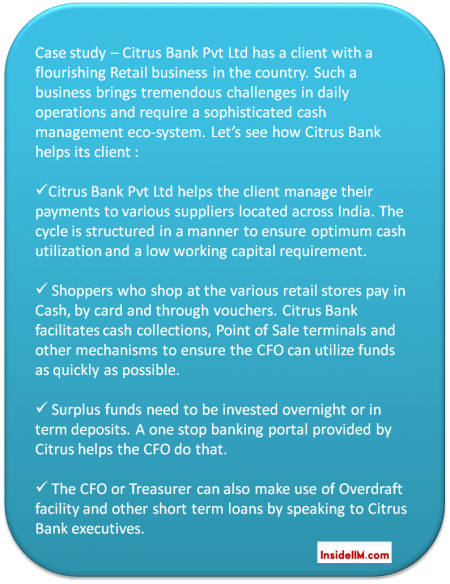

Cash Management

Now it’s all about the money with Ms Senorita giving Tito a complete description on his favourite aspect. She requests him saying “My mobile bill is yet to be paid and today is the last day, will you please drop my cheque in the drop box?” Tito already mesmerized by her could only manage a nod!!! How do you think it still works for the company?? Cash management is not restricted to managing cash as the term depicts, it requires you to provide solutions to meet diverse needs of corporate clients.” Tito recollects how he ended up paying his mobile bill on the last day without a penalty and out comes his pen and diary. He writes

It is a service provided to clients on an instant and continuous basis which reduces the time lag between the payment by the customer and availability of funds for use by the company.

There is a cash management solution provided by banks where the CFO gets complete visibility of the cash position in the company and surplus funds if any are invested overnight in government securities or term deposits. Facilities like OD are used in cases of cash deficits. All this is controlled by a single portal for the company by the bank. Other sectors that require specific cash management services include retail, FMCG, insurance etc.

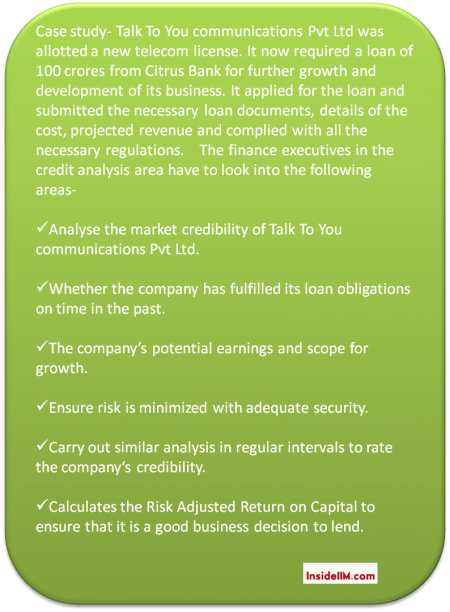

Credit Analysis and Approval

TC after having understood money and finance is suddenly taken over by the power of analysis and its importance in the business world. Here Ms Senorita explains

“This department plays the role of a credit rating agency within the organization. If CRISIL or ICRA interest you then this is an alternative. It is an independent analysis of the creditworthiness of corporate clients. Loan structuring is a part of the process. The two basic aspects to begin with:-

- Approving credits

- Achieving appropriate balance between risk and return

It is about providing services to those corporates who have a competitive edge over the others in their sector.” Tito Chinappa ‘s own summary - Here we maintain a constant check on the credit ability and market reputation of companies for clients and rate them in areas of debt, equity and other aspects as required. Ms Senorita then introduces Tito to the other side, the procedural side. “When number crunching and figures is not what you want to wake up with each day but nevertheless want the corporate banking tag, there is the admin side to it.

It covers the following aspects:-

- Loan processing

- Loan monitoring and reporting activities

- Verification and maintenance of documentation

- Compliance to statutory requirements and bank policy

For those who can handle documentation and like the legal side, credit administration is the place.”

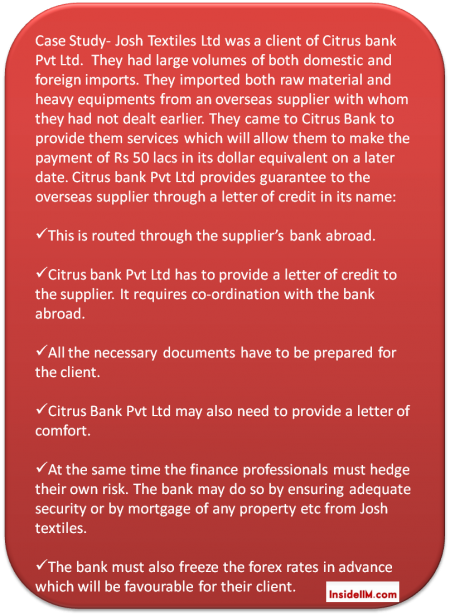

Tito Nano Chinappa‘s uncle was a retail banker and had a business of his own. Tito once overheard his uncle telling his dad that he imported all necessary machinery for his new business without making complete payment. Tito wondered how anyone could enjoy such trust..How did it work?? Of course he could trust Ms D’cruz with anything. She led him to the trade credit block, he blindly followed tagging along, eventually all his questions found answers. “Trade loans come into the picture as we take to globalization and international trade. A career in Trade Finance requires you to provide import and export transactional products, trade guarantees as well as structured trade finance advisory. In simple words an exporter always wants the importer to pay something in advance to reduce risk. Here comes in the role of the trade credit executives who assists an importer by providing various services to ensure a smooth trade transaction.” It involves providing innumerable products and services

- Letter of credit is the routine manner of providing guarantees to clients.

- The new sought after way is trade conducted on open account basis where banks play a very crucial role. Its follows the principle ‘ buy now, pay later’

- Factoring services where banks relieve the lending party by paying lesser than the original amount, thus letting them continue their trading activities.The factor receives commission for his services.

- Forfaiting involves directly purchasing the exporter’s receivables at a discount by paying cash. Now the importer has to pay the bank.

Trade credit insurance and political risk insurance are new areas covered by the department in the light of the current economic scenario and global slowdown. It has opened new avenues to the new set of brains to not only manage but to come up with innovative methods to tackle the situation.

Tito Nano Chinappa was attracted to finance because his only dream was to multiply every penny instantly. Senorita D’cruz began “For those who are attracted by the words profit, risk and return and having money in hand gives them the push treasury management services is the area. Today not only do large banks have separate treasury departments even smaller banks are launching and expanding treasury management operations.

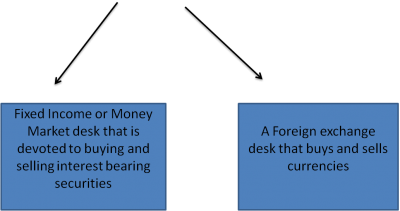

To begin with the areas covered are

Other areas include proprietary trading functions where trading is to be carried out on the bank’s own account, the asset and liability management that aim to reduce the risk of interest rate mismatch and liquidity.

The ultimate goal of the treasury management department is maximizing the firm's liquidity and mitigating its operational, financial and reputational risk.

The treasury functions are generally divided as follows :-

Created by Kala Krishnan

Kala Krishnan is a Chartered Accountant and pursuing her Company Secretary course. She is a graduate from Narsee Monjee College of Commerce and Economics. She has a passion for writing and oration and the idea of being an author and owning a publishing house excites her the most. She has been the Sub editor of 'Sans Frontiers' the official magazine of Umang - Narsee Monjee College’s festival. A cricket lover, Rahul Dravid and Sourav Ganguly inspire her and she dreams of writing their biography someday.....

Kala Krishnan is a Chartered Accountant and pursuing her Company Secretary course. She is a graduate from Narsee Monjee College of Commerce and Economics. She has a passion for writing and oration and the idea of being an author and owning a publishing house excites her the most. She has been the Sub editor of 'Sans Frontiers' the official magazine of Umang - Narsee Monjee College’s festival. A cricket lover, Rahul Dravid and Sourav Ganguly inspire her and she dreams of writing their biography someday.....

If you are preparing to secure your dream job, you may want to visit - The InsideIIM Career Guide

Also see results of the InsideIIM Recruitment Survey 2012