Economic forecast downgrades

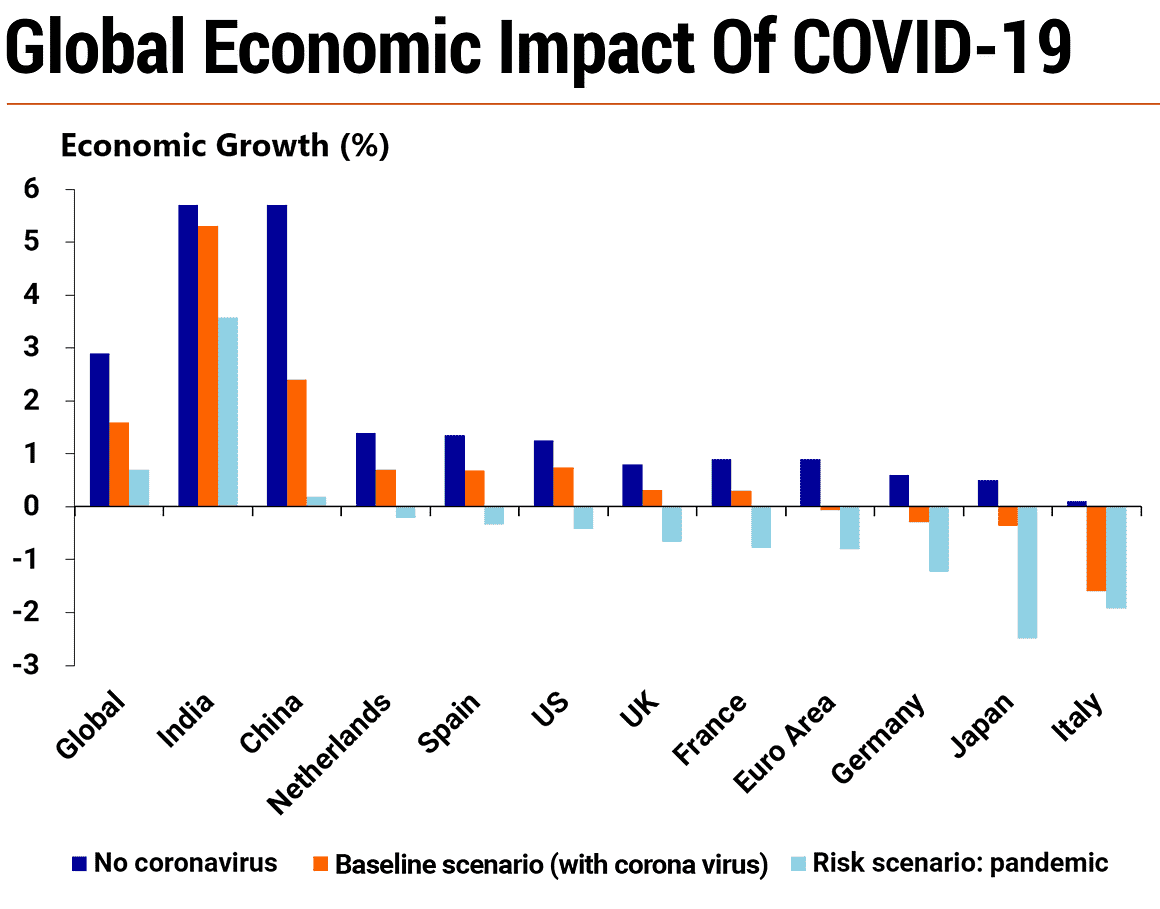

This particular virus outbreak has made sure that organizations and banks on a multinational level, cut their forecasts for the global economy. The latest organization which took a toll is the Organisation for Economic Co-operation and Development (OECD). In the recent March report, the OECD made sure that it downgraded almost all the economy's growth forecasts, including those of the states and the European region.

China’s GDP took the biggest hit, according to the OECD report. The report had earlier forecasted a growth of 5.7%, but in less than a week the growth is now forecasted to be 4.9%. This is the slowest GDP growth China has seen in more than a decade, which is sure to hit the Asian economic giant badly!

The downgrade in the manufacturing industry

The worst industry in China that has been hit, is the manufacturing industry. According to a report on the 22nd of March 2020, although China has slowly started recovering from the Wuhan crisis, the manufacturing and the textile industry of China do not see any profit for the next 10 years in the least. China’s factory activity has seen a record low of 40.3, and a number below 50 for any country means contraction of the economy.

Factories in China will take months to resume their operations, as forecasted by analysts and economists. The fact also remains that since the virus outbreak started in China, the global manufacturing industry will also take a hit since many countries would want to stop their trades with the Asian giant for a long time.

Contraction of services

It goes without saying that the retail stores across the world have taken a toll as well, as fewer people are on the streets. Restaurants, aviation industries have also taken the hit since people are travelling less as compared to before. The Markit services PMI for China measured at just 26.5, and this is the first time in 15 years that number has dropped down below 50.

China is not the only country to be hit by the economic tragedy, the United States, the world’s largest market for consumers also took a huge hit according to the IHS Markit. The monthly PMI data clearly shows that be it the States, Europe or Asia, everything is going to take a huge amount of time to be financially and economically stable again.

The stock market hit

The investor sentiment across the globe has certainly been hit due to the pandemic and in turn, the stock prices in major markets have been brought down without a doubt. The head of the global strategy and country risk at Fitch solutions, Cedric Chehab points out three ways through which the Coronavirus could make its way through the market. The first way is through the domestic outbreaks, wherein the domestic market of each country gets affected. The second and the biggest way is the stock market hit because the investors of MNC’s are now skeptical of any investment whatsoever, and the third is the financial market stress which will have the highest global impact in the last 20 years.

The conclusion - or is there any?

To be fair, there can never be any conclusion to this until and unless a vaccine arrives. All the countries around the world have been tirelessly striving for one, and maybe it's not long before one comes out. Unfortunately, until that day comes the global financial market will keep taking a hit each and every day. Work from homes has been imposed and companies have been downsizing their employees every day. The market has never been unstable, and at this point in time; we can do nothing but pray.

Comments