“As venture capital investment continues to pour into India's thriving tech industry, the country's fourth-place ranking in global VC investments in 2022 serves as a testament to the resilience and innovation of its entrepreneurs." Let's face it; working on Wall Street was for the previous generation, and McKinsey isn't cool anymore since Shark Tank premiered. These days, venture capital is the name of the game. It's a job that offers enormous respect (and even higher compensation - Read on to know more about the salaries in venture capital).

Instead of being chained to your desk, you'll be mingling with the sharpest and most innovative entrepreneurial minds that are constructing the companies of tomorrow, which you can support today. Imagine being pitched by Steve Jobs on Apple or Mark Zuckerberg on something called "Facebook." Now imagine if you invested in them and profited from them. It's no wonder why everyone who's anyone wants to be in venture capital.

However, those who want to pursue a career in venture capital should be aware of the industry's realities. Recognize that jobs in venture capital are competitive, demanding, rare, and not for everyone - AltUni has come up with a Certificate Program in Venture Capital to help you enter this glorious industry with Artha Group, check it out!

Therefore, before you embark on this career path, you must familiarize yourself with the roles and responsibilities that await you in the venture capital world & learn about salaries in venture capital.

What Does a Venture Capitalist Do?

Venture Capitalists scour the landscape for promising startups that have high-growth potential and raise capital from Limited Partners such as pension funds, endowments, and family offices. In exchange for this capital, they get an ownership stake in these companies, which they aim to grow and eventually exit via acquisitions or initial public offerings (IPOs).

Venture capitalists spend most of their time in six key areas:

- Sourcing - Identifying potential startups for investment and initiating contact with them

- Deal execution - Investigating startups' finances, markets, and terms for potential investment

- Portfolio company support - Providing support to portfolio companies across various areas, including recruiting, sales and marketing, engineering, fundraising, and administrative and financial matters

- Networking & Brand-Building - Networking with industry professionals, attending events, and publishing content online

- fundraising & LP(Limited Partner) relations - Facilitating fund-raising, providing LP updates, and sourcing new investors.

- Internal operations & other tasks - Administrative duties such as hiring for positions in investor relations, accounting/legal, and IT as well as enhancing internal reporting and deal monitoring are among them.

Skills Needed

- An Expert at Structuring and Closing Deals

- Communication

- Being able to raise money

- Solid networks of Limited Partners

- Prior investing track record

- Relationships with seasoned, all-star serial entrepreneurs

- Understanding if a company has the ability to grow and scale given its team, the marketplace, the financial composition, and the vision for the product or service

- Reputation in both the founder and investor communities

- Long-term vision and ability to see opportunities and gaps in the market

- Commercial judgment and the ability to find an exit

- Ability to help portfolio company founders with their biggest operational challenges

- Strong access to high-quality deal-flow

Launch Your Venture Capital Career | Learn From Experts + Work On Live Project + Get Interview Chance & More!

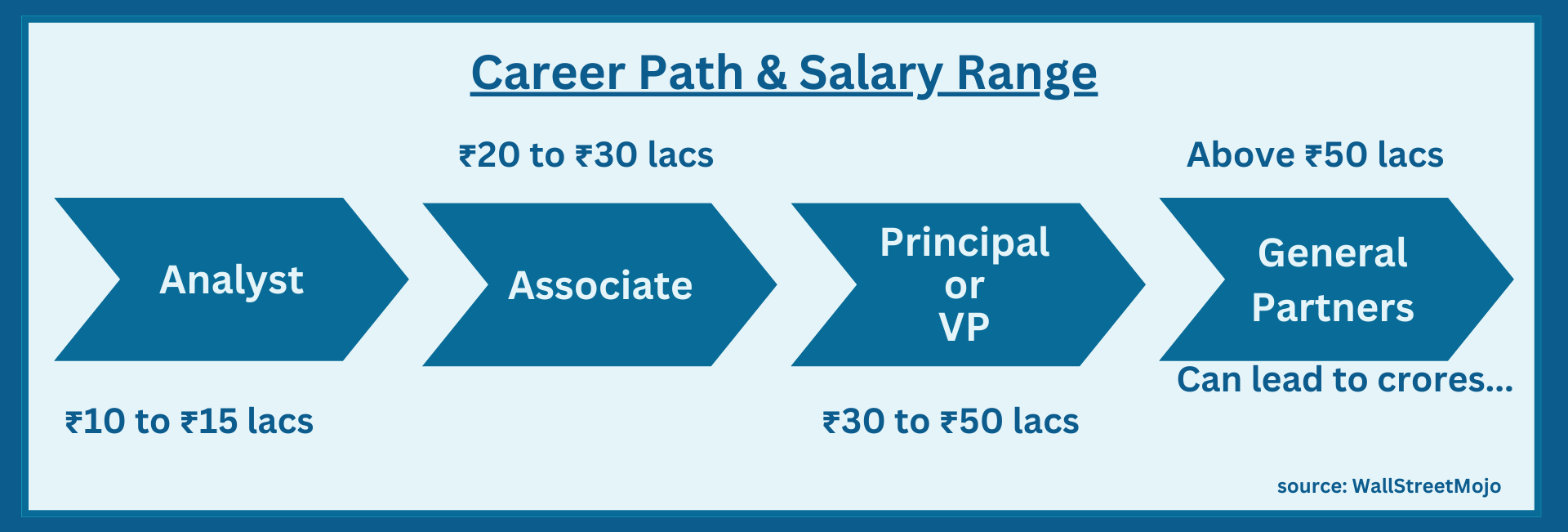

Careers & Salaries In Venture Capital

Job Roles & Responsibilities

An Analyst:

This is an entry-level role that works with associates on research and due diligence.

An Analyst will be responsible for:

- Supporting the ventures investment team on both quantitative & qualitative projects

- Performing financial analysis and modeling

- Interpreting company & financial data to help make investment decisions

- Assist with company and market research

- Preparation of investment memos and other written materials

- Due diligence & other tasks

An Associate:

An Associate is responsible for researching and conducting due diligence for potential investments, often bringing in deals. They work closely with mid-level managers and are typically entry-level employees gaining experience in their field.

An Associate will be responsible for:

- Supporting the delivery team in preparing & handling project documentation

- Assisting with administrative tasks related to the delivery team

- Contributing to efficient operations

- Working directly with business stakeholders & external suppliers to prepare documentation for approval

Principal or VP:

They are the senior members of a firm who source new deals and work with portfolio founders, earning a percentage of carried interest.

A Principal or VP will be responsible for:

- Supporting portfolio companies from operations to growth strategies to M&A

- Contribute to the firm’s brand-building

- Involving in Internal operations, LP relations & fundraising

- Leading the higher-level aspects of deal execution

General Partners (GPs):

They are the leaders of the venture fund. They also contribute significant amounts of their own capital to the fund to demonstrate their commitment to the venture.

General Partners (GPs) are responsible for:

- Making strategic decisions

- Guiding the investment decisions

- Developing and guiding the fund’s strategy

- Taking board seats in their portfolio companies

- Involving in hiring and firing decisions & internal promotions

- Acting as firm representatives by speaking at conferences & with news sources

Do you have an appetite for meeting exceptional individuals with one-of-a-kind concepts from around the globe?

Are you an aspiring investor who wants to switch from entrepreneurship to the investor side of things?

Are you adept at turning down the most idealistic and enthusiastic startup founders?

Can you handle poring over enough due diligence, data, and financial modeling that could make the U.S. Federal Reserve Chairman yawn?

If so, a promising career in venture capital could be your golden ticket to success.

Your lack of experience in the financial industry is irrelevant because you have never missed an episode of Shark Tank. You may not have an MBA, but you made smart investments in GameStop.

You know you've got what it takes to enter the field in respective of careers & salaries in venture capital. Now is the time to enter this glorious industry with AltUni.

Check Out AltUni’s Certificate Program in Venture Capital in association with Artha Group

Here’s What You’ll Get:

- 30 LIVE learning interventions with concepts, frameworks, case studies, and projects by renowned industry experts

- Get invaluable industry exposure with Live Project by Artha Group

- Interview opportunities with our Recruitment Partner - Artha Group as a Portfolio Analyst

- 12+ hours of training content on Portfolio Analysis

- Comprehensive interview preparation for roles on Buy-Side

- Access to refresher courses on Finance Basics, Excel & visualization tools like Power BI

- Job search assistance - Become an AltUni alumnus & get access to exclusive job opportunities

- Free Access to our learning community - Klub AltUni