Imagine this: you the common man or woman, is struggling to buy daily rations and 2 meals a day. Everything from soaps, to the internet seem out of your financial effort zone, because everything is expensive. While you struggle to make the 2 ends meet, your country’s president visits with international communist and socialist leaders and makes impossible deals with other countries in a bid to buy political clout and show off his power. Your nation’s greatest natural resource, a matter of pride for many, the natural oil wells in your country, are used as a political tool by the president to gain public support and stay in office. Meanwhile, you wait in a long line to convert pesos into dollars so that you can pay an exorbitant amount for a cup of coffee. Sounds morbid right? But this is exactly what happened and is happening in Venezuela. Hyperinflation has the country in its vice like grip. Once known as the pioneer in oil mining and policy across the world, today Venezuela has fallen on harsh times. How did this happen. Check out the case study below and answer the following questions to understand Venezuela’s situation.This is a part of the Learning IRL series brought to you by ABGLP.

Our Protagonist

Do you know the famous story of the hen that laid golden eggs? The farmer who owned the hen, one day out of greed, cut off the hen’s belly, hoping to find a secret way to get more golden eggs. But alas, the poor creature died for nothing, and the farmer couldn’t even get a single golden egg! The story of Venezuela’s state-run oil monopoly called Petróleos de Venezuela (PDVSA) is equally similar and disastrous. What’s more, it managed to take Venezuela into a new era of hyperinflation.

The then President of a newly national and free Venezuela, Carlos Andrés Pérez sought a much greater role for the state over the economy and especially wanted to use the country’s fast-growing oil wealth to turbocharge development. In order to gain full national control over the oil fields, Venezuela’s largest resource, Caracas banished foreign oil firms and created a new, state-run oil monopoly. This was Petróleos de Venezuela (PDVSA). The moves marked the capstone to Pérez Alfonso’s decades-long dream of Venezuela grabbing full control of its destiny. It was also the logical outcome of the widely held belief that the country’s oil, discovered in 1922 on the shores of Lake Maracaibo, was of national patrimony.

At first, Venezuela’s state-owned oil company stood out from peers such as Petróleos Mexicanos in many ways. A large number of its executives, for example, had previously worked for foreign companies in the country and imbued the new firm with a business-oriented outlook and a high degree of professionalism. PDVSA had a lean workforce, an efficient cost structure, and a global outlook: A decade after its creation, the company acquired half of Citgo, the big U.S. refiner, and stakes in a pair of European refineries.

Get updates when a new part of the Learn Management Concepts With ABG #IRL is launched. Subscribe here:

Back to the present, as of 2018, Venezuela is struggling with hyperinflation. And the PDVSA, instead of dealing in oil which it was created for, has taken to importing utilities for the state. What explains the country’s precipitous decline from being one of Latin America’s richest and most stable states?

The Decline & Fall Of Venezuela’s Oil Industry

None of their assets though, proved much help when a global oil glut in the mid-1980s depressed prices and hammered the national economy. By the middle of the decade, Venezuelan production had fallen below 2 million barrels a day, or about 50 percent less than during the heyday right before nationalization.

When oil is cheap, it becomes very tempting for countries to pump more crude — even if that extra production ends up keeping prices low. And so, to right the reeling Venezuelan economy in the early 1990s, the government sought to reopen the oil industry to international companies. The outsiders would be especially useful in accessing Venezuela’s mother lode, the Orinoco heavy oil belt, which holds more than a trillion barrels of tar like bitumen. Unlike regular light crude oil, which can be pumped straight out of the ground and sold as is, heavy oil is more

difficult to extract and then needs to be upgraded to something resembling liquid oil before sale. Doing all that takes the kind of cash and sophisticated know-how PDVSA lacked at the time.

By the mid-1990s, international firms, including Chevron and ConocoPhillips, had moved back into the country and were hard at work unlocking Venezuela’s massive heavy oil deposits. But in 1998, the price of oil collapsed again, dipping to $10 a barrel. The impact on Venezuela — which, like many oil-rich countries, had never managed to diversify its economy despite a bout of reform efforts in the 1970s — was severe, given that petroleum exports then represented about one-third of the state’s revenues. Then along came Chávez, a former army lieutenant colonel who’d served time in prison for an abortive coup attempt in 1992. He won the 1998 presidential election on the promise to reshape and restore Venezuela’s reeling economy.

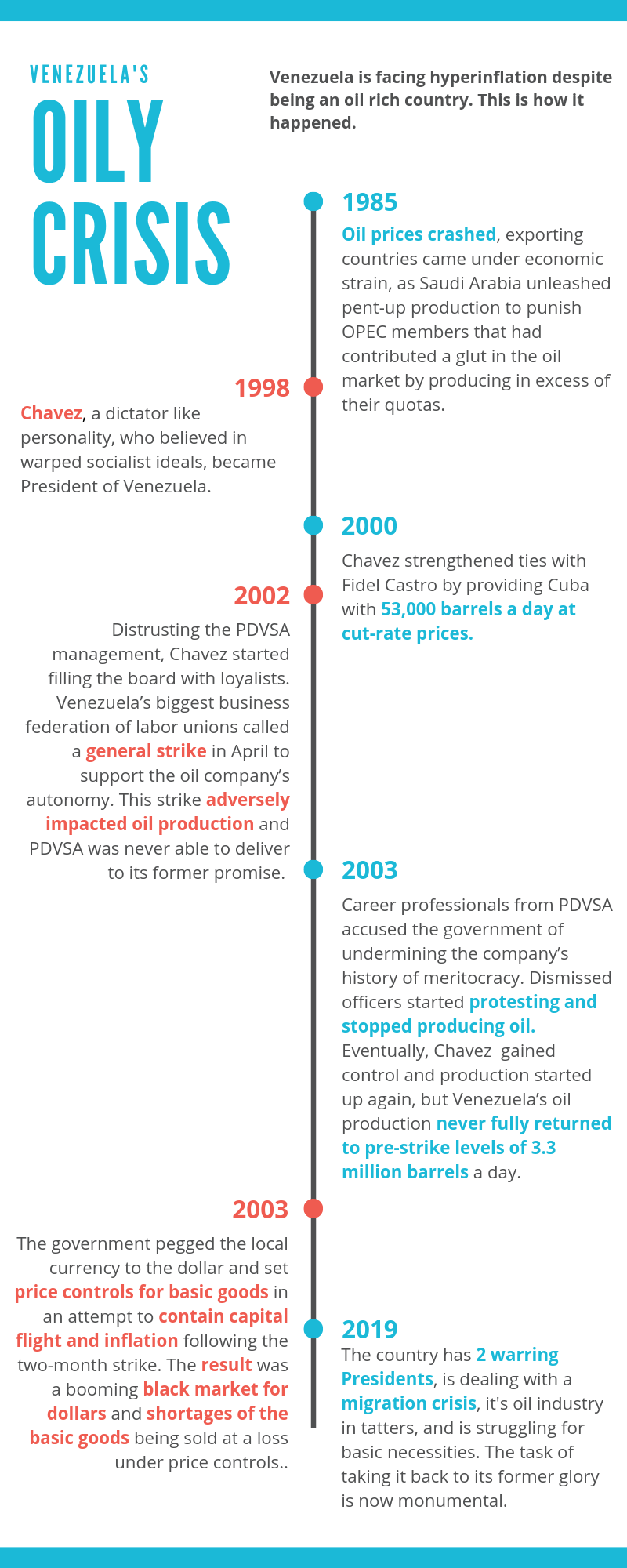

A snapshot of the timeline can be viewed here:

Entry Of Chavez, And Further Worsening Of The Situation In Venezuela

Chávez’s goal was to exert control of PDVSA and maximize its revenue, which he needed to fund his socialist agenda. But achieving the latter required cooperating with the rest of the Organization of the Petroleum Exporting Countries (OPEC), which, as in the 1980s, wanted to cut production in order to raise prices. The problem for Chávez was that many of PDVSA's then-managers wanted to increase production, by continuing the development of Venezuela’s technically challenging heavy oil fields. To do so, they needed to reinvest more of the company’s earnings rather than hand them all over to the government. So the managers had to go.

Unfortunately for Venezuela, Chávez — like many of the people he appointed to run PDVSA — knew nothing about the business that was so central to the country’s prosperity.

In 2001, Chavez pushed through a new energy law that jacked up the royalties foreign oil firms would have to pay the government. It also mandated that PDVSA would lead all new oil exploration and production; foreign firms could only hold minority stakes in whatever partnerships they struck with the national company.

In 2002, Chávez took two more steps to turn the once-proud PDVSA into his private preserve. First, he installed a new president, Gastón Parra Luzardo, a leftist economics professor who was a fierce opponent of opening the industry to more private investment. Then, in April, he went on live television to humiliate and fire a handful of PDVSA managers, replacing them with political hacks. Together, the moves sparked violent public protests, which turned into a coup attempt against Chávez.

The president survived the putsch, but his popularity plummeted — especially inside PDVSA. By the end of 2002, opposition to Chávez had solidified, and big labor groups called for a national strike in hopes of pressuring him to leave office. Oil workers backed the effort, setting the stage for what would turn out to be the critical step in PDVSA’s road to ruin.

During the two-month work stoppage, PDVSA’s output plummeted as field workers stopped pumping and tanker crews refused to leave port. Venezuela’s oil production fell from close to 3 million barrels a day before the strike to levels as low as 200,000 barrels a day in December 2002.

The strike severely impacted oil production and crippled the economy, with GDP falling 27% during the first four months of 2003.

In order to retaliate, Chavez instituted measures that involved 18,000 workers from PDVSA to be fired. This evisceration of PDVSA's human capital would prove the most damaging of Chávez’s many moves against the company. Even his own government soon realized the harm it had done. Accidents and spills began to proliferate, and in 2005, a top energy ministry official admitted privately that it would take at least 15 years to rebuild the technical skills lost by the mass firings. Conditions at the company (and in the economy) are now so bad that employees take home a pittance — just a handful of dollars a month — and face political pressure to support the regime. Such treatment has led to the large-scale flight of skilled workers: more than 25,000 since last year, union officials say. According to Reuters, the exodus has grown so big that some PDVSA offices have begun refusing to let their workers resign.

While some of his underlings clearly understood the havoc he was causing, Chávez either didn’t know or didn’t care; determined to finance his ongoing socialist revolution and use cheap exports to buy friends abroad, he kept turning the screws on the oil industry. Using legally questionable methods, he started siphoning off billions of dollars in PDVSA revenue to pay for his social programs, including housing, education, clinics, and school lunches. While this strategy may have paid off politically in the short term, it was extremely dangerous: for the more cash the government took out of PDVSA, the less money the oil company had to invest in maintaining production or finding new resources. Since oil fields gradually produce less oil over time as they get tapped out, countries constantly need to dig new wells and rejuvenate shrinking reservoirs with injections of water or gas. Thanks to their geology, Venezuela’s oil fields have enormous decline rates, meaning the country needs to spend more heavily than other petrostates just to keep production steady. But as Chávez channeled more income into other areas, PDVSA was forced to mortgage the future to pay for the political present.

The introduction of a currency peg, installation of import controls, the nationalization of other industries, and the establishment of subsidies for food and consumer goods all followed the strike. These actions sowed the seeds for the future inflation crisis.

According to the IMF, the Venezuelan economy shrank by 30% from 2013 through 2017, and the IMF is forecast a fall in real GDP of 18 percent in 2018 alone.

Problem Statement

It’s hard to imagine daily life with an annual inflation rate of 1,000,000%. At that rate, the price of a cup of coffee doubles between your weekly paychecks. That is what the citizens of Venezuela are facing, according to a recent report from the IMF.

The price of a cup of coffee, measured using Bloomberg’s Café Con Leche Index, is now more than 2,000,000 bolivars. That is up from 1,400,000 bolivars last week and 190,000 in April. The 3-month annualized inflation rate is over 1,200,000%. That is hyperinflation not seen in the world since Germany in the 1920s or Zimbabwe in 2008.

Questions

- If you were a PDVSA executive, assuming a corrupt official would not be the President, what strategies would you put in place to bring PDVSA out of debt?

- What economic and social factors do you think are the main reasons for Venezuela’s poverty?

- If you were working at a financial institution in Venezuela before and after the strike, what advice would you give your customers regarding personal finance?

- How would you solve Venezuela’s poverty? What measures would you implement to revive and bring back Venezuela’s economy?

Share your responses to this case study on this thread.

What’s This?

This is a part of a series called Learning #IRL, brought to you by InsideIIM in association with ABGLP. Read on to find out more…

Why Learning #IRL?

Simple really. We are tired of reaching out for giant textbooks, or “researching” online for all the answers. We want out. And we’re sure you do as well.

Whether you’re

– Planning to join b-school.

– Already in b-school and worried about placements.

– Someone who’s looking to shift jobs, upgrade their position, etc.

Everyone needs to know and remember the basics. And now, you can learn and refresh your concepts in a fun way! Simply read a comic strip or watch a video to understand management concepts. Or solve a quiz and case study to check your comprehension.

Get an overview on various concepts ranging from marketing strategies, operations concepts, basics of finance and HR tricks every month. Learn with the examples and instances from latest case studies and real stories.

Here’s to making learning fun and easy as pie. Subscribe now and receive updates every month.

What’s This Series About?

In this series, we bring you 4 fun things. Basically, instead of reading boring textbooks, or trawling through search pages on Google, here’s your shortcut to learning with fun.

- Quiz: Solve a quiz based on management concepts in marketing, HR, finance and operations. Test your conceptual clarity and know how! Basically learn with fun.

- July: Operations Management.

- August: Marketing Management

- September: Human Resource

- October: Finance Resource

- Case Study: Solve a sector-wise case study every month! Don’t all interview prep experts tell you to sharpen your logical thinking and practise cases?! Well now, you can practise a case every month and find out how well you know various concepts! Check out the July Case Study On Operations Management for an OTT platform like Disney here. Check out the August Case Study On IKEA India here. Check out the September Case Study On IT Services Companyhere. Check out the October Case Study On Venezuela's Oily Hyperinflation Story here.

- Video: Check out this unique explainer video laying out the facts and figures for you. Whether it’s the 7 Ps of marketing or the Jidoka model in supply chain and operations, these videos tell you all. Have a specific concept you wish to understand? Let us know and we’ll help you comprehend it! Check out July explainer Video on an Operations Management concept called Hub & Spoke here. Check out August explainer Video on The Science Behind Marketing Promotions here.

- Comic Strip: Reading reams of pages can be so boring. Now read comic strips and find out what’s what in your b - school curriculum! Wondering about Time Value of Money? Or perhaps HR strategies and tools? These comic strips will help you understand the same old concepts in new and refreshing ways. Check out July explainer Comic Strip on an Operations Management concept called Jidoka here. Check out the August Comic Strip on Marketing Concepts Made Easy here.