In the case being heard by the Supreme Court from the 17 public sector bank consortium, the only worry should not be that Vijay Mallya has fled the country. It is also that a consortium of banks gave away loans to a beleaguered Kingfisher by breaking the norms of sound banking practices. So we should be more worried about the banks fleeing away as well from their responsibility as bankers to the nation. Because then the government and the public will be left holding the can! And the perpetrators of this gigantic financial indiscretion will all slink away quietly into the sunset.

As the learned bench of the Supreme Court said 'How could Banks lend Rs 9000 crores with only 10% security?'

The Indian Empress throwing away lavish parties in Monaco

But unfortunately the media trial and the public seem bent on venting their anger at Mallya rather than the banks. This is because Mallya attracted their attention with his flamboyant lifestyle. Does this mean that the banks will forgiven and they will walk away from the crime scene (to use a rather unfair term), as well?

On hearing that Vijay Mallya has fled the country on March 2, the bench asked 'What can be done now?'. While nothing can be done about Mr Mallya except bringing him back lawfully, a lot can be done about the way the banks do business. Quizzing the 17 banks on what basis the banks disbursed loans to Mallya without taking adequate securities would be a good first step.

One of my investment banker friends once told me he found out during his thesis at New York University, that there are only 2 businesses that made no money over the course of a 25 year period. Airlines and making movies. So if one added up all the profits and all the losses, these two industries came through as zero sum games. You don't necessarily have to believe in my friend from New York. The history of these businesses will tell you that Howard Hughes burnt his money on airlines and entertainment as well.

Howard Hughes with his Boeing 100 in the 1940s

Which raises the question how did the banks lend Rs 9000 crores without adequate security to cover them?

Or are we saying that Indian public sector banks are highly evolved financial institutions that have an appetite to take large risks based on brand valuation like the VCs do for e-commerce businesses. Maybe they do because they have access to tax payers money. Maybe they do because the Government is obliged to bail them out like some guardian angel who is happy to resurrect the financial sinners of fiascos like Kingfisher.

I notice that Indian journalism is being very kind to the bankers while bashing up Vijay Mallya severely. They have even invented a politically correct vocabulary to deal with the bankers sins like 'crony loans'. Crony loans? Really?

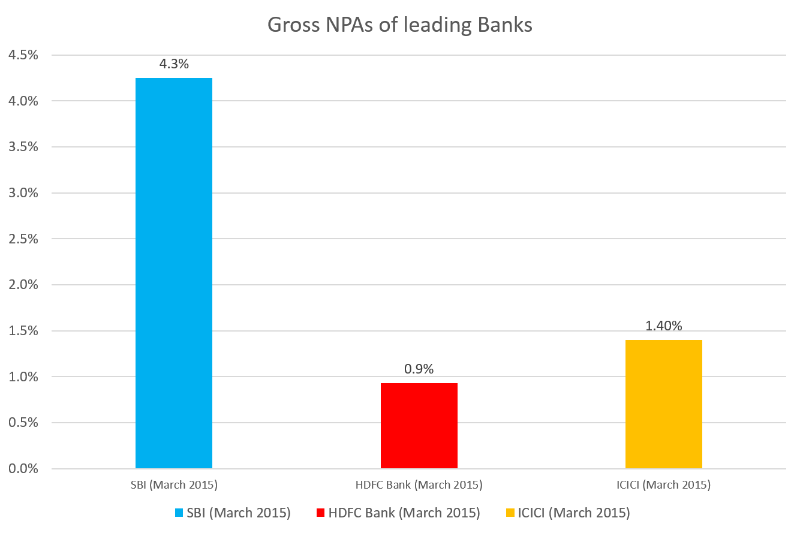

Subhash Chandra in his piece on LinkedIn titled Not just Mallya : Are PSU banks sitting on $10 b of crony loans? draws your attention to the scale of NPAs of SBI versus HDFC Bank and ICICI Bank with the help of the following chart. A reading of this article would suggest that Mallya is just a flash in the pan.

Source : Not just Mallya : Are PSU banks sitting on $10 b of crony loans?

The allocation of credit by banks on ‘soft’ terms to friends and relatives rather than on the basis of ‘hard’ market criteria is is often termed cronyism. In the years leading up to the Asian financial crisis of 1997-98 it had been hypothesised as an important cause of the crisis starting with Thailand. These practices had their basis in the implicit guarantees provided by the government to banks, which in turn percolated down to firms having ‘crony’ ties to banks as “soft-budget constraints” for projects of uncertain quality.

The Kingfisher case bears testimony to the fact that NPAs are not the result of bad judgement or even bad luck or adverse probability affecting the public sector banks, but of flaying every possible basic norm and rule in the business of banking. 'Don't the banks secure the loans?' asked the Supreme Court of India bench. Only to receive a weak reply that the loans were disbursed on the basis of the brand valuation of Kingfisher. Most of the aircrafts were on wet lease therefore not allowing banks to take security against loans they said. Well it is time public sector banks learn that brand valuations are still a fuzzy flight of fancy and not solid ground for regular commercial banks to rely on while disbursing large amounts like Rs 9000 crores. Valuations can drop dead in a day given a bad tail wind. Especially for airline brands which have a historically notorious past.

So once we have got to the bottom of this muck someone had better lay down some strict guidelines for the public sector banks on their lending practices. They need to be warned that lending against brand valuation, which is especially a dangerous and risky game, is better left to venture capital firms, rather than public sector banks which rely on public money.

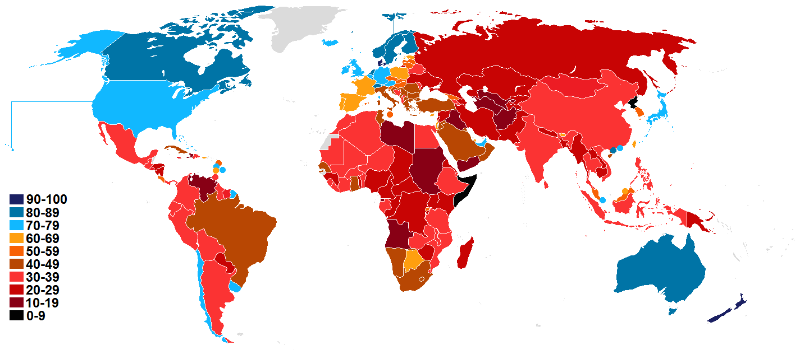

Source : Transparency International

In a country that is noted for its corruption, strict regulations on banking in the public sector are particularly necessary in a country like India, which inspite of the improvement it has shown in the last few years, still ranks 76 out of 168 countries on the Global Corruption Index, with a score of 38 as evaluated by Transparency International.

The Mallya - Kingfisher case has exposed both : the public sector banks and the way business is done in India by the so called 'Indian promoters' ! Both are to blame.

The magician is known to use misdirection as one of his tools - a form of deception in which the attention of an audience is focused on one thing in order to distract its attention from another. In this case the banks are using misdirection by throwing Mallya in the limelight to distract the audience from its own misdoings! But the real magic show is over.

The public instead of just asking for Vijay Mallya's head should be asking the public sector banks about the rest of the $ 10 B of crony loans.

--------

About the Author

Prabhakar Mundkur is an ad veteran with over 35 years of experience in Advertising and Marketing. He works as an independent consultant and is also Chief Mentor with Percept H.