Amongst top companies hiring for General Management roles, which are the ones that MBA grads from top business schools end up at? What percentage of IIM ABC alumni end up at TAS, ABG, Mahindra, Reliance and other massive conglomerates? In the Alumni Report series, we attempt to track where MBA grads from top Indian business schools end up in their careers, analysing trends to get broad yet valuable insight into company preferences. Here is a detailed breakdown of latest available LinkedIn data on where IIM alumni are currently working.

What Is The Alumni Report? What Data Is It Based On?

This series looks at the concentration of alumni of top b-schools at India's top companies with the aim to find out where are MBA graduates from top b-schools working now today. For current MBA students, this report aims to provide an estimate of which top companies have the highest concentration of their respective institutes' alumni.

The Alumni Reports are based on secondary research involving the collection of publicly available data on LinkedIn. Given that this method of data collection has its limitations, the data provided is best interpreted as an estimate.

What Are The Contents of This Report?

This report has been split into two clusters based on the years in which the top b-schools considered for this report were established. The rationale behind this is to ensure that the alumni base is strong and comparable for the b-schools under comparison. For a more detailed explanation, please refer to the section titled 'Methodology' in this report.

The report has been further split into two sub-clusters for each of the two primary clusters. These two sub-clusters are:

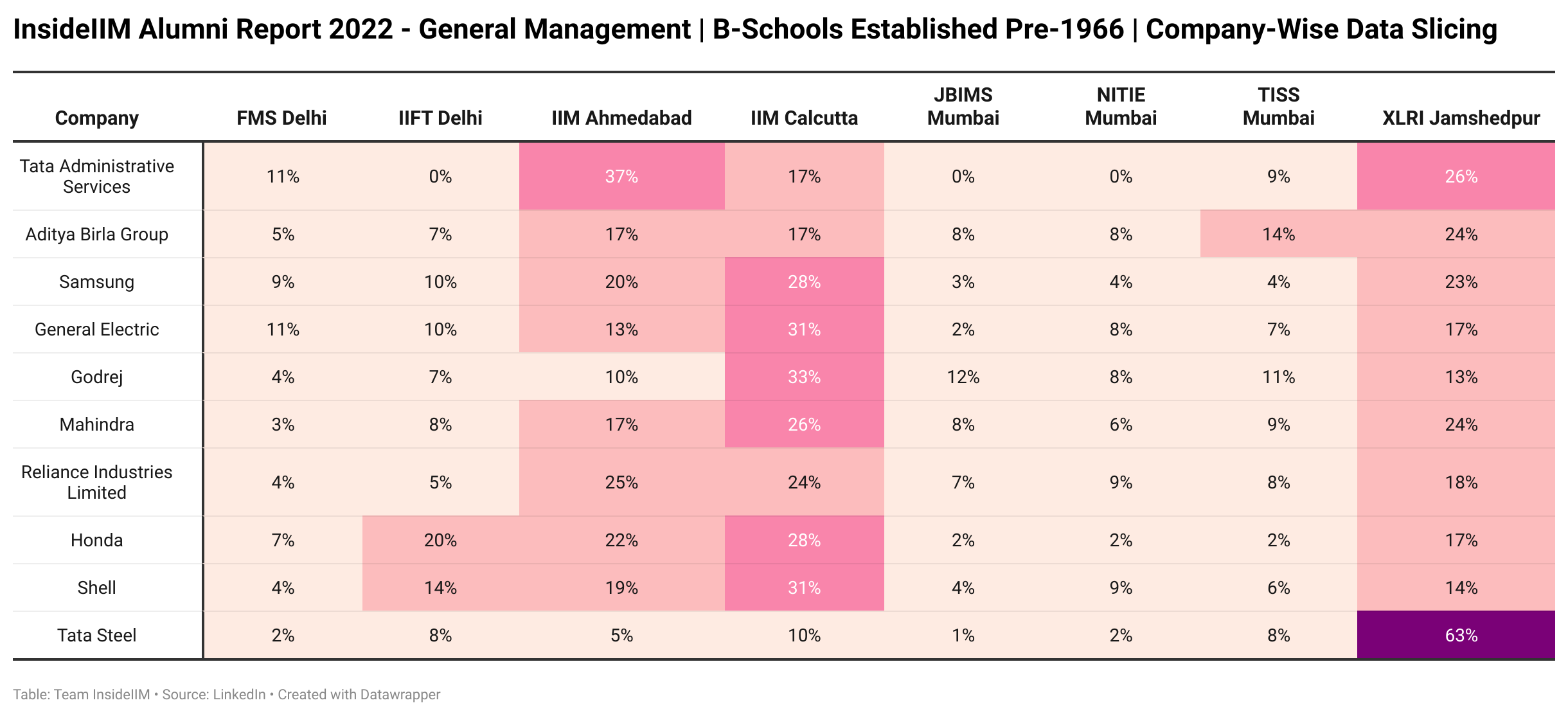

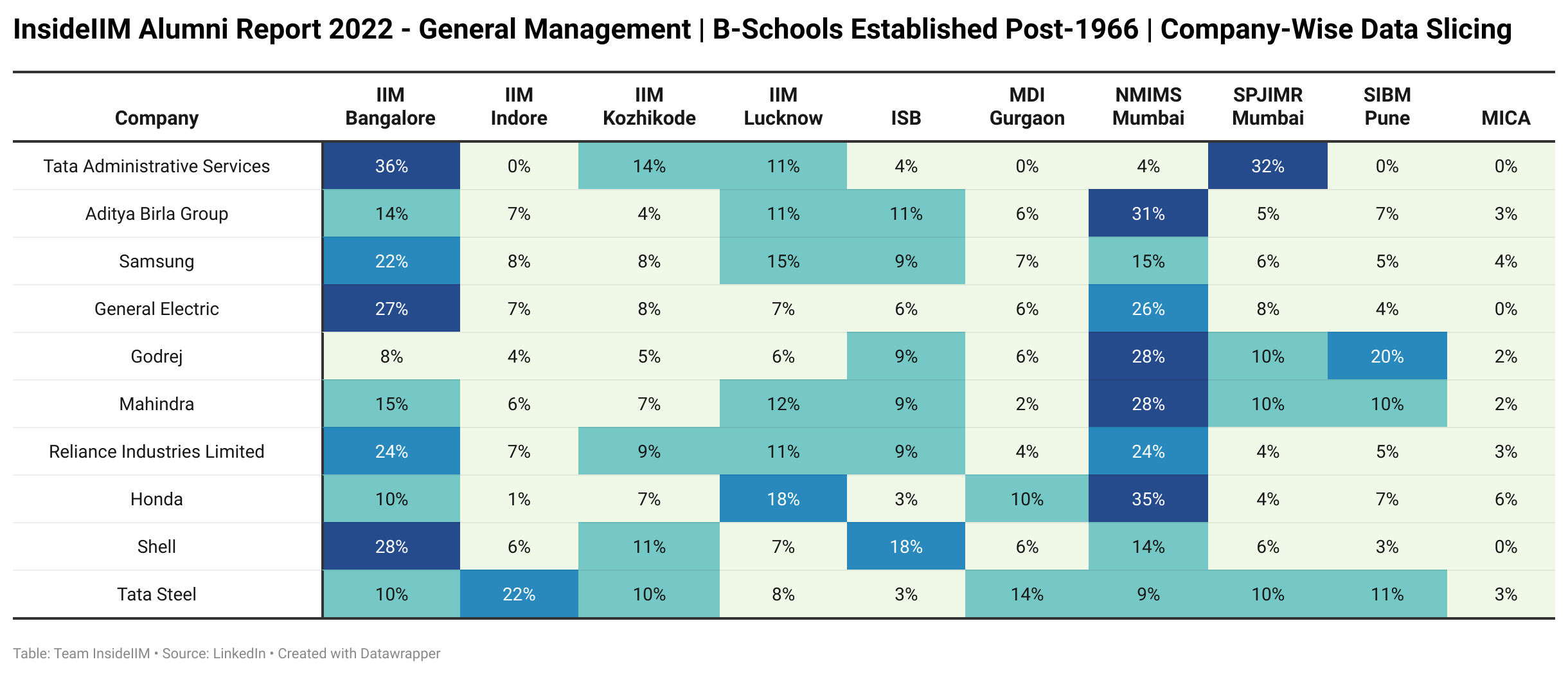

- Company-wise Slicing, i.e., the percentage of alumni of all b-schools at a particular company (view row-wise).

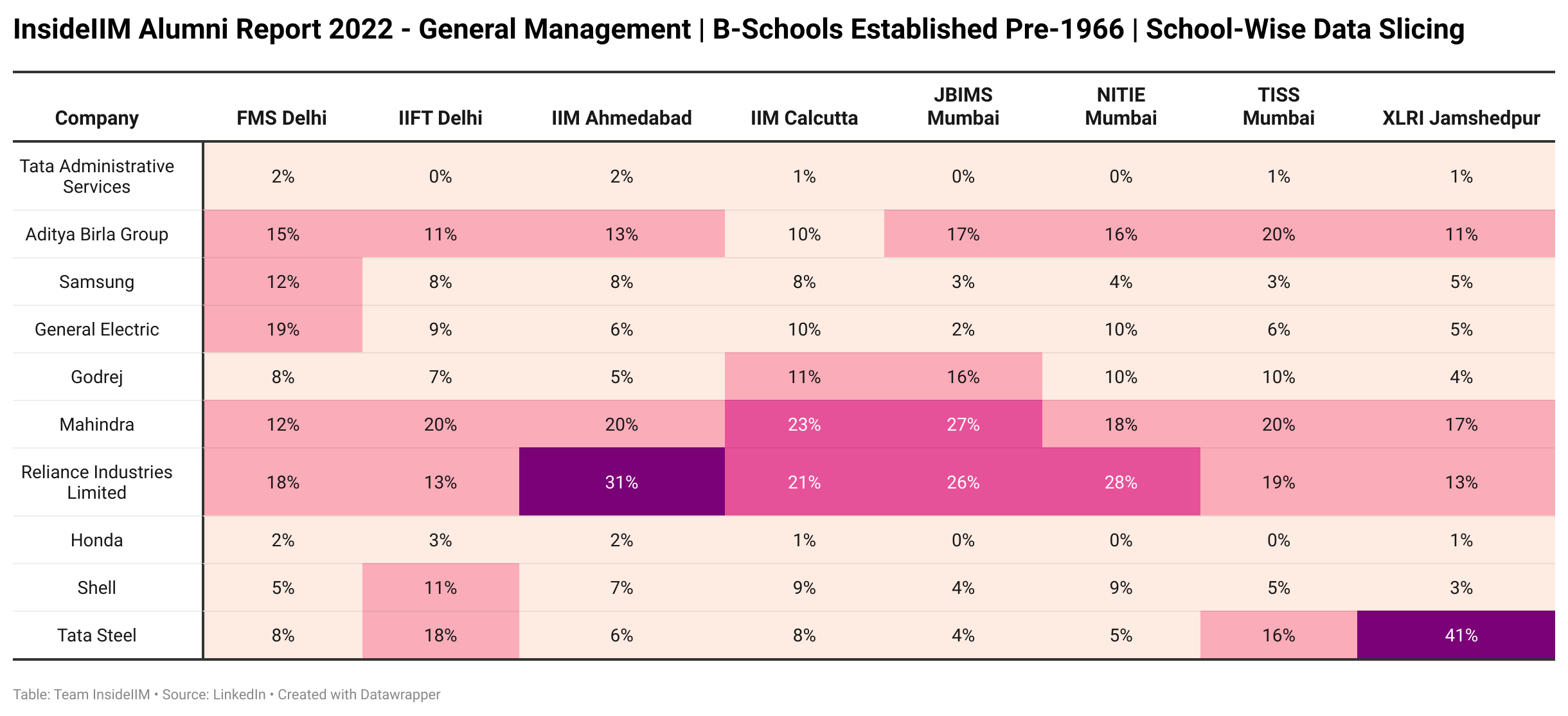

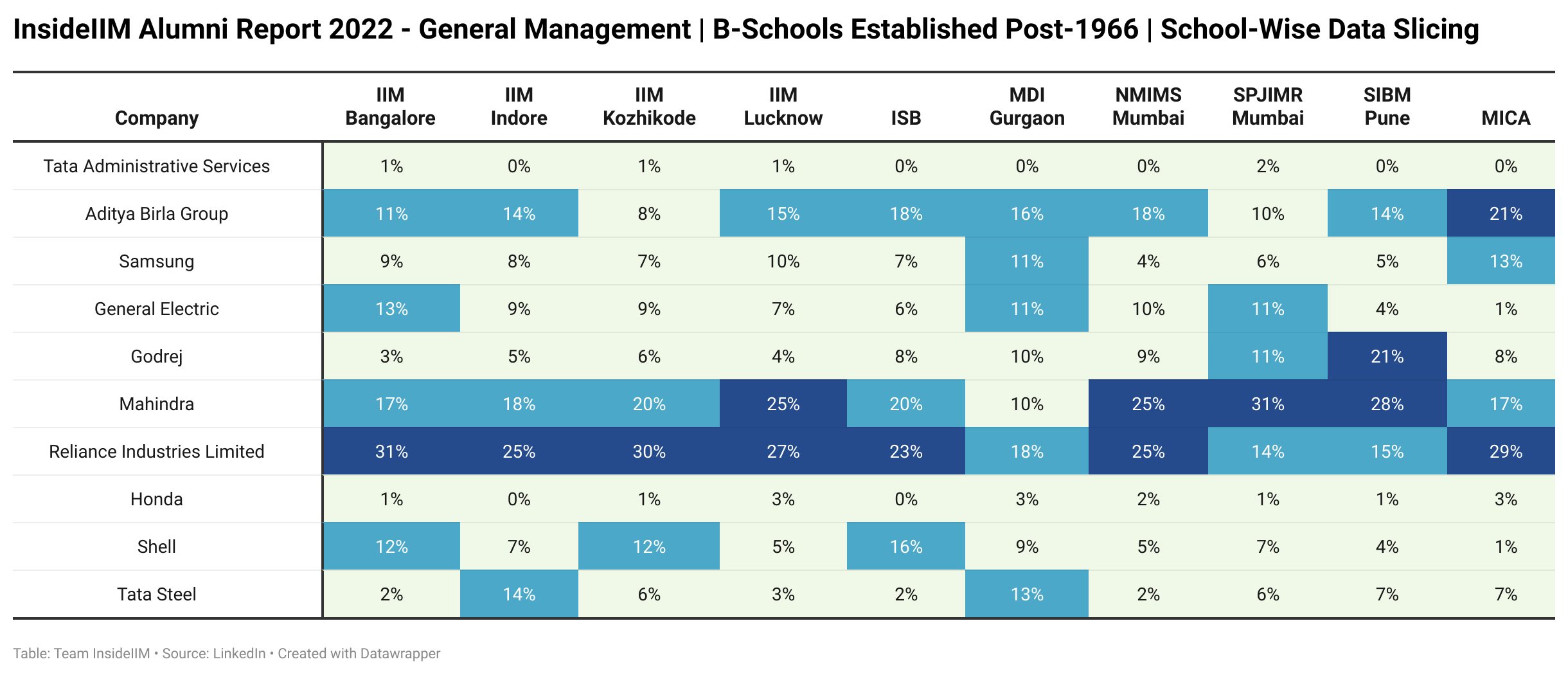

- B-School wise Slicing, i.e., the percentage of alumni of a particular b-school at all companies (view column-wise).

InsideIIM Alumni Report 2022 - Analysis For Business Schools Established Pre-1966

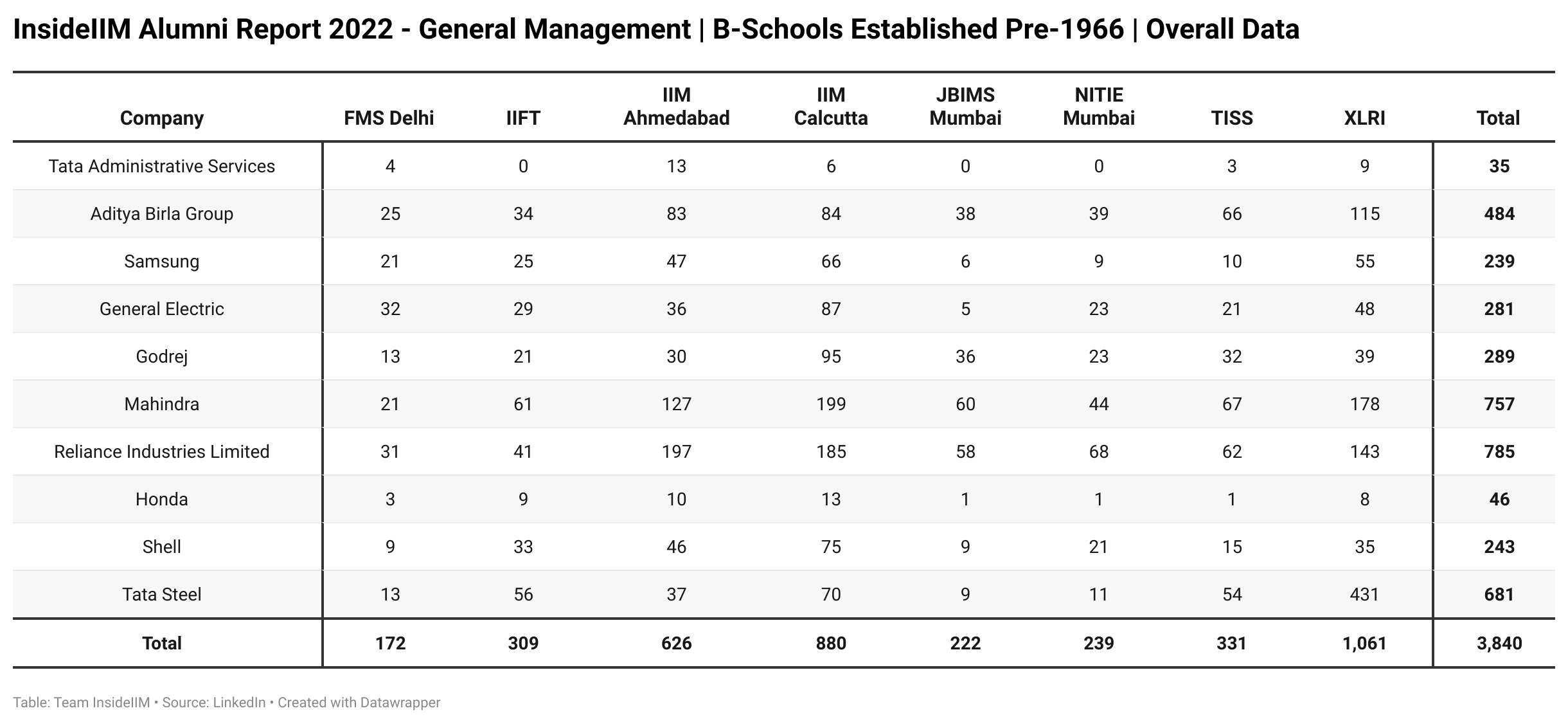

The table above contains the raw data for Indian b-schools established before 1966. Please note the following:

- Relevant filters have been applied in the research process. However, the existence of anomalies is also quite possible. So, there can be a positive or negative variance from the actual figures.

- All possible businesses of the companies have been considered.

- In this report, a higher number does not equal more influence on alumni of specific business schools. The seniority of alumni, quality and diversity of roles play a bigger part. Unfortunately, this cannot be captured with exact accuracy given the subjectivity involved.

Most notably, the concentration of IIM A, IIM C and XLRI alumni is the highest across listed conglomerates. 2 out of 3 alumni included here are alumni of these leading b-schools. XLers make up more than 25% of the combined alumni strength. Their numbers are particularly high at Tata companies.

In terms of recruitment numbers, RIL and Mahindra lead the way. Together, these companies account for over 40% of the combined alumni strength. These are followed by Tata Steel, which accounts for nearly 20% the total alumni strength. Recruitment numbers are also significant at the Aditya Birla Group companies (though not so much at IIM Calcutta), where many MBA grads from top b-schools began their careers as ABGLP management trainees.

InsideIIM Alumni Report 2022 - Analysis For Business Schools Established Post-1966

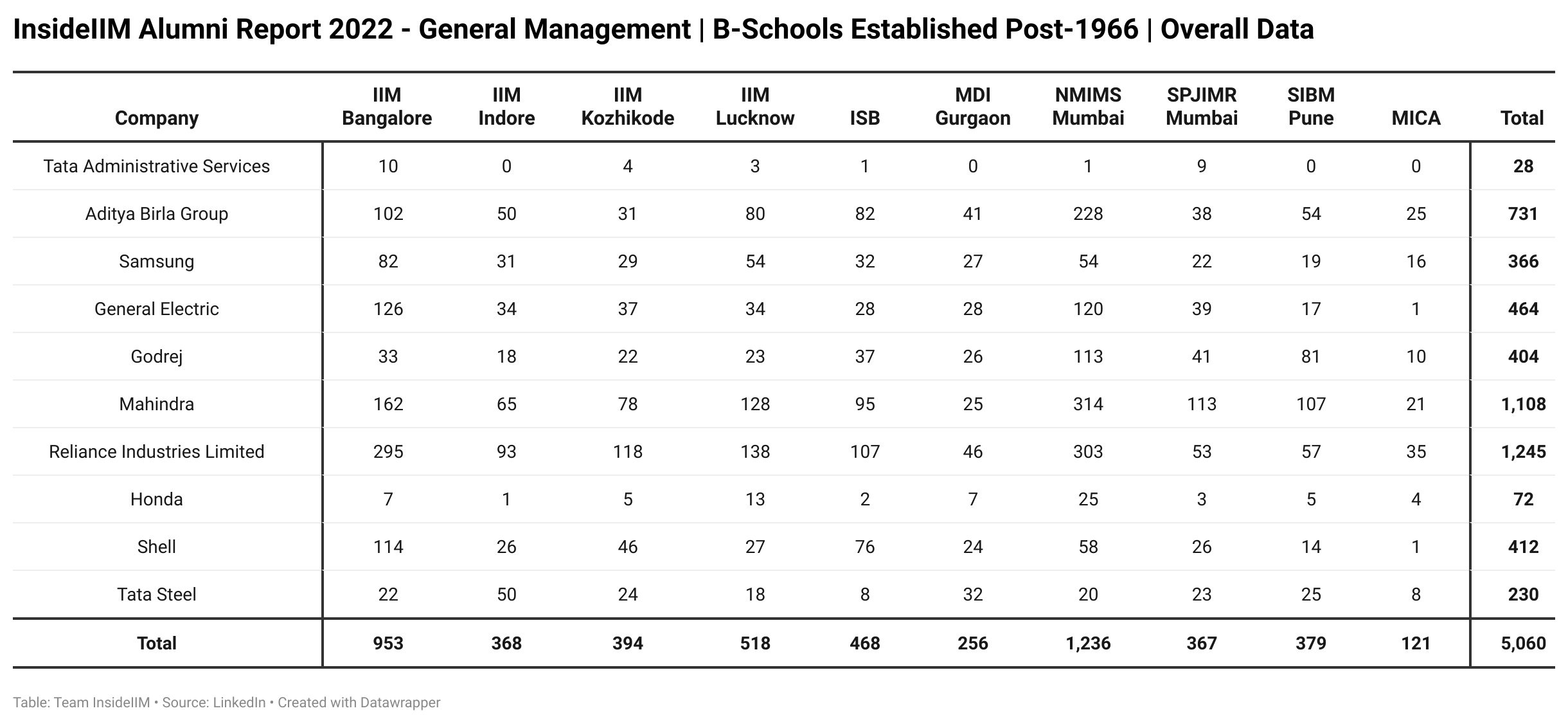

The table above comprises the raw data for Indian business schools established post-1966. Please note the following:

- Relevant filters have been applied in the research process. However, the existence of anomalies is also quite possible. So, there can be a positive or negative variance from the actual figures.

- All possible businesses of the companies have been considered.

- In this report, a higher number does not equal more influence on alumni of specific business schools. The seniority of alumni, quality and diversity of roles play a bigger part. Unfortunately, this cannot be captured with exact accuracy given the paucity of time and subjectivity involved.

- The figures at NMIMS Mumbai may be heavily influenced by the alumni of NMIMS who may have pursued a non-MBA undergraduate degree from NMIMS, though the filters applied during the research will minimise such anomalies.

The most striking visual is the dominance of IIM Bangalore grads at these highly sought-after conglomerates. IIM B alumni concentration is particularly high at TAS, Shell, General Electric and Samsung.

IIM K, IIM I and ISB alumni are present in significant numbers at many of the listed enterprises. Though the concentration of SIBM Pune alumni hasn't exactly been overwhelming across other reports in this series, they make a mark in the General Management cohort. SIBM grads are in especially notable numbers at Godrej companies, and have decent representation at Mahindra and Tata Steel as well.

Mahindra, RIL, and ABG lead the way as recruiters in this cohort. Combined, they account for 60% of the overall alumni concentration. RIL is particularly popular amongst the listed companies, with alumni concentration at above 20% for 6 of the 10 b-schools in this cluster.

Certain limitations of the research process prevent us from arriving at conclusions with pinpoint accuracy. Some of the major limitations are:

- Not everyone is on LinkedIn B-school alumni may not necessarily have registered on LinkedIn, therefore not giving a comprehensive overview of the actual figures of alumni concentration at some of the world’s most well-known and reputed conglomerates. It is also possible that those on LinkedIn may not necessarily update their profiles, thereby giving erroneous or incomplete employment data.

- Not everyone is a B-school student: Unfortunately, LinkedIn does not allow one to filter out MBA graduates from the crowd, and therefore, it is difficult to distinguish between MBA alumni and those who have pursued a certificate course, those who have pursued a short-term duration program, or summer interns at the companies mentioned in this report. Additionally, for institutes such as NMIMS Mumbai that offer multiple courses, there are chances of errors in attempting to distinguish between NMIMS alumni who have pursued undergraduate programs, and those who have pursued a PGDM program.

How can we improve this report? What additional questions would you want this report to answer? Share your thoughts in the comments below!