Harvard Business School, ranked as the world's best business school in 2020, is a dream institution for those looking to make a career in management. Only the creme de la creme of the talent pool from across the world makes it to an HBS classroom. So what makes this institution worth joining? What kind of remuneration and job profile does an HBS grad receive? This recruitment report is an analysis of the careers and salaries that Harvard MBA graduates pick up in their first year post-graduation, based on data for the past five batches that have graduated from the business school.

Harvard Business School - Important Highlights From The Recruitment Report For HBS

- The highest median base salary for an HBS batch over the past five years stands at $148,750.

- HBS grads opting for Finance or Consulting roles tend to earn significantly higher than the rest of the batch, and also make up over 50% of the batch.

- For the Class of 2019, HBS graduates pursuing roles with VC/PE/LBO firms have reported a 75th percentile base salary of $200,000 - the highest across all domains. Nearly 30% of all MBA graduates opting for these roles also received guaranteed salary component of $132,500.

- Based on trends over the past five years, a Harvard MBA graduate is likely to be hired by a firm in the Consulting or Financial Services industry in his/her first year as an MBA graduate. Also high in demand amongst HBS grads is the Technology industry - specifically organisations in the software and internet services business.

- Based on trends over the past five years, a Harvard MBA graduate is likely to re-join the corporate world in a Finance, Consulting, General Management or Marketing role.

Also read - Here's What You'll Need To Score On The GMAT To Get Into HBS And Other Top Business Schools

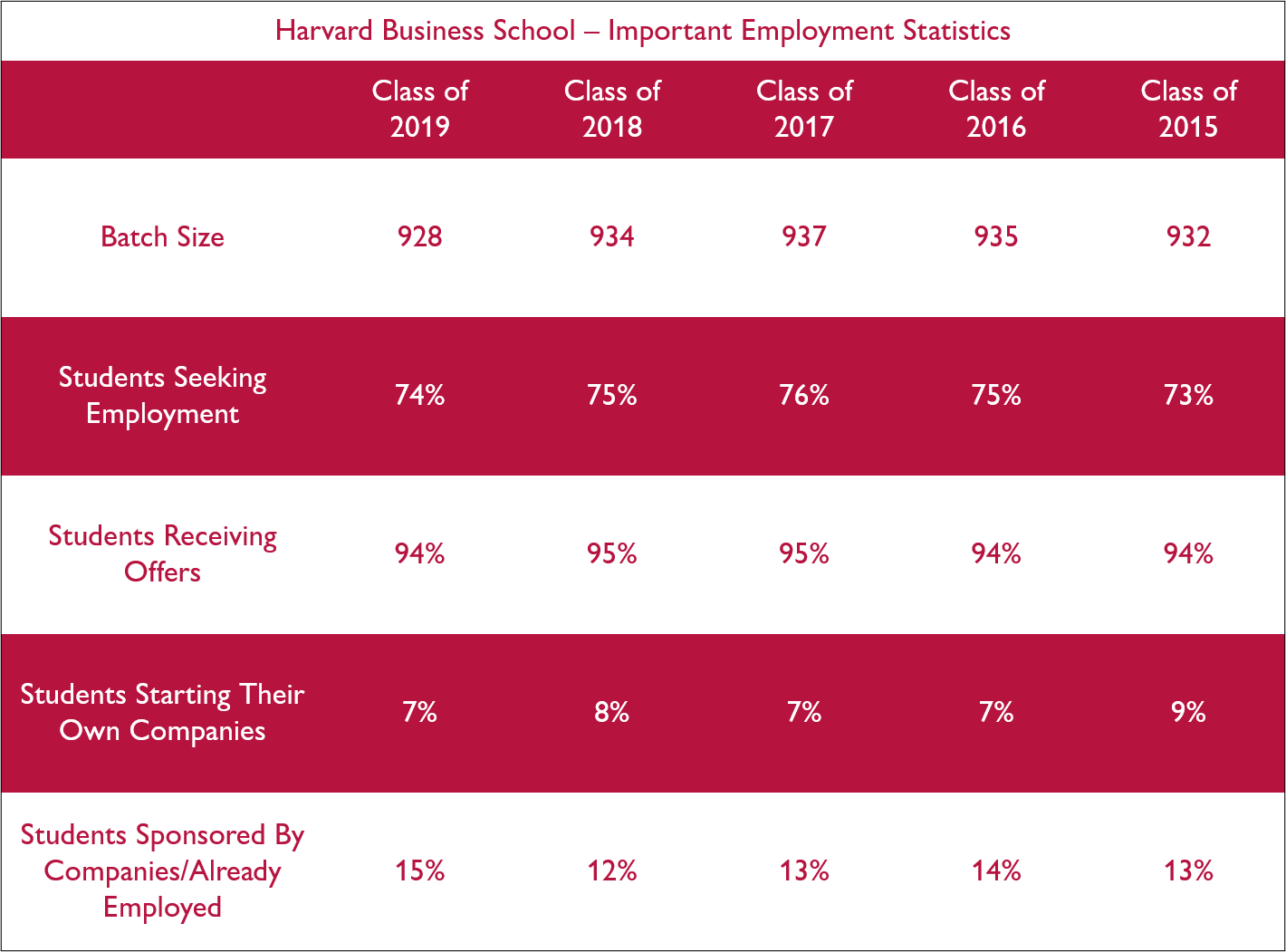

Harvard Business School - Important Employment Statistics For Previous Batches At HBS

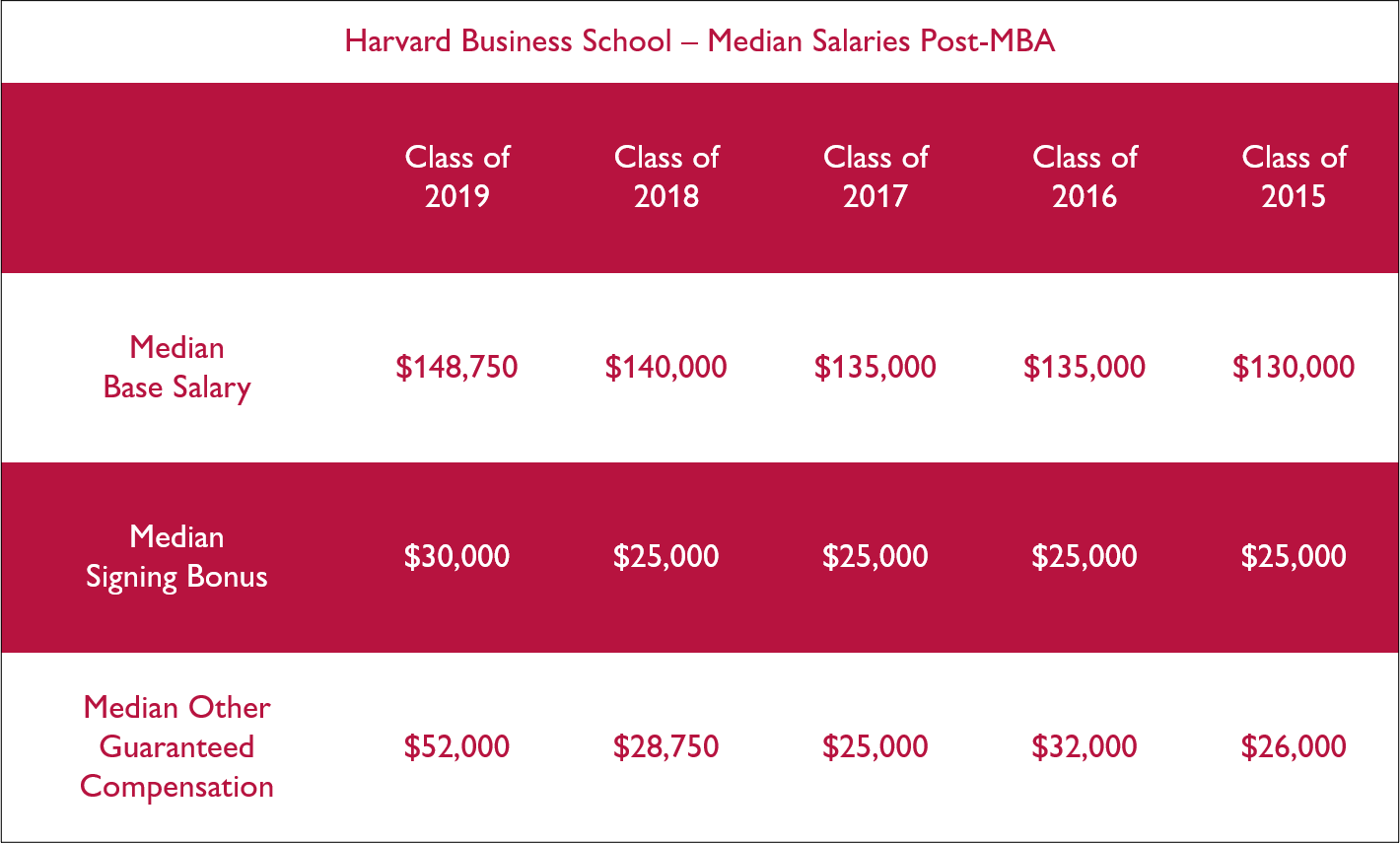

Harvard Business School - Salaries HBS Graduates Earn Post-MBA

The table below tells us what salaries HBS MBA graduates have earned in their first year post graduation, for batches graduating between 2015 and 2019.

The median other guaranteed compensation has seen a 100% increase in a span of five years, though in these years, less than a fifth of each MBA batch has received this salary component. Usually, graduates from HBS joining the Consulting, Financial Services, and Technology industries receive this salary component.

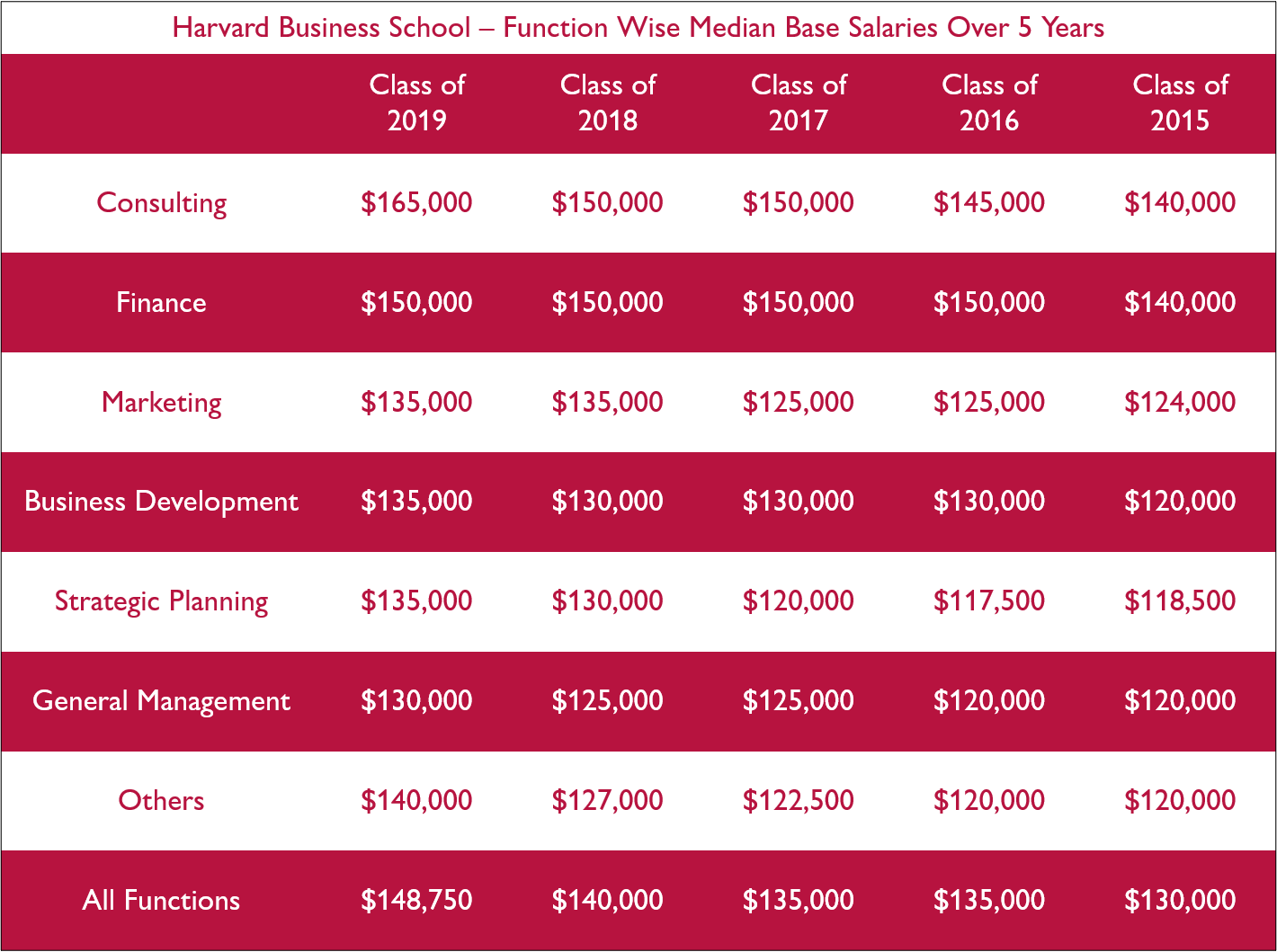

Harvard Business School - Consulting, Finance Top Paying Roles At HBS

HBS graduates who pick up offers for Consulting and Finance roles in their first year tend to earn the highest in their first year post-graduation, compared to their batch mates. Within these, those opting for roles with Investment Management, VC/PE, and Hedge Fund firms tend to earn the highest salaries. These students make up a very small percentage of the batch at HBS.

Outside of Consulting and Finance, roles in Real Estate emerge as the functional areas with the highest 75th percentile salary for the class of 2019 at Harvard Business School. A tiny 1% of the batch at HBS opted for this role, with the 75th base salary at $157,500. Those opting for General Management and Business Development roles have also reported above significantly above average base salaries, with 9% of the class of 2019 at HBS reporting a 75th percentile base salary of $150,000 for each of these domains.

Over a period of 5 years, the base median salary for Consulting roles has seen an increment of nearly 18% - the highest across all domains. The class of 2019 saw a jump of 10% over the previous year in the base median salary offered for Consulting, which is the highest recorded jump across all domains at HBS in half a decade.

Harvard Business School - Function Wise Hiring Trends At HBS

The two roles HBS grads are clearly after are Consulting and Finance roles, with Finance emerging as the most-sought after functional domain over the past five years. Within Finance, majority of HBS grads prefer to go for roles with venture capital, private equity, or leverage buyout firms - 18% of the MBA class of 2019 at Harvard Business School opted for roles with VC and PE firms, up from 14% for the class of 2018. With the 75th percentile base salary standing at $200,000 for the class of 2019, it's easy to understand why a major chunk of the each batch at HBS in the past five years has opted for these roles.

Outside of Consulting and Finance, Business Development, Product Management, and General Management are other highly sought-after domains for HBS grads. On the other end, very few of them prefer to enter Sales, HR, Brand Management, or Corporate Finance roles - less than 1% of the batch, consistently over the past five years.

Also read - How This MBA Student Took His GMAT Score From 670 To 740 In His Second Attempt

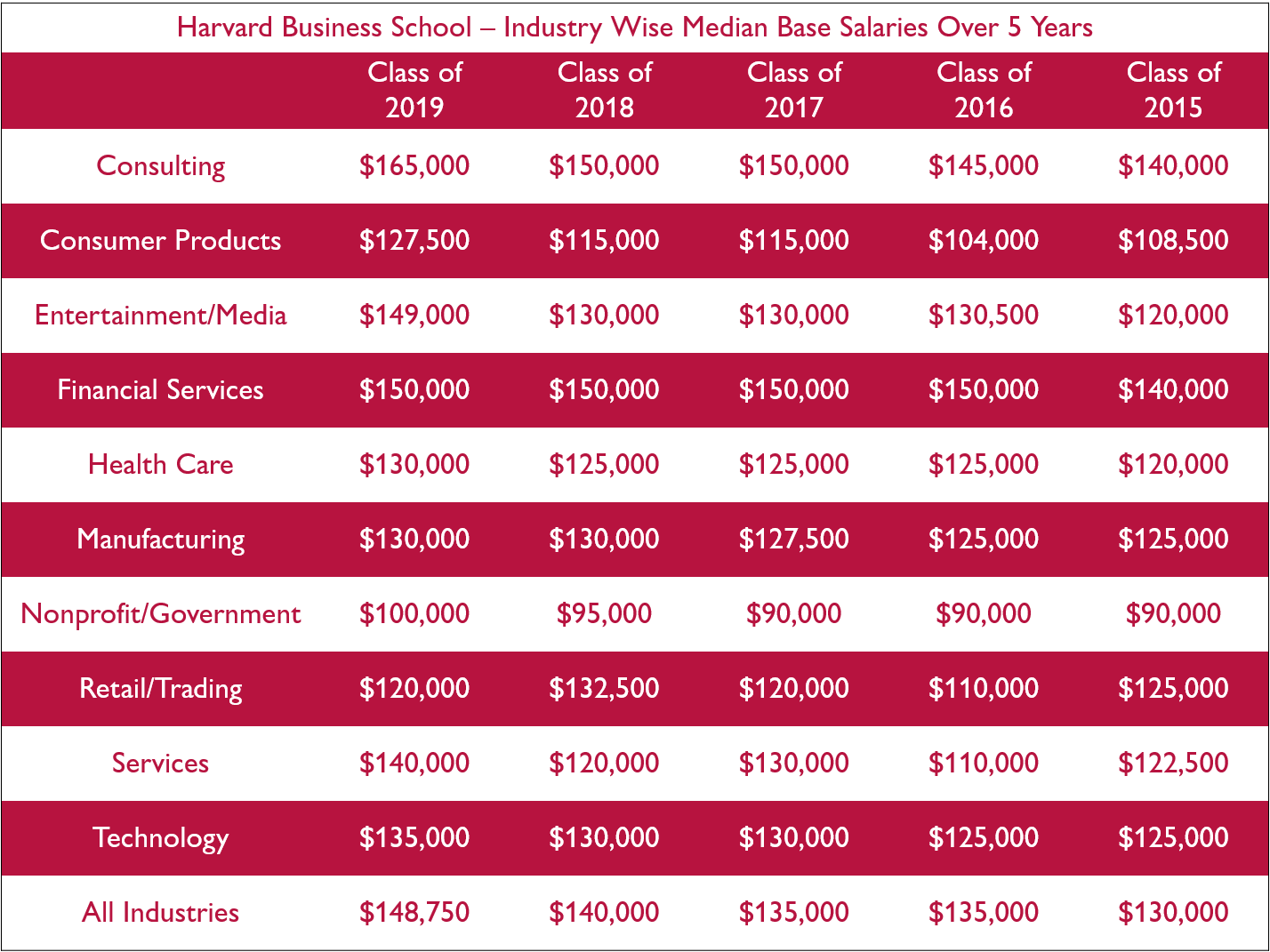

Harvard Business School - Industry Wise Salary Statistics At HBS

In line with salaries based on functional domain, Consulting and Financial Services emerge as the industries that are top paymasters for HBS grads.

While those working with VC, PE, LBO, Investment Management firms and hedge funds have reported the highest 75th percentile base salaries (not to mention other salary components that go up to a cool $125,000) it is interesting to note that the minuscule 2% of the class of 2019 working with the energy and extractive minerals industry have reported a 75th percentile base salary of $189,125 - significantly higher than what the Consulting industry had to offer to over a fifth of the class of 2019 at HBS.

Also read - How I Made It To BCG | Shatakshi Sharma – Harvard Business School, ISB

Harvard Business School - Industry Wise Hiring Trends At HBS

The graph below helps us visualise trends that emerge in terms of industry wise recruitment of Harvard MBA graduates. Only the top-5 from a total of 10 industries that have consistently hired HBS grads in large numbers over the past five years have been included, i.e., Financial Services, Consulting, Technology, Manufacturing, and Health Care.