A war can never be an isolated event in the history of time. A conflict between two countries has ripple effects across the world; on the people, finances & economies of the two countries, their neighbours & their active trade partners. Make no mistake, the loss of human lives can never be put on the same pedestal & quantified. But for the sake of this article, let’s look at how has the Russia-Ukraine war affected the world economy & how is the world coping, in plain and simple words.

Let’s skip the ‘why’ & first understand what sanctions have the US & Eurasian leaders imposed on Russia?

- Oil & Gas - All imports of oil and gas have been either permanently banned or temporarily stopped only to be phased out later

- Banks & Finances - The Western countries have frozen the assets of Russia’s central bank to not allow it to use forex reserves. Russian banks are also being removed from the SWIFT system which is used to transfer money overseas, thereby delaying all payments made to Russia for its previous transactions including oil

- Luxuries - Sanctions on travel, vodka trade & all luxury goods trade like vehicles, high-end fashion and art

- Oligarchs - Travel bans and asset freezes of Putin, former President Medvedev, several Russian oligarchs considered close to Kremlin like Roman Abramovich, the owner of Chelsea FC

- Brand Exodus - A growing number of international companies including McDonald's, Coca-Cola and Starbucks have suspended trading in Russia.

The Bank Drain

- There are billions of dollars of Russian debt in foreign banks that are at a high risk of defaulting due to the war and sanctions. Due to this, even the foreign banks who do not have Russian debt become wary of trading with the former, thereby, inviting a liquidity crisis. Austria, France & Italy have a combined Russian debt of almost USD 67.5 billion that they risk losing; so is the case with US and EU banks.

- Don’t forget that the war will also empty the coffers of the already-struggling Ukraine and that it will add to the default risks!

- In addition to this, since the banking services in Russia and Ukraine have been hit, several European banks will also face the heat in terms of revenue loss. Switzerland, Cyprus and the UK are the biggest destinations for Russian oligarchs seeking to store their cash overseas. This will be a definite loss of business for banks in these countries.

Source - Reuters

If you find the workings of the global financial system fascinating, then we recommend you take a look at AltUni’s Certificate Program in Corporate Finance in association with SDA Bocconi. This program is specifically designed for young professionals looking to build a career in this exciting industry by detailed sessions on topics like capital structure & estimation, corporate & business valuation, mergers & acquisitions, etc. by SDA Bocconi Milan faculty. Click here to read more about the program.

Business & Funds

- With the sanctions and the ouster from SWIFT in place, any company that is owed money by Russian businesses is going to face challenges in getting paid.

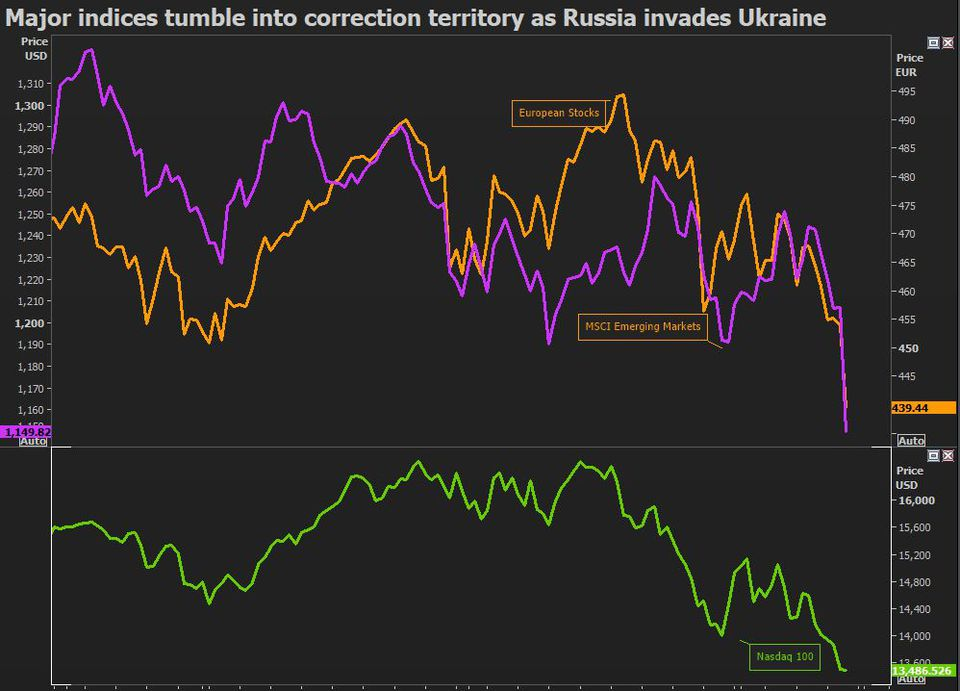

- Companies and investment funds with high-value assets in Russia will see the heavy devaluation of their assets and eventual write-offs if things go even more south. If that’s the case, it could also lead to panic sell-offs in the stock markets.

Oil & The Hole In Your Pocket

- The prices of commodities have also not been spared. Crude oil prices were at USD 139 a barrel for the first time in 14 years and continue to hover around USD 100. Russia is the third-largest producer of crude, after the US and Saudi Arabia. As India imports 85% of its oil requirements, it will surely put a strain on the budget.

- Higher energy costs would also likely make “every step in food processing and transportation more expensive.” Prices for a number of agricultural commodities are jumping, as Russia and Ukraine together account for about 20% of global corn exports and 25% of wheat exports.

Source - Reuters

3. “The impact on growth, inflation, current account and fiscal deficits will depend on the persistence of commodity prices at elevated levels,” the department of economic affairs in India said in its latest monthly economic report for February. Morgan Stanley pegs retail inflation at 6% for the fiscal year 2023, much higher than the RBI’s 4.5%. It also lowered India’s GDP forecast for the fiscal year 2023 by 50 basis points to 7.9%, citing risks to macro stability due to high crude oil prices.

The Russia-Ukraine war has yielded almost a never-seen-before geopolitical response from the west. The embargoes have been comprehensive and swift. But there’s no winner in a war. Loss of life, livelihood and property is inevitable in armed conflicts. The economic ramifications will linger on for a long time in a time when we are still experiencing the wrath of the pandemic. It remains to be seen when the call for sanctions will be replaced by a call for dialogue and peaceful resolution.

If you wish to understand banking, investments & the world of finance from a global b-school, this is your chance. If you do have a basic understanding of finance, then this program will take you to the depths of Corporate Finance. And the best part is that if you don’t have any prior knowledge, AltUni ensures that you have your basics in place before the program begins!

Other Reasons Why You Should Sign Up For This Program

- Ace Core Topics - Master core Corporate Finance topics like capital structure & estimation, corporate & business valuation, mergers & acquisitions, etc.

- Placement Assistance - Get a chance to interview for full-time roles with Finvox Analytics & CFO Bridge (our recruitment partners) and other similar companies

- Top-Notch Learning - Learn from SDA Bocconi Milan faculty & get certified by SDA Bocconi, a globally accredited European university and ranked 5th best b-school globally

- Real-Time Application - Apply your learnings in a Live Industry Project that will give you industry exposure & will add value to your CV

- Industry Exposure - Follow-up each academic module with industry expert sessions where you get insider insights and strategies that are used in the industry

- Holistic Learning - 1-on-1 mock interviews & profile building sessions with industry experts

- In-Depth Curriculum - A total of 65+ hours of live & recorded learning content from top academia & industry experts.